The European Central Bank on Thursday held interest rates steady, and reiterated it would keep them high for a “sufficiently long duration” to bring inflation to target.

The central bank is holding rates for the third straight meeting, after hiking its benchmark deposit facility to 4% in September. It said that recent data had “broadly confirmed” its previous medium-term inflation outlook and that a declining trend in underlying inflation had continued.

ECB President Christine Lagarde said during a press briefing that the uptick in December inflation was expected and caused by base effects, and “does not detract from the view we have that the disinflation process is at work.”

Nonetheless, the consensus of the central bank’s Governing Council was that it was “premature to discuss rate cuts,” she said. It will continue to be data dependent rather than “fixated on any calendar,” Lagarde added.

The Governing Council’s “future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary,” the ECB said in a statement, echoing its previous language.

The central bank is facing a sluggish euro area economy and fragile financial stability, but it is also focused on bringing inflation down to 2% from 2.9% currently. The ECB is highly concerned with possibly cutting rates too soon and undoing some of the effects of the existing tightening.

Rates pushback

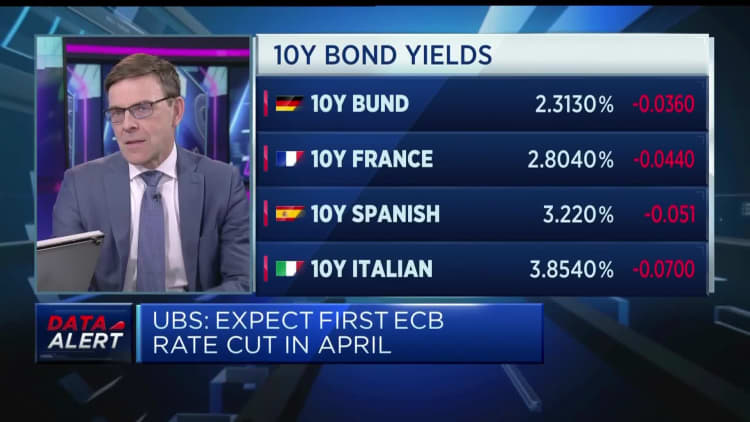

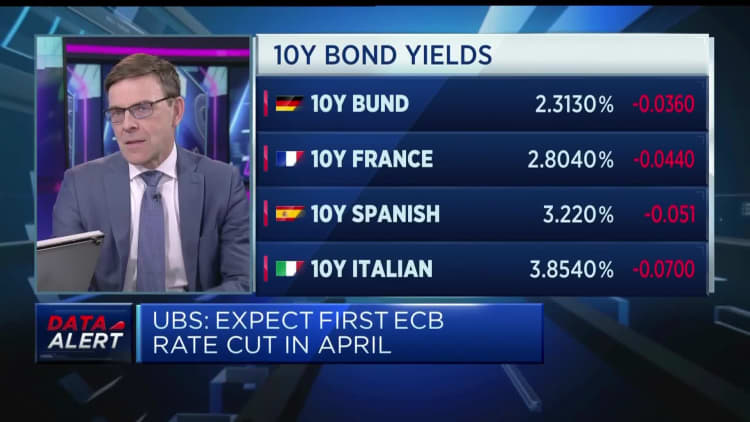

Some ECB officials have spent the month pushing back against market expectations for rate reductions in the spring, stressing the need to wait for first-quarter wage data. On Thursday morning, markets were factoring in a 62% probability of an April cut, according to LSEG data.

The ECB is looking carefully at a range of data on wage growth, including from jobs site Indeed and from its own wage negotiations tracker, according to Lagarde.

The next few months will be “rich in information” on this front, she said, adding that wage growth is currently “directionally good.” The ECB’s hope is that any further wage increases are absorbed by corporate profits so that they do not create second-round inflationary effects, she said.

The euro traded lower against the U.S. dollar and British pound late Thursday afternoon, while European stocks moved slightly higher and bond yields were lower.

The announcement meant the ECB “reiterating its reluctance to begin making cuts despite the ever mounting pressure to do so,” Richard Carter, head of fixed interest research at Quilter Cheviot, said in a note.

“Inflation had been falling consistently in the Eurozone but saw an unwanted uptick to 2.9% in December, adding fuel to the ECB’s relatively hawkish position.”

Vincent Chaigneau, head of research at Generali Investments, noted the ECB retained its language around being sufficiently restrictive with monetary policy for a long enough time, while removing it would have been seen as dovish.

“What is slightly positive, I suppose, from a market point of view, is that the perception on domestic inflation pressure seems to be a notch lower. They are no longer talking about elevated domestic inflation pressures,” he told CNBC.

“But of course, it reflects the very quick fall in inflation. So it’s not very surprising,” he added.

This story originally appeared on CNBC