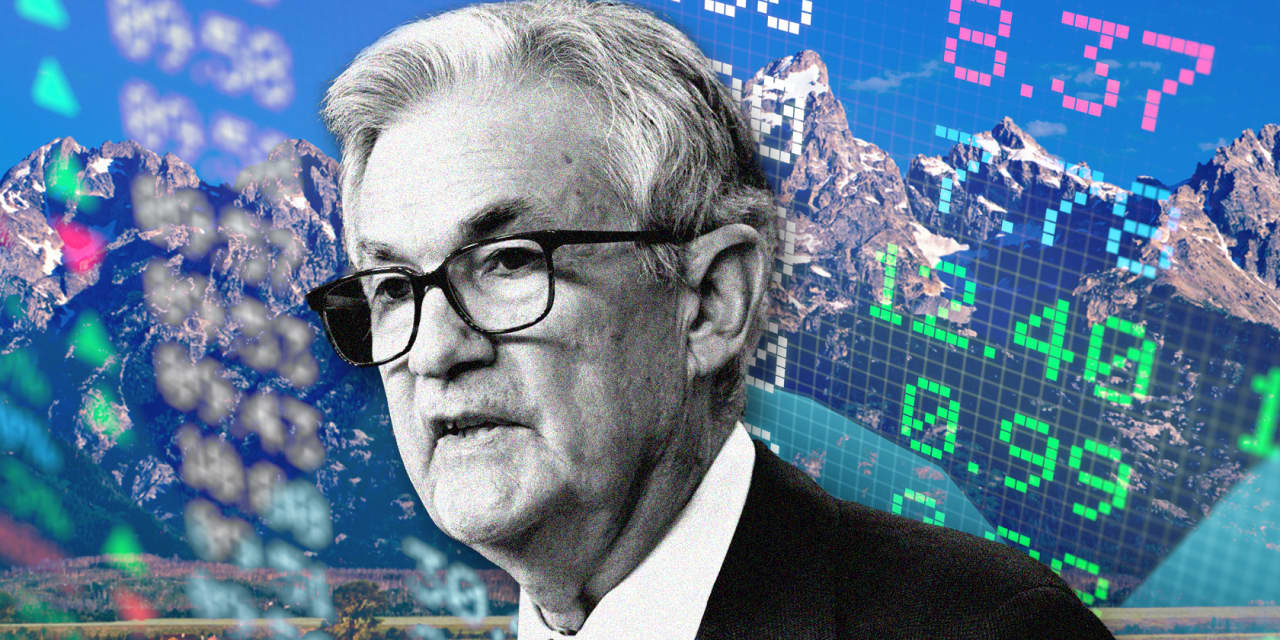

There’s one big, but theoretical, concept that has the potential to shake up the stock market the most on Friday, when Federal Reserve Chairman Jerome Powell is scheduled to deliver a speech at an annual symposium held in Jackson Hole, Wyo.

It has to do with the neutral rate of interest. That’s the level of real short-term interest rates that’s expected to prevail when the U.S. economy is at full strength and inflation is stable. The real neutral rate — known alternatively as r* or r-star— is estimated to be around 0.5%, after subtracting the Fed’s 2% inflation target from policy makers’ latest forecasts for where the fed funds rates is likely to be in the long run. And that neutral rate may be moving higher, given how the economy is performing right now.

Read: Jackson Hole meeting: When is Jerome Powell’s speech? What investors need to know.

Settling on the right theoretical level for the neutral rate matters because the U.S. economy appears to be accelerating, even after the Fed has hiked rates by more than five full percentage points to a 22-year high of 5.25%-5.5%. The world’s largest economy grew at a solid 2% pace in the first quarter, followed by a 2.4% pace for the second quarter. Now, the Atlanta Fed’s GDPNow model is forecasting a third-quarter growth rate of 5.8% for real gross domestic product — a number that’s drawn plenty of skeptics, but underscores just how well the economy seems to be doing.

See: R-Star Is the New Buzzword. Listen for It at Jackson Hole.

“The notion of a higher r-star or neutral rate has crept its way into the marketplace and has been a hot topic lately,” said Thomas Urano, co-chief investment officer at fixed-income money manager Sage Advisory in Austin, Texas, which oversaw $23 billion as of July. “The market is trying to digest where the Fed views this neutral rate and is looking to get a little more clarity as Powell speaks in Jackson Hole.”

If the neutral rate is higher than previously thought, that means policy makers might need to hike the fed-funds rate target even further, in addition to holding borrowing costs higher for longer and delaying the timing of their first rate cut.

Traders and investors are well aware that the Fed is likely to keep interest rates higher for longer, and they’ve pushed out their expectations about the timing of the first rate cut next year, according to Dan Eye, chief investment officer for Pennsylvania-based Fort Pitt Capital Group, which manages $4.9 billion in assets.

However, the market is not yet fully positioned for the Fed to put rate hikes back on the table, Eye said via phone on Wednesday.

Dow industrials

DJIA,

the S&P 500

SPX,

and Nasdaq Composite

COMP

are respectively up so far this year by 4.1%, 15.6%, and 31.3% as investors and traders hold out hope for a soft- or no-landing scenario in which the U.S. economy can emerge relatively unscathed as inflation keeps falling.

As of Wednesday afternoon, all three major stock indexes were higher, led by a 1.8% advance in the Nasdaq Composite as investors await a fiscal second-quarter earnings announcement from chip maker Nvidia Corp.

NVDA,

that’s due after the close.

Any remarks by Powell on Friday that can be interpreted as suggesting that more rate hikes are likely to come will produce volatility and “a downdraft in stocks,” Eye said. The best possible outcome for stock investors would be if Powell “stresses data dependency and says that policy makers will continue to consider the cumulative impact of rate hikes that have been done already.”

The theme of the Kansas City Fed’s Jackson Hole symposium, being held Thursday-Saturday, is “Structural Shifts in the Global Economy,” a topic that’s led to the growing expectation that Powell will address where he and the Fed currently see the neutral rate.

In the run-up to Friday’s Jackson Hole speech, the Treasury market has already priced in a scenario of better-than-expected U.S. economic growth, with 10- and 30-year yields reaching multiyear highs on Monday and last week. Though both yields pulled back on Tuesday and Wednesday, they could bounce back again if investors sell off long-dated government debt in response to Powell’s remarks, investors said.

The recent rise in yields has been blamed, in part, for August’s decline in U.S. stocks, with the S&P 500 down more than 3% so far this month.

“Powell has to sound hawkish, he cannot afford not to do so” because “any signal that the hiking cycle is done will probably lead to such a bullish response in risk assets that it will loosen broader financial conditions,” said strategist Rikkert Scholten at Rotterdam-based Robeco, which oversees $194 billion.

Still, Robeco’s investment team also expects the Fed chairman to stress data dependence as a way of “credibly” keeping his options open.

Brad Conger, deputy chief investment officer at Hirtle Callaghan & Co. in West Conshohocken, Penn., which manages $18.5 billion in assets, said he believes the Fed is near the end of its rate-hiking cycle, which began in March 2022.

Nevertheless, “any discussion about a higher natural rate of interest due to the shifting structure of the economy would set off a bout of uncertainty,” he said. Natural rate is the phrase used to describe where the neutral rate may settle over the longer run.

This story originally appeared on Marketwatch