At last, it’s time to send August packing — take your heat waves and miserable summer weather and begone.

As for stocks, a recent string of wins has whittled the S&P 500’s

SPX

monthly loss to 1.6%, though it’s still shaping up the worst since February, with a stormy September looming.

But spare a thought for the Russell 2000

RUT

small-cap index, set to lose nearly 5%. While up 8% on the year, the interest-rate sensitive group of stocks has battled for returns this year:

@biancoresearch

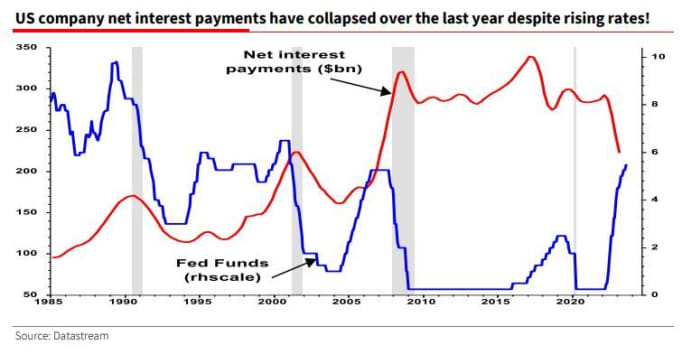

That brings us to our call of the day from Société Générale’s poke-the-bear strategist Albert Edwards, who updated his “maddest macro chart” showing why U.S. corporate profits have held up so well during rate hikes.

As he explained in July, those profits have delayed a U.S. recession because companies have largely been net beneficiary of higher rates. Corporates borrowed long-term at 2020 and 2021’s low rates, then lent money back via Treasury bills and other vehicles at higher short-term rates.

The “maddest” chart

Société Générale/Datasteam

However, in his note to clients on Wednesday, Edwards declares that “beneath the megacaps, the vast bulk of companies are in big trouble.” Yes, he’s talking about smaller companies.

The strategist who has devoted time to talking about corporate greedflation this year, spent much of his August break picking the brains of colleagues like the bank’s head of quant equity research, Andrew Lapthorne. He says a big fall in aggregate corporate interest payments “masks a big divergence in fortunes,” as shown in his chart:

“It stands to reason that smaller quoted companies in the Russell 2000 index, as well as unquoted companies, don’t have as much access to corporate bond issuance so have been unable to lock into the near-zero long-dated fixed borrowings that the larger companies have,” writes Edwards.

With that, he walks back his July conclusion that the U.S. is “practically immune from rising rates. Large and megacaps might be immune, but the explosion higher in corporate bankruptcies is sending a clear message,” he says.

He points to S&P data showing 402 corporate bankruptcies so far this year, nearly equal to 407 seen in 2020 and only higher during the global financial crisis. Look out for August data from the American Bankruptcy Institute, he advises. And citing the Fed senior loan officer opinion survey, Edwards says a willingness by U.S. banks to lend to small and large companies is now at recessionary levels.

But the real issue is that smaller companies remain the lifeblood of the U.S. economy, providing a chunk of jobs, he says. That’s as the megacaps may be the “vampires sucking the lifeblood” out of those corporates and others.

Edwards concludes. “It seems the lights are going out all over the U.S. smaller-cap corporate sector. They weren’t able to lock into long-term loans at almost zero interest rates and pile it high in the money markets at variable rates.” Ultimately that pain may trigger a recession, and maybe even the bigger companies will start to wobble.

The markets

Dow futures

YM00,

are up 120 points, while those for the S&P 500 and Nasdaq-100

ES00,

NQ00,

are mixed. The 10-year Treasury yield

BX:TMUBMUSD10Y

is slightly lower at 4.103%. China stocks

XX:000300

slipped on data showing another contraction in manufacturing activity.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Dollar General

DG,

stock is tumbling after the discount retailer missed on earnings and cut guidance. Campbell Soup

CPB,

and Hormel Foods

HRL,

are ahead, with Broadcom

AVGO,

due to report after the close.

Salesforce shares

CRM,

are up over 5% after the software giant delivered a strong outlook and improved margins. Okta

OKTA,

is up more than 10% after the ID-management software group lifted its annual earnings outlook. Five Below

FIVE,

stock is off nearly 7% after the retailer said it would tweak guidance to account for bigger-than-expected “shrink.”

Shopify shares

SHOP,

are up over 5% after Amazon

AMZN,

announced an enhanced collaboration with the e-commerce platform.

China search engine and AI group Baidu

BIDU,

released its AI chatbot to the public and shares are up 3%.

UBS

UBS,

is up over 4% after the Swiss bank reported a record $28.88 billion net profit.

Weekly jobless claims are due at 8:30 a.m., along with the Fed’s favorite inflation gauge, the personal-consumption expenditures price index. That’s all a day ahead of the August jobs report.

Best of the web

Valuable lessons from 6 financial mistakes

Shell has abandoned its $100 million a year plan to shrink its massive carbon footprint.

India’s wealthy Adani family may have spent years buying stock in its own companies, driving a sky-high valuation.

Top tickers

These were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

PLTR, |

Palantir Technologies |

|

VFS, |

VinFast Auto |

|

TTOO, |

T2 Biosystems |

|

ICCT, |

iCoreConnect |

|

MULN, |

Mullen Automotive |

Random reads

Cornhuskers volleyball players lay claim to world attendance record for a women’s sport.

Also in Nebraska, a giant bull named Howdy Doody riding shotgun.

Five million bees went on the lam in Canada.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

This story originally appeared on Marketwatch