Bond yields moved higher on Thursday as traders continued to discount debt-ceiling negotiations and Federal Reserve policy trajectory.

What’s happening

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.414%

added 3.7 basis points to 4.419%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.757%

rose 1.5 basis points to 3.765%. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.986%

climbed less than 1 basis point to 3.998%.

What’s driving markets

Debt-ceiling concerns and Federal Reserve policy continue to impact different parts of the market for U.S. government paper.

The yield on the 1-month Treasury bill

TMUBMUSD01M,

maturing on June 20th eased 4.4 basis points to 5.667% but remains just shy of recent highs after ratings agency Fitch placed Washington’s AAA credit rating on watch for a possible downgrade as the debt-ceiling deadline looms.

The prospect of a technical default by the world’s largest economy — possibly as soon as the start of June — saw traders dump Treasury bills maturing on June 1st, pushing yields up to multi-decade highs of 7.226% by late Wednesday, according to Tradeweb data.

Yield on U.S. Treasury bill expiring June 1st. Source: Tradeweb.

Meanwhile, investors were also parsing the latest Fed-meeting minutes, and commentary by Fed officials, and increasing bets that the central bank may resume tightening policy after skipping a rate rise next month.

Markets are pricing in a 66% probability that the Fed will leave interest rates unchanged at a range of 5.0% to 5.25% after its meeting on June 14, according to the CME FedWatch tool.

But the chances of a 25 basis point increase on July 26 have risen from 5.4% a month ago to 45.5% now.

U.S. economic updates set for release on Thursday include the weekly initial jobless claims data and the second reading of first quarter GDP, both at 8:30 a.m. Eastern. Pending home sales for April will be published at 10 a.m..

Fed officials making comments include Richmond Fed President Tom Barkin speaking at 9:50 a.m. and Boston Fed President Susan Collins talking at 10:30 a.m..

What are analysts saying

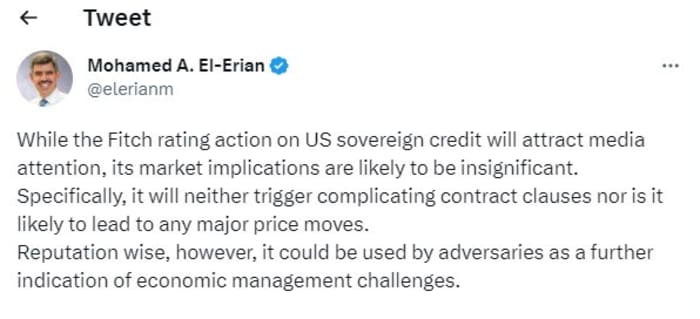

Here’s Mohamed El-Erian, President of Queens’ College, Cambridge University, and an advisor to Allianz and Gramercy, on the fallout from Fitch’s warning.

Source: Twitter

This story originally appeared on Marketwatch