It’s jobs Friday, already! Can a goldilocks nonfarm payrolls report help stop the latest market wobble by boosting hopes the Fed will stop hiking?

Stocks have stalled this week as longer-duration bond yields move towards multi-month highs after the Treasury said it would borrow $1 trillion in the third quarter.

And significantly, this year’s rally that has the S&P 500

SPX

up 17.3% and the Nasdaq Composite

COMP

up 33.4% seems to have left traders increasingly more willing to find an excuse for selling.

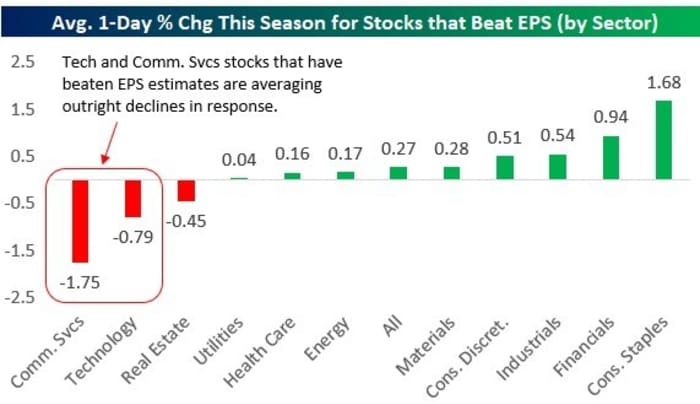

Consider the ongoing second quarter reporting season: we are in a Shania Twain market, where when it comes to earnings: “That Don’t Impress Me Much”.

Bespoke Investment Group notes that as of midweek the season so far has been slightly stronger than normal in relation to beat rates and guidance.

Of the 946 reports, 71% of stocks reported better than expected EPS compared to consensus analyst estimates, says Bespoke, while 61% reported stronger than expected revenues. Additionally, 9% of stocks have raised forward guidance while 8% have lowered guidance.

But there’s a problem: price action. “Generally speaking, stocks reporting strong results are not being rewarded with a higher share price as much as usual, while stocks reporting weaker results are getting hit even harder than usual,” their analysts say.

Observe the chart below. Stocks that beat earnings per share estimates this season have seen an average one-day share price advance of just 0.27%, well below the 10-year average of a 1.58% gain. Those stocks missing EPS forecasts averaged a one-day decline of 3.54%, slightly worse than the 10-year average, while those reporting inline EPS have lost 2.89% this time, much worse than the longer term average of 1.08%.

Source: Bespoke Investment Group

The second chart illustrates that its some of the market’s high profile winning sectors of this year that are bearing the brunt as few fresh investors are left to build positions after even decent results.

“It’s the stocks in the tech and communication services sectors that are to blame for the weakness. Even the stocks that have beaten EPS estimates in these two sectors have averaged pretty big declines on their earnings reaction days. Given that these were the two best performing sectors of the market YTD heading into earnings season, traders appear to be ‘selling the news’ right now,” they conclude.

Source: Bespoke Investment Group

Perhaps, then, investors should consider those sectors where the market is currently more amenable to rewarding earnings performance, like energy.

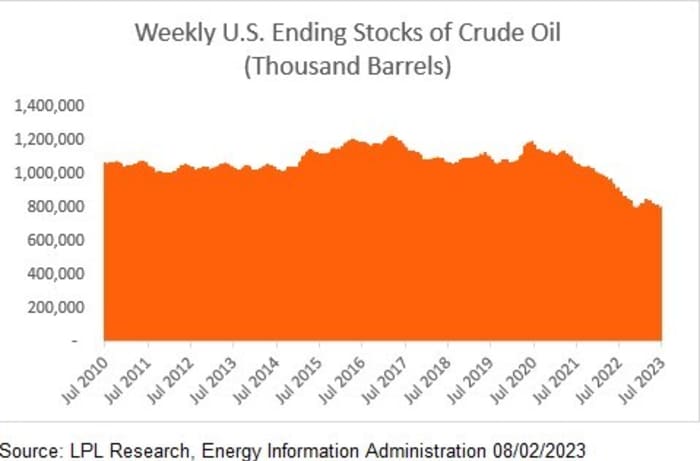

Jeffrey Buchbinder, chief equity strategist at LPL Financial, notes that while major oil companies have reported plunging second-quarter profits because of much lower energy prices compared to a year ago, “stock prices have not faltered in a commensurate manner.”

LPL holds a ‘neutral’ view on the energy sector but with a positive bias. Yes, the geopolitics and recession fears are a cause for concern. But supply restrictions — as OPEC+ seeks to curtail output — should underpin oil prices. In addition, U.S. stocks of crude fell by 17 million barrels for the week to July 28, the biggest decrease since 1982, when the data was first reported.

Source: LPL Financial

Crucially, companies have been emphasizing boosting shareholder value by increasing dividends and undertaking chunky share buybacks, all the while taking a greater focus on stricter cost measures.

“We’ve seen both free cash flow yield and cash flow return on invested capital, measures of valuation and profitability, turn positive this year as industry management teams—with pressure from Wall Street—have focused less on production volumes and more on profitability,” says Buchbinder.

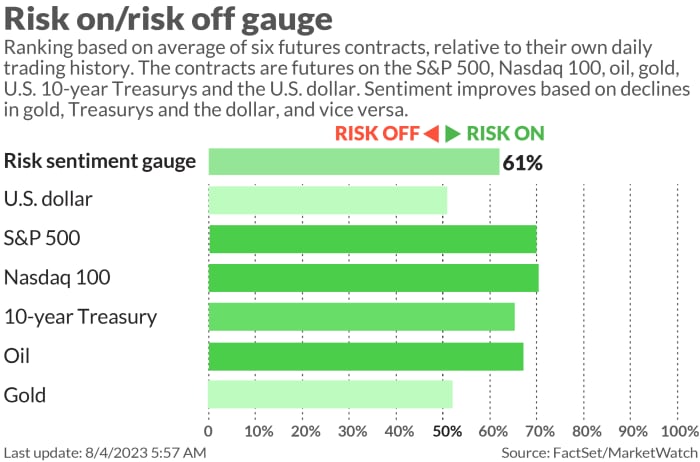

Markets

U.S. stock-index futures

ES00,

NQ00,

are higher as benchmark Treasury yields

BX:TMUBMUSD10Y

rise. The dollar

DXY

is little changed, while oil prices

CL.1,

gain and gold

GC00,

dips.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

The U.S. nonfarm payrolls report will be released at 8:30 a.m. Eastern. Economists expect a net 200,000 jobs were created in July, down from 209,000 in June. The unemployment rate is forecast to remain at 3.6% and month-on-month hourly wages to have grown 0.3%, easing from 0.4%.

Shares of Apple

AAPL,

are 1% lower in premarket trading Friday, after the iPhone maker revealed a third consecutive quarter of sales declines.

In contrast, Amazon.com stock

AMZN,

is jumping 8% after beating expectations for its e-commerce and cloud sales.

DraftKings

DKNG,

shares are up 10% after the online sports-betting platform reported a surprise second-quarter profit and boosted its full-year sales forecast.

Companies releasing earnings on Friday include Icahn Enterprises

IEP,

Nikola

NKLA,

XPO

XPO,

and Dominion Energy

D,

Best of the web

How Brookfield made $2 billion in defaults disappear.

Fitch downgrade won’t break Washington’s tax, spending habits.

The rebel group stopping self-driving cars in their tracks – one cone at a time.

The chart

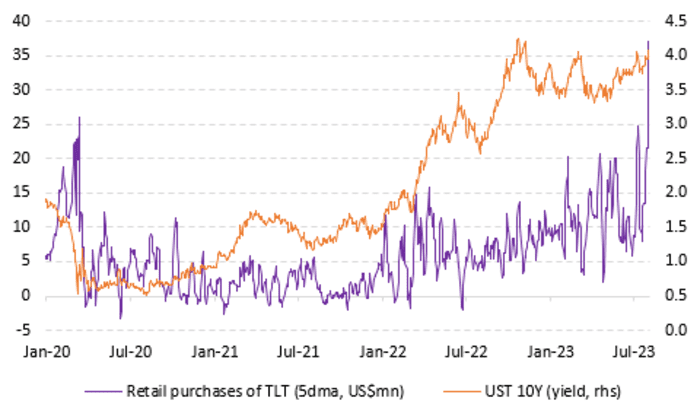

Individual investors are piling into longer-duration government bonds as yields flirt with multi-month highs. The chart below from Vanda Research shows a surge in retail purchases of the iShares 20+ Year Treasury Bond ETF

TLT.

Source: Vanda Research

“TLT was the 4th most-bought ETF on Wednesday behind the Big 3 equity ETFs [

SPY,

QQQ,

TQQQ

]. Notably, the increase in purchases over the past week easily eclipsed any bond ETF buying during the Covid downturn of March ’20,” says Vanda

“There’s undoubtedly a yield-focused mindset now across certain segments of the retail crowd (likely the older, wealthier ones) as the surge in bond ETF purchases is occurring during an upward trending equity market environment rather than in the midst of a sell-off.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

AMZN, |

Amazon.com |

|

TUP, |

Tupperware Brands |

|

TSLA, |

Tesla |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

NKLA, |

Nikola |

|

AMC, |

AMC Entertainment |

|

MULN, |

Mullen Automotive |

|

TTOO, |

T2 Biosystems |

|

NVDA, |

Nvidia |

Random reads

Telescope captures end of a star’s life.

Gen Z intern shocks recruiter with list of demands.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton

This story originally appeared on Marketwatch