VinFast Auto Ltd. late Thursday reported a second-quarter loss of half a billion dollars, saying it delivered more than 9,000 electric vehicles globally for sales of about $315 million in the period.

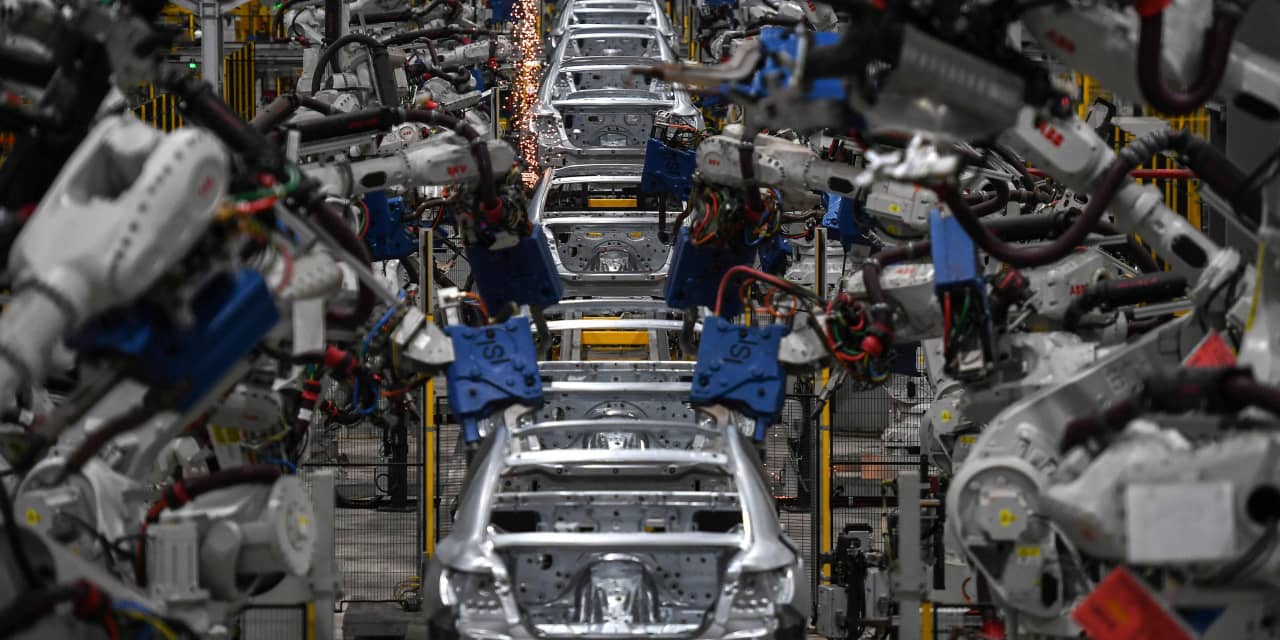

Vietnamese EV maker VinFast

VFS,

went public in August through a SPAC deal, and the stock more than tripled by the end of its first session, sending the company’s market valuation soaring to more than $200 billion.

VinFast’s market cap hovered around $36 billion on Thursday, lower than Ford Motor Co.’s

F,

market value of $48 billion and General Motors Co.’s

GM,

$45 billion. Its stock lost more than 8% on Thursday to close at $15.75, and edged 0.3% lower in the extended session.

The company pegged EV deliveries at 9,535 for the quarter ended June 30, from 1,780 vehicles in the first quarter.

Vehicle sales topped $315 million, and total revenues were $334 million, mostly from the EV sales, the company said. VinFast also makes e-scooters and electric buses.

VinFast reported a net loss of $526.7 million in the quarter, which was 8% less than its quarterly loss in the year-ago period. FactSet does not compile analyst estimates for VinFast.

Some 99% of VinFast shares are controlled by Vingroup chair and VinFast founder Pham Nhat Vuon, making only a small portion available to investors.

VinFast is a majority-owned affiliate of Vingroup, a conglomerate that is one of the largest publicly traded companies in Vietnam.

VinFast broke ground on its North Carolina plant in July. The company said it plans to invest up to about $2 billion in the plant initially, and it expects to eventually reach the capacity to make 150,000 EVs a year.

The stock is down 54% so far this month, compared with a loss of around 2.7% for the S&P 500 index

SPX.

For the year, however, the shares are up 57%, compared with an advance of around 13% for the S&P 500 in the same period.

This story originally appeared on Marketwatch