It’s CPI day and the mood is a little tense, understandably given expectations for that number to bump up.

While a summer swoon for stocks has already left some investors wary, optimists remain. Manish Kabra, head of U.S. equity strategy at Société Générale, is the latest on Wall Street to lift his S&P 500

SPX

target, predicting the index will reach 4,750 by the end of 2023 versus a prior 4,300. (Here’s where the rest of Wall Street currently stands)

He says in our call of the day that they are staying bullish near term, “despite the likely jitters in 2024,” as investors will begin accounting for a more optimistic economic outlook. So recession calls will be “deleted/delayed,” they say.

Kabra says they still see a U.S. recession likely mid next year, but for now the S&P 500 will be the “last man standing,” when it comes to defending its roughly 16% gain seen this year.

“We continue to see support for the S&P 500 from AI-driven investments and fiscal/reshoring manufacturing spending. Further, interest-rate coverage for the largest 10% of U.S. stocks by market cap (78% of S&P 500 market cap) is near all-time highs, and thus the Fed hikes have had a limited impact on these companies –which are even earning interest on their cash balances,” said the strategist in a note that published Wednesday.

SocGen has been bullish on growth stocks — up 35% so far this year — and bearish on value names — flat –and expects that trade will get “stretched for the rest of the year.” He said earnings per share for growth stocks should start to rise in the next two quarters:

He suggests sticking with growth names, as tech stocks are likely to benefit from that EPS inflection, supported by robotics and AI-related stocks. They also like industrials, thanks to an expected fiscal/reshoring boom spurred by the Inflation Reduction Act. Kabra says they’d sell growth stocks if the Institute for Supply Management manufacturing index goes over 55 (It has been contracting for 10 months) or if U.S. 10-year Treasury yields top 5%, which he doesn’t expect.

Read: 20 stocks of aerospace and defense companies expected to grow sales most quickly through 2025

Another plus for U.S. stocks is that they stack up well against other international markets, with stagflation in Europe and a disinflationary downturn in China. “With EPS momentum already stronger for the S&P than the rest of the world, it will not take a lot of convincing for global investors to plough money into any weakness in the large U.S. equities,” he said.

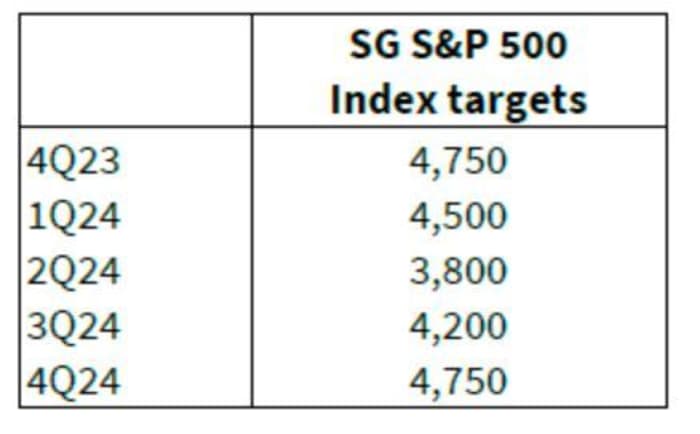

Kabra and his team do see a stumbling block ahead for 2024, with this table laying out their S&P 500 road map:

Société Générale

Kabra says it will take a couple of quarters for their recession expectations and credit market shocks to hit markets.

“We expect a 15% shock in the S&P 500 in 2Q24, likely driven by a contraction in U.S. consumer spending. However, with a return to 5% nominal GDP growth in 2025, the S&P 500 should recover,” he says. Bond yields will drift down to 3% to 3.5% in a soft recession and aggressive Fed rate cuts should be a feature by the middle of next year, he says.

Read: Howard Marks says good luck beating the stock market without Apple, other big winners this year

The markets

Stock futures

ES00,

NQ00,

are holding steady ahead of inflation data, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

also going nowhere. It was a mostly weaker day across Asia

XX:000300

Read: Here’s what DoubleLine’s Jeffrey Gundlach thinks about Bill Gross’s ‘bond king’ slap down

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

All eyes on consumer price inflation data due at 8:30 a.m., with the biggest jump in 14 months expected, a 0.6% gain for August, and a shift to 3.6% from 3.2% on an annual basis.

Ford

F,

and General Motors

GM,

stocks are up in premarket. UBS lifted them both to a buy, rating, saying focus on growth and not a looming strike. Elsewhere, the EU has launched a probe into subsidies provided by China to electric vehicle makers.

China has denied banning Apple’s

AAPL,

iPhones as some news reports indicated last week, but says it has noted security incidents related to those handsets.

Shares of Rocket Pharmaceuticals

RCKT,

are up 17% after the late-stage biotech said it reached alignment with the FDA on a trial for its treatment for Danon disease.

KULR Technology stock

KULR,

is off 29% after the sustainable energy management group said it was planning a public offering of common stock to pay down debt. And Evolution Petroleum shares

EPM,

are down 13% after the oil and natural gas group reported a sharp revenue fall.

Binance U.S. CEO Brian Shroder has left the crypto exchange as about 100 workers were also laid off, say reports.

Talks between Russian President Vladimir Putin and North Korean leader Kim Jong Un got under way Wednesday at a remote Siberian rocket launch facility.

Best of the web

Hedge funds’ big bet against Treasurys isn’t what you think

This retiree has found joy in traveling the world as a clown.

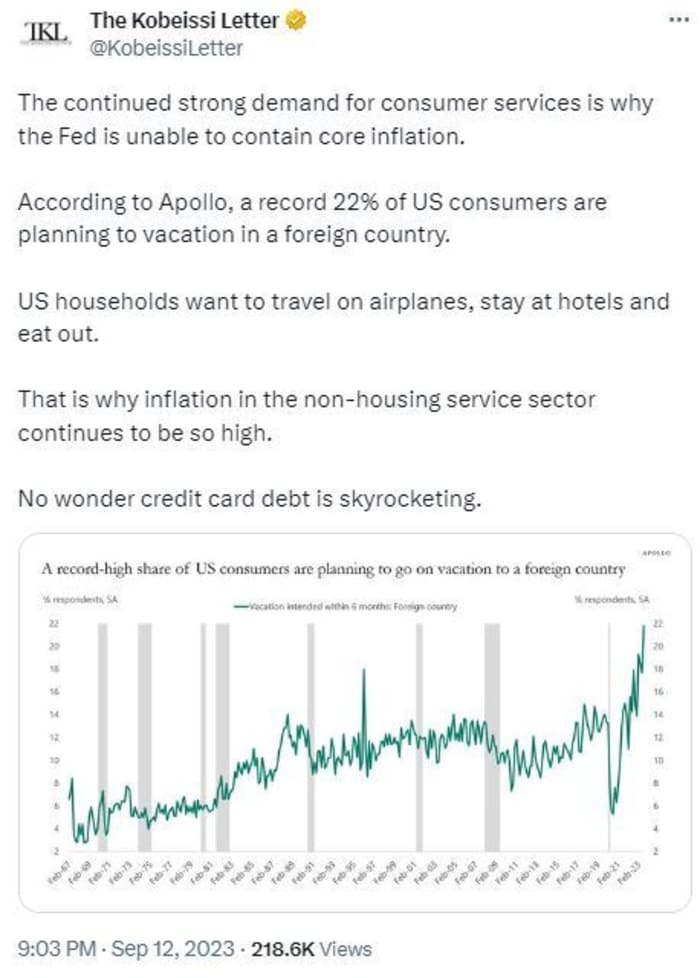

The chart

Why is the Fed unable to keep inflation under control? Americans want to dine out and take pricey vacations, says this chart tweeted by Kobeissi Letter’s editor in chief and founder, Adam Kobeissi:

@KobeissiLetter

The tickers

These were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

CGC, |

Canopy Growth |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

ACB, |

Aurora Cannabis |

|

AMZN, |

Amazon |

Random reads

Pink-leathered armchairs, bedrooms. All aboard Kim Jong Un’s armored train.

Flood of “good quality wine” sloshes through Portuguese town.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

This story originally appeared on Marketwatch