Stocks are pointing to more gains, as yields go tumbling. Reopening after a holiday, bonds are rallying in part due to haven seeking after Hamas’ deadly attacks on Israel. But also, two Fed officials talked down interest rate hikes on Monday — more speakers are ahead for Tuesday.

Investors, especially oil traders, will obviously be monitoring the Middle East for any escalation, but Wall Street has a way of quickly and coldly getting back to business, as inflation data and the start of earnings season loom.

Onto our our call of the day from Goldman Sachs, which says that an influential crowd of momentum traders is ready to buy the S&P 500 in a big way over the next month.

The below chart from the bank shows record-low exposure for U.S. equities among commodity trading advisors, or CTAs, who profit from bets on futures markets, and often follow trends.

According to a note from the bank, these CTAs are short some $90 billion of global equities, what it says is a zero percentile reading. In the U.S. alone, they are short $47 billion in equities — the largest U.S. short position for this group on record.

“Per GS model, [the] CTAs are now buyers of SPX in every scenario over the next month,” said the bank in an note from Monday.

Positioning in U.S. stocks by CTAs is at a record low of $47 billion.

Goldman Sachs

So those CTAs who have been busy selling the S&P 500, are ready to buy it back if Goldman is right. However, not everyone advises following the trend-loving CTAs, who some criticize for often swinging from one extreme to the other.

As the FT has pointed out, CTAs had a record 2022 performance thanks to surging inflation, but got burned earlier this year on bets that bank turmoil would force the Fed to stop hiking interest rates.

MarketWatch’s Mark Hulbert notes that while October can be a historically volatile month, it can also mark the start of a seasonal bounce for stocks. Jeff Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor Newsletter, refers to October as a “bear-killer, bargain month and turnaround month,” with solid, though yes, volatile trading at times.

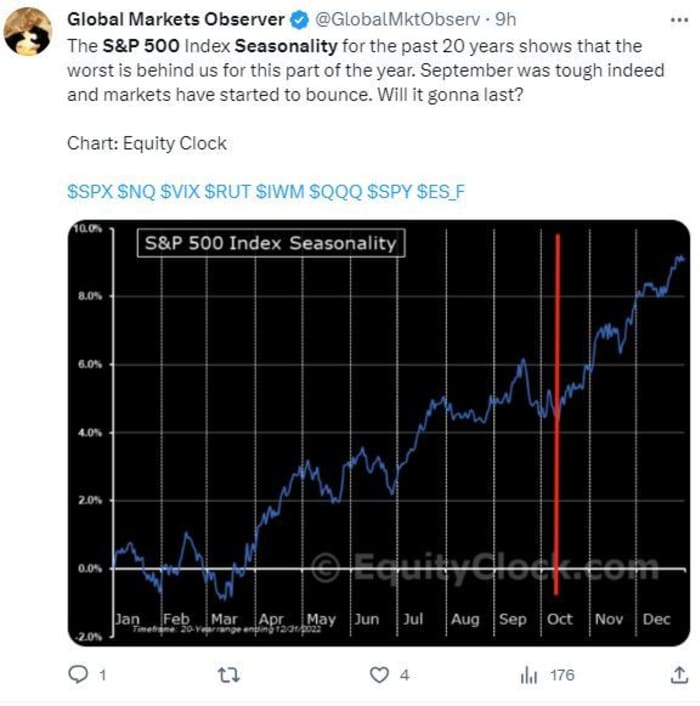

This seasonality chart from Equity Clock that has been making the rounds may also support stock buyers:

@GlobalMktObserv

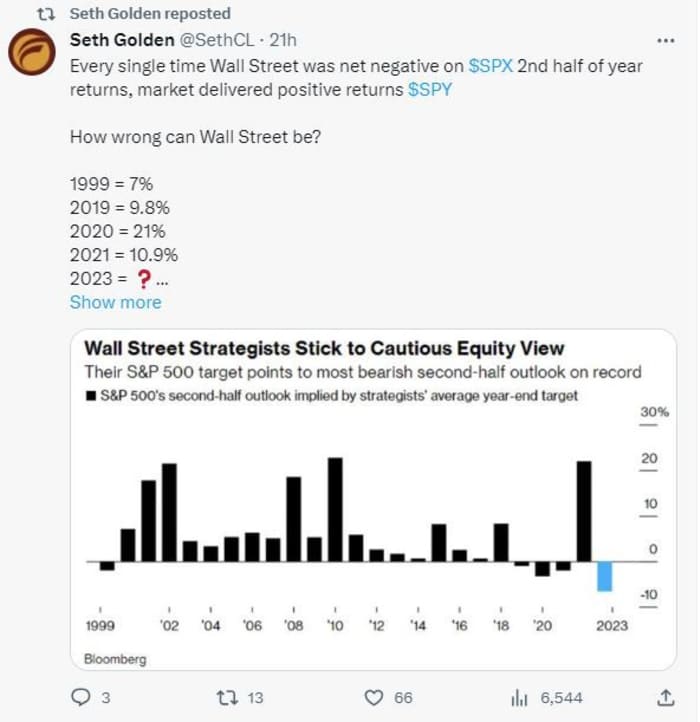

Here’s yet another buyer friendly chart — maybe — from Finom Group’s chief market strategist, Seth Golden:

@SethCL

Also read: 1970s-style stagflation may be at risk of repeating itself, Deutsche Bank warns

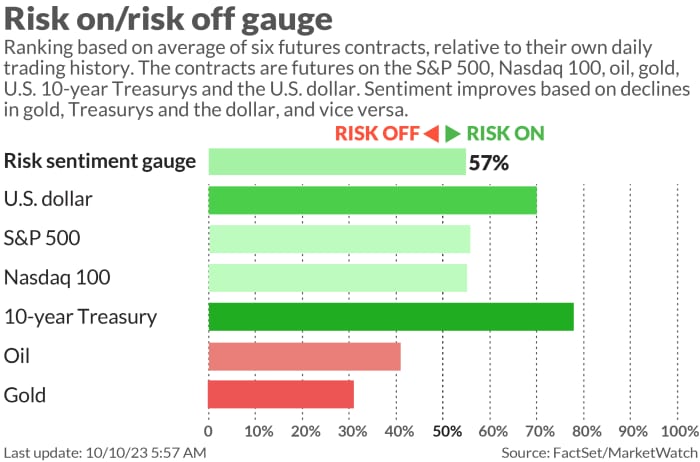

The markets

Stock futures

ES00,

NQ00,

are rising, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

diving. Gold

GC00,

is up another $6, but the dollar

DXY

is down, along with oil

CL.1,

is down modestly as investors turn to inventory reports due later in the week.

Read: Treasury-market selloff has become the worst bond bear market of all time, according to BofA

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Israel’s war on Gaza entered its fourth day on Tuesday, with repeated bombings of Gaza City and 300,000 reservists called up. A senior Hamas official rejected the idea that Iran had some role in the planning of the surprise attacks that have led to 1,600 deaths on both sides.

PepsiCo

PEP,

shares are up after the drinks maker lifted guidance. That’s as investors wait for Friday’s second-quarter kickoff from banking giants JPMorgan

JPM,

BlackRock

BLK,

Citigroup

C,

and Wells Fargo

WFC,

Auto workers walked off the job at three GM

GM,

facilities in Canada early Tuesday after their union failed to reach a deal.

Country Garden, China’s largest property developer, has warned it may not repay international debts.

Fed appearances are as follows: Atlanta Fed President Raphael Bostic will take part in a moderated conversation starting at 9:30 a.m., then Fed Gov. Christopher Waller at 1 p.m., Minneapolis Fed President Neel Kashkari at 3 p.m. and San Francisco President Mary Daly at 6 p.m. Wholesale inventories are due at 10 a.m.

The IMF kept its limp global expansion forecasts mostly in place — 3% for 2023 and slightly less growth of 2.9% next year.

Best of the web

How rising Treasury yields can make houses, cars and even student loans more expensive.

Zombie viruses are waking up after 50,000 years as planet warms.

Yellen may face questions at IMF meeting over U.S. dysfunction.

Chart of the day

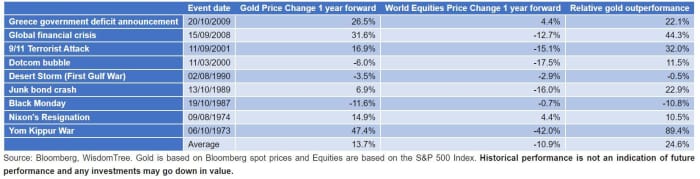

Gold climbed 1% on Monday as jittery investors seeking a haven for their money amid fresh Middle East violence pushed the commodity to its best day since August. This chart from Wisdom Tree takes a look at how gold has performed a year on from major geopolitical events and crisis:

“The metal has a strong reputation as a geopolitical hedge, even though frequently the price moves dissipate quickly. Occasionally the prices gains stick and are very meaningful. Take the Yom Kippur War 50 years ago, where gold prices surged more than 47% by 1 year after the start of the event,” Nitesh Shah, head of commodities & macroeconomic research at WisdomTree, told clients in a note.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

PLTR, |

Palantir Technologies |

|

AMZN, |

Amazon.com |

|

HUBC, |

Hub Cyber Security |

|

TTOO, |

T2 Biosystems |

Random reads

Levi’s CEO says wash your jeans in the shower, and not often.

Unhappy with Seinfeld finale? A redo could be in the works.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

This story originally appeared on Marketwatch