Following reports of financial firm Goldman Sachs’s deteriorating relationship with Apple, the company’s CEO has avoided saying anything about wanting to pull out of its Apple Card and Apple Savings deals.

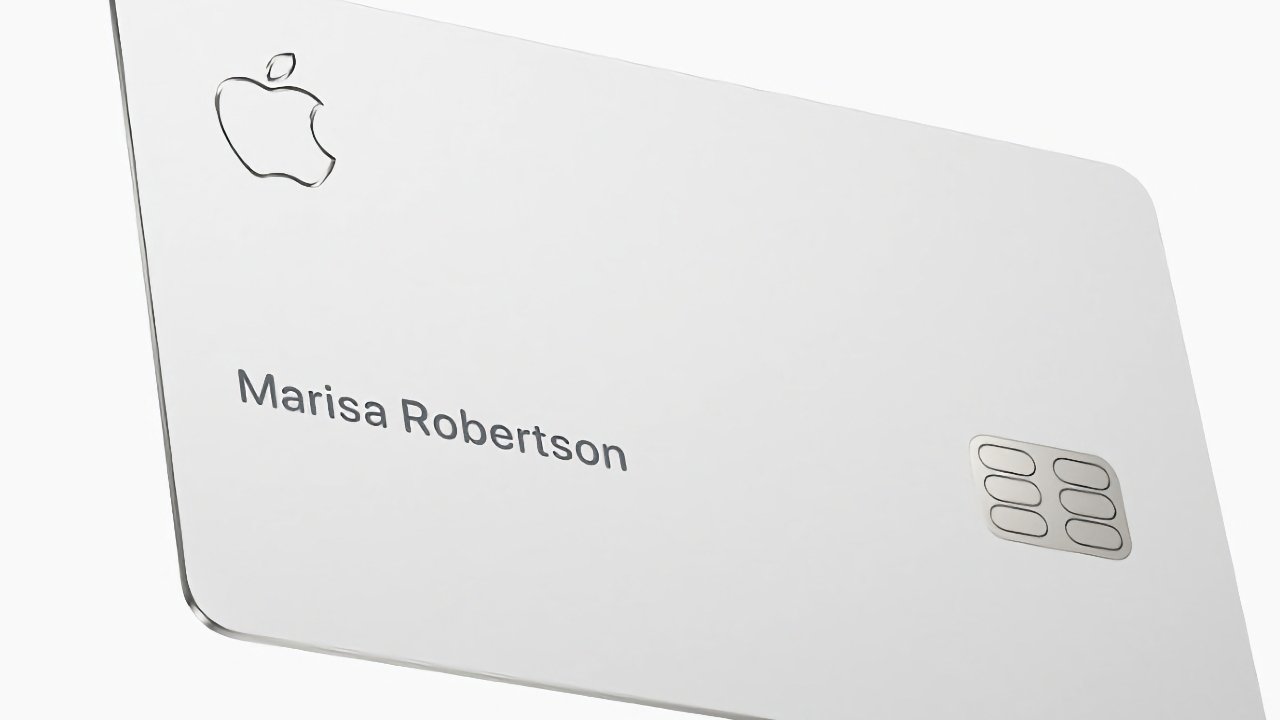

Goldman Sachs has lost so much money — $1.2 billion in 2022 — on Apple Card, that it reportedly has tried to sell the deal to American Express. It’s also been accused, and cleared, of credit line bias, plus its whole consumer credit portfolio is being investigated.

Then following its April launch of Apple Savings, an executive at the finance firm reportedly even said that “we should never have done this f****** thing.”

Consequently, CEO David Solomon was asked about Apple — and a similar situation with General Motors — during its latest earnings call with investors and analysts.

“Our partnerships with Apple and GM are long-term contracts, and we don’t have the unilateral right to exit those partnerships,” he said, according to a transcript by Seeking Alpha. “So our focus at the moment is on managing them better, getting rid of the drag and bringing them to profitability.”

“And we’re making progress, both in the way we run them and against the cost base that we put against them,” he continued. “We’ll continue as we go forward to work constructively with our partners and examine what’s best in the long run for Goldman Sachs.”

“But our core focus is on reducing the drag over the course of the next 12 to 24 months,” he said, “and ensuring we operate them better.”

The business of “ensuring we operate them better” is a clear enough commitment to the deals that Goldman Sachs does not “have the unilateral right to exit.”

However, one way to “reduce the drag” would of course be to find a way to get out of the deals. Separately, one option that has reportedly been raised but not at the highest levels, is that Apple could take on some or more of the financial arrangement.

This story originally appeared on Appleinsider