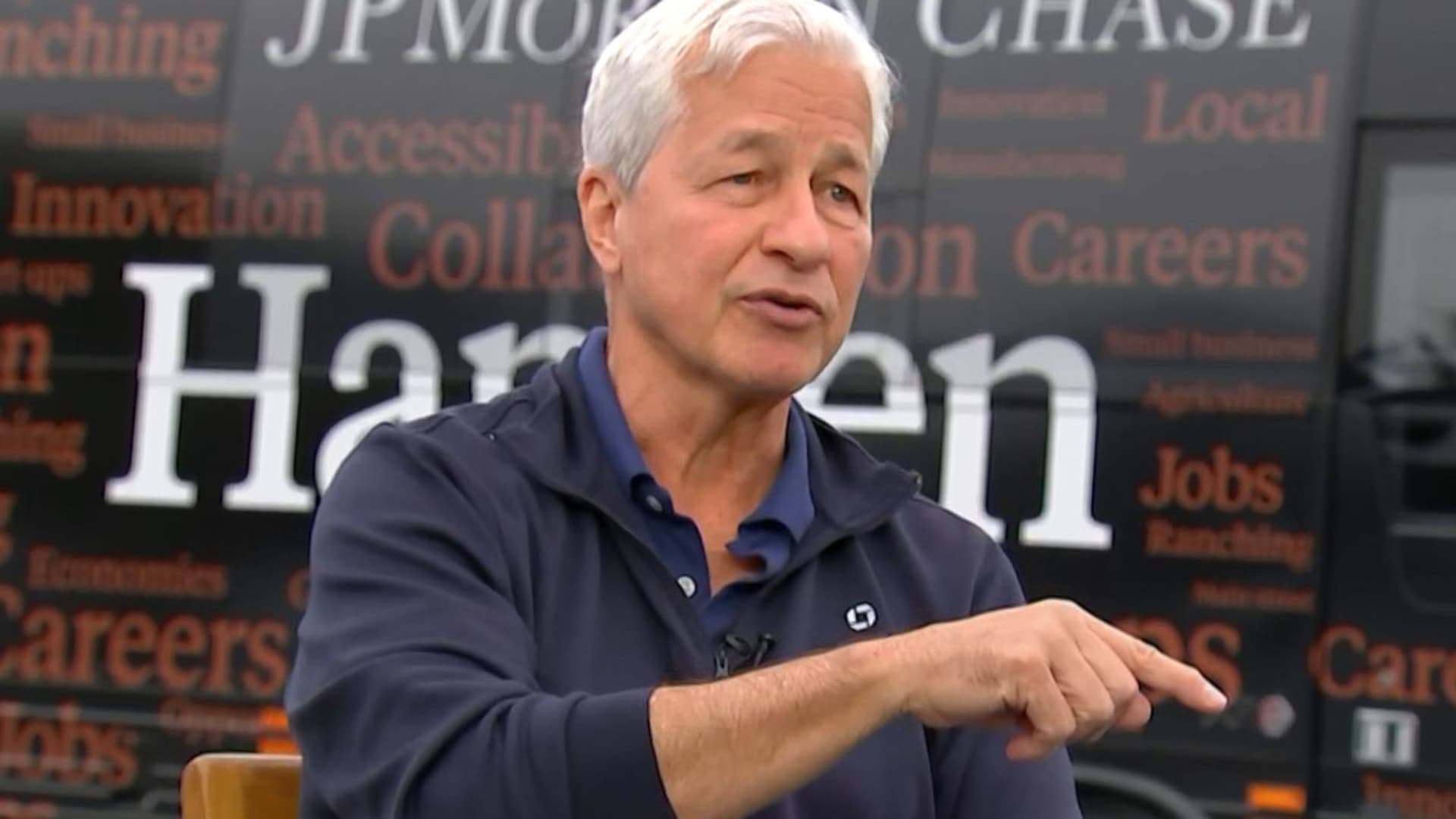

JPMorgan Chase CEO Jamie Dimon will begin to sell one million shares of the bank he runs next year, the company said Friday in a filing.

The plan sparked concern that Dimon, 67, could be contemplating retirement. Dimon is arguably the country’s top banker. He has led JPMorgan since 2005, helping build it into the biggest and most profitable American bank. His stewardship included navigating JPMorgan through two banking crises, helping stabilize the industry by acquiring failed banks.

Before now, Dimon has never sold shares of JPMorgan except for technical reasons such as exercising options. He has also spent his own money snapping up JPMorgan shares in the past.

Shares of the bank slipped 3.6%, worse than the 2.3% decline of the KBW Bank Index.

“This is a reminder that the CEO is getting closer to retirement,” Wells Fargo analyst Mike Mayo said in a note. Dimon may transition from his current role in about three and a half years, if prior statements prove accurate, Mayo added.

A spokesperson for the New York-based bank said the move wasn’t related to succession planning, and that Dimon has “no current plans” for another sale, though his needs could change over time.

Here is the bank’s statement:

Chairman & CEO Jamie Dimon confirmed today that he and his family plan to sell a portion of their holdings of JPMorgan stock for financial diversification and tax-planning purposes. Starting in 2024 they currently intend to sell 1 million shares, subject to the terms of a stock trading plan. This is Mr. Dimon’s first such stock sale during his tenure at the company.

Mr. Dimon continues to believe the company’s prospects are very strong and his stake in the company will remain very significant. He and his family currently hold approximately 8.6 million shares, and in addition he continues to have unvested Performance Share Units relating to 561,793 shares and Stock Appreciation Rights relating to 1,500,000 shares, subject to the terms and conditions of each grant.

Mr. Dimon will use stock trading plans to sell his shares, in accordance with guidelines specified under Rule 10b5-1 of the Securities and Exchange Act of 1934.

Don’t miss these CNBC PRO stories:

This story originally appeared on CNBC