If you are eligible to receive Social Security benefits, you can begin receiving monthly payments at the age of 62. But you can wait longer to claim the benefits, to receive higher payments. There are also other factors to consider.

You can look at your own Social Security payment estimates here and download your statement. It is a good idea to take a look at the updated estimates once a year.

Before thinking of how much your payments will increase if you wait to begin receiving them, keep in mind that Social Security’s Full Retirement Age (FRA) is 67 for people born in 1960 or later. If you were born earlier, you can look up your FRA here. If you are married and begin to receive payments before your FRA, benefits to your spouse may be reduced. Your monthly payment will max out at the age of 70 if you wait that long.

If you are married, it is important to factor that into your Social Security timing decision. If you have a nonworking spouse who is several years younger than you are, keep in mind that your spouse may live for quite some time after you die, and rely on your Social Security payments for income.

Mark Hulbert discusses how your thought process can drive your decision on when to begin collecting Social Security payments. And dozens of readers have added thoughtful comments.

From my own Social Security estimate, the amount that monthly payments will increase for each year I wait past the initial eligibility age of 62 varies from 7.3% to 9.1%. But if I calculate a compound annual growth rate for the amount of the monthly payment if I wait until the age of 70, the rate is just about 8%.

For an illustration of the effect of waiting, we can create a back-of-the-envelope set of numbers for a person who is eligible to receive Social Security, turns 62 this year and is facing the timing question. For simplicity, we will leave out the Social Security Administration’s cost-of-living adjustments (COLA), which are based on inflation.

Here’s how much the payments will increase if the person waits, from an arbitrary monthly baseline payment of $2,000, with payments increasing 8% for each year of waiting:

| Retirement age | Monthly payment | Annual income |

| 62 | $2,000 | $24,000 |

| 63 | $2,160 | $25,920 |

| 64 | $2,333 | $27,994 |

| 65 | $2,519 | $30,233 |

| 66 | $2,721 | $32,652 |

| 67 | $2,939 | $35,264 |

| 68 | $3,174 | $38,085 |

| 69 | $3,428 | $41,132 |

| 70 | $3,702 | $44,422 |

You can calculate percentage increases for various scenarios, but under this one, the payment will increase by 85% if the recipient waits until age 70.

If you are in dire need of income when you turn 62, you will, of course, begin to take the payments. But what if you are still working or have other sources of income to tie you over until you are 65 or until you reach FRA?

In the comments below Hulbert’s story, more than one reader said they had never heard of anyone regretting a decision to begin receiving payments at an early age. Another topic of discussion is how long someone might be expected to live. One reader said he knew people who had waited until FRA or even until the age of 70, and then received benefits for less than 10 years.

From my own experience of knowing many people well into their 90s, and when factoring-in that a nonworking spouse who is not eligible for their own Social Security payments might outlive the initial Social Security recipient by many years, the timing decision can affect a family for decades.

More than one reader wrote of the importance of incorporating expected investment returns into Social Security timing decisions. There were also philosophical discussions and expressions of lack of confidence in the federal government’s ability to maintain Social Security long-term.

With so many things to consider, you should create a My Social Security account, look at your statement and read about the eligibility rules for you and your spouse, which are all in the same place.

Read on:

- Here’s how the government may shore up Social Security

- It is a win-win’: Federal program helps ‘the most vulnerable’ seniors find jobs — and helps employers facing labor shortages.

Tech earnings (mostly): the Ratings Game

Amazon Web Services (AWS) has a much higher operating margin than its parent company does.

Getty Images

Shares of Amazon.com

AMZN,

soared early Friday after the company reported an 11% increase in quarterly sales from a year earlier. Analysts had been eager to see how well the Amazon Web Services unit would perform, because of its high profit margin, and AWS didn’t disappoint.

For AWS, second-quarter operating income of $5.37 billion exceeded Amazon’s consolidated operating income of $3.32 billion.

Analysis: How Amazon’s ‘game-changing’ earnings could unlock a sustained stock surge

Following Thursday’s market close, Apple Inc.

AAPL,

reported a 1% decline in quarterly sales from a year earlier. This was the iPhone maker’s third straight sales decline.

At a time when many large tech companies are touting their forays into artificial intelligence, Apple CEO Tim Cook explained why the company wasn’t making much AI noise.

Read: Apple is slogging toward a mediocre milestone not seen in 22 years

Therese Poletti looks at Uber Technologies Inc.

UBER,

which has defied naysayers to turn its first quarterly operating profit.

Here’s a selection of coverage from the Ratings Game column as corporate earnings season rolls on and stock analysts react:

Are you a contrarian investor?

Getty Images

Here’s how so many of us ride along with the herd: The SPDR S&P 500 ETF Trust

SPY

is 24% concentrated in shares of five companies:

So even if you are invested in a low-cost exchange-traded fund that tracks the U.S. benchmark

SPX

by holding shares of 500 companies, the weighting by market capitalization means you are concentrated in the largest tech-oriented names.

A contrarian investor is one who is willing to move money into areas of the market that other investors have been shying away from.

Michael Brush interviews Nick Schommer, manager of the Janus Henderson Contrarian fund JACNX who cautions that you need a compelling reason to make a move against the market, “which is right most of the time.” He describes three tactics for making contrarian investments.

Robinhood makes two moves to help investors build retirement nest eggs

Robinhood Markets Inc.

HOOD,

is well-known for making it easy for stock traders to win or lose quickly in the stock market using its phone app. But the brokerage firm is now offering to pay investors 1% to move their retirement accounts onto its platform. Beth Pinsker reports how Robinhood changed its interface to encourage customers to invest for long-term growth within their IRAs.

Fix My Portfolio: I’m in my 70s and doing Roth conversions, but I’m not sure I’m doing it right

Carl Icahn’s wild ride

Carl Icahn, chairman of Icahn Enterprises.

Neilson Barnard/Getty Images

Shares of Icahn Enterprises L.P.

IEP,

were down 30% in morning trading Friday, after the company cut its quarterly dividend in half to a dollar a share.

The firm’s CEO Carl Icahn blamed the company’s second-quarter net loss and dividend cut in part on a report published by the short seller Hindenburg Research in May.

In the firm’s earnings press release, Icahn also said: “I believe it is compelling that if you purchased 1,000 IEP depositary units in January 2000, for $7.63 per unit and elected to take all distributions in cash as they were paid, you would have received approximately $76,000 in cash distributions and would have still owned the 1,000 units.”

At a midmorning share price of $23.12 on Friday, those 1,000 IEP units would be worth $23,120. If you were to add the Icahn-referenced $76,000 in cash dividends, you would be looking at $99,120. Not bad for an original investment of $7,630.

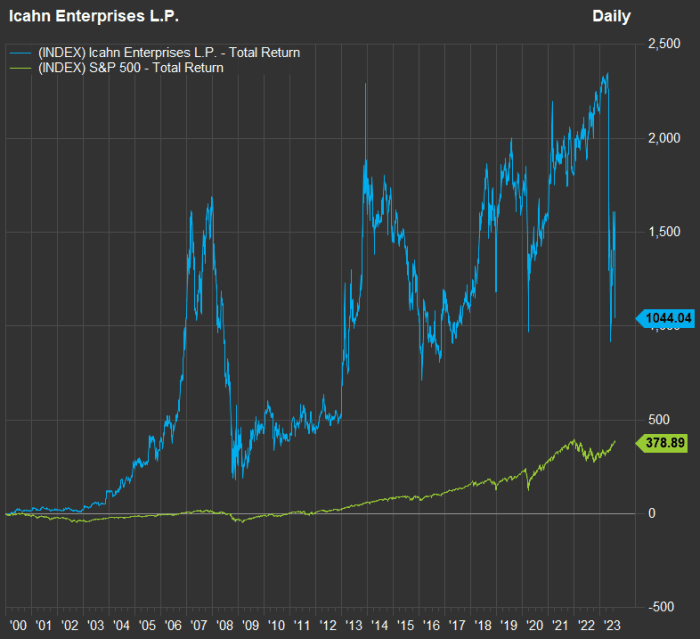

But what if you had reinvested the dividends? Here’s a total return-comparison between IEP and the S&P 500, with dividends reinvested for both, from Dec. 31, 1999 (when IEP closed at $7.63 per unit) as of about 10:30 ET on Friday:

Despite such high volatility, Icahn Enterprises has performed very well for the full period since the end of 1999, when compared with the S&P 500.

FactSet

Even with the dilution to the stock, as Icahn himself has taken dividends in the form of new shares over the years, the partnership’s total return since 1999 has been very good when compared with the S&P 500, factoring in the large decline for the stock early Friday.

The dynamic housing market

Oceanfront homes line the sands of Mantoloking, New Jersey.

Getty Images

Guess which state experienced the largest increase in home prices over one year through June 30? Here’s a hint: The state also has the highest property taxes in the U.S., on average. Aarthi Swaminathan summarizes the ups and downs of U.S. home prices from the CoreLogic Home Price Index.

Here’s a trend that highlights how important it can be to do a lot of research before moving. An increasing number of people are moving to flood-prone areas of the U.S. If your home is in a Special Flood Hazard Area, as determined by FEMA, a mortgage lender will require you to maintain flood insurance. But even if you are not in a flood zone, your area might still be prone to flooding and you may want to carry flood insurance even if it isn’t required.

More housing coverage:

Expensive stocks, momentum and different investment approaches

Joseph Adinolfi explains how expensive the U.S. stock market has become during this year’s rally and how momentum could push prices even higher.

If you think stocks are due for a prolonged downturn, here’s an exchange-traded fund that sailed through the 2022 bear market with a positive return.

And here’s an outperforming aggressive growth fund whose managers stick to their guns no matter what is going on in the economy or the stock market.

James Rogers looks at two stocks — Tupperware Brands Corp.

TUP,

and Yellow Corp.

YELL,

— that have shot into the stratosphere over recent days.

A spending trend

Margot Robbie at the European premiere of “Barbie” in London on July 11.

AFP via Getty Images

Leslie Albrecht looks at the tremendous spending by consumers on entertainment content dominated by women during the summer of 2023.

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.

This story originally appeared on Marketwatch