Investors look set to close out January with profit-taking on Big Tech after Microsoft, Google and AMD didn’t quite bedazzle, as a Fed decision awaits.

Where tech is concerned it’s been a matter of timing for the past couple of years. Our call of the day comes from Thomas Hayes, founder and chairman of long/short equity manager Great Hill Capital, who made some prescient stock calls in that period and has some “rocket ship” investing ideas to share.

After calling the pandemic bottom, Hayes was among a handful of investors who turned bullish on stocks in October 2022 and October 2023, both big market turning points. For example, in October 2022, he took long positions in Amazon and Alphabet when “you couldn’t give them away,” and says they have no plans to sell.

Speaking to MarketWatch on Tuesday, Hayes admitted to his less lucrative bets — biotechs and Alibaba

BABA,

— tied to expectations for a faster recovery in China, but sees a turnabout coming.

“Now that the Fed is getting out of the way, I think it’s a rocket ship both in Alibaba and biotech,” he said.

Hayes, who blogs at Hedge Fund Tips, explains that there is money to be made in long-duration assets. “So those assets that were negatively impacted by high rates are going to start to outperform as we move into a great normalization period,” he said.

Biotech and real-estate investment trusts are areas to look at. As for the former, he says this year will be about “deals and drugs. So as capital becomes more available, as the Fed becomes more accommodative and risk appetite increases, you’re going to see a lot more yield,” he said. Big pharma has lots of cash, but little growth and innovation, and will need deals with undervalued biotech companies to make that happen, he adds.

Smaller companies are lagging a bit as they “have not yet started to behave in line with a rate normalization environment,” he notes.

What does he like? He owns Cooper-Standard

CPS,

a global supplier of sealing and fluid handling systems and components for GM

GM,

Ford

F,

and Stellantis

STLA,

Shares have climbed to $18 per share from $6 when he first started buying in May 2022.

“There is still pent-up demand, because there was limited supply due to the semiconductor shortage just a year and a half ago and before. As those volumes return closer to prepandemic levels, the operating leverage in some of these auto parts suppliers to the companies producing new cars will be phenomenal,” he said.

He also likes Canada Goose

GOOS,

GOOS,

“the Apple Store of luxury expensive jackets,” as it’s increasing margins and direct-to-consumer sales, and poised for a “good turnaround recovery story” looking out 24 to 36 months.

Hayes owns Comstock Resources

CRK,

which sits in the “most hated” sector of natural gas. He sees it as a “turnaround play on global demand,” even though it’s currently a depressed asset.

As for the year ahead, he sees general stock indexes rising by “high single digits, low double digits [percentage], which would be in line with an average presidential election year average of 11.28% since 1928. So the bigger opportunities are going to be under the surface. And I think the Alpha opportunities are going to be found in small and mid caps and emerging markets plus China,” he says.

The markets

S&P 500 futures

ES00,

are sliding, with Nasdaq-100 futures

NQ00,

off more than 1%, and Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

falling. Oil prices

CL.1,

are down more than 1%, as gold

GC00,

rises. The Hang Seng

HK:HSI

fell again as China manufacturing contracted again.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,924.97 | 1.16% | 4.68% | 3.25% | 19.56% |

| Nasdaq Composite | 15,509.90 | 0.18% | 6.29% | 3.32% | 31.26% |

| 10 year Treasury | 4.016 | -16.54 | 9.57 | 13.47 | 59.16 |

| Gold | 2,054.70 | 2.00% | 0.25% | -0.83% | 4.47% |

| Oil | 77.46 | 2.79% | 6.08% | 8.59% | 0.99% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

It’s Fed day, with a decision due at 2 p.m. Ahead of that private-sector payrolls data is coming at 8:15 a.m., followed by the employment cost index at 8:30 a.m.

Microsoft

MSFT,

stock is down despite forecast-beating results, with Alphabet shares

GOOGL,

off 5% after the Google parent’s digital ad rebound disappointed. Advanced Micro Devices

AMD,

dramatically boosted its AI chip revenue outlook, but the stock is off 6%. Samsung

005930,

reported a 34% profit fall as chip sales couldn’t compensate for sluggish TV sales and share fell.

Boston Scientific

BSX,

is up on an earnings beat, with Boeing

BA,

Phillips 66

PSX,

and Mastercard

MA,

results still to come, followed by Qualcomm

QCOM,

after the close.

Cardinal Health

CAH,

is buying multi-specialty platform Specialty Networks for $1.2 billion in cash.

Walmart stock

WMT,

is up after the retailer announced a 3-for-1 stock split.

Universal Music Group

UMG,

which represents megastars such as Taylor Swift, warned it will yank songs from TikTok after a licensing deal expires.

Best of the web

Inside the Taylor Swift deepfake scandal: ‘It’s men telling a powerful woman to get back in her box’

AI sector on course to use as much power as Spain.

The chart

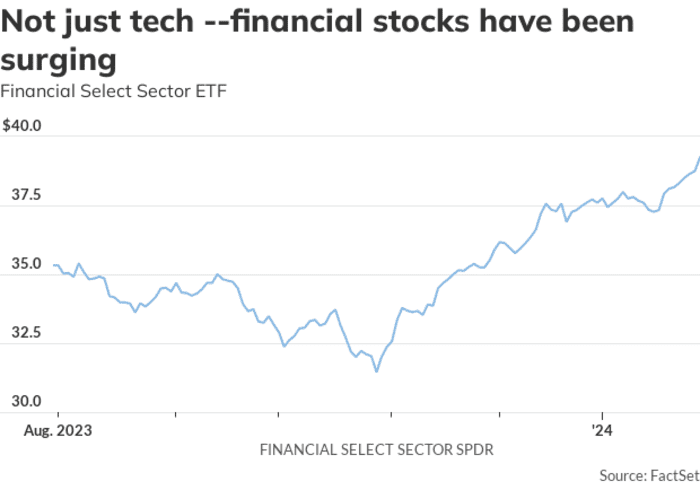

Daily Chart Report’s Patrick Dunuwila notes the financial sector ETF

XLF

closed at a two-year high on Tuesday, roughly 5% below all-time highs. “Financials have shown impressive leadership since the Oct. low. It has become the second-largest sector of the S&P 500, and it’s bullish to see that Tech isn’t the only area working,” he said.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

|

TSLA, |

Tesla |

|

MSFT, |

Microsoft |

|

AMD, |

Advanced Micro Devices |

|

NVDA, |

Nvidia |

|

AMZN, |

Amazon.com |

|

AAPL, |

Apple |

|

GOOGL, |

Alphabet |

|

NIO, |

NIO |

|

GM, |

General Motors |

|

GME, |

GameStop |

|

META, |

Meta |

Random reads

The humans chasing robots on the loose at companies.

A monk on a comic roll. The very first British joke.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

This story originally appeared on Marketwatch