Here’s some good news for investors fretting over what promises to be a highly contentious 2024 U.S. presidential election: History shows stocks tend to rally in the year before Election Day.

But there’s a rub, noted Saira Malik, chief investment officer at Nuveen, which has $1.2 trillion in assets under management: While the S&P 500

SPX

has seen an average total return of around 10% in presidential election years based on data going back to 1928, the large-cap benchmark had already rallied by more than that between early November and the end of last year.

In other words, those pre-election gains may have already occurred.

“That’s kind of an interesting statistic and one of the many reasons we’re a little bit more concerned about equities coming into the beginning of 2024,” Malik told MarketWatch in a phone interview.

Nuveen

Those other reasons include a tendency for markets to be more volatile in election years, as well as concerns that investors are still pricing in more interest rate cuts than the Federal Reserve is likely to deliver, Malik said. Also, stocks are pricey, with the S&P 500 trading at about a 20% premium to its average valuation since 2010, she noted.

Investors also know the 2024 election is likely to be highly contentious. Donald Trump heads into Tuesday’s Republican primary as the clear front-runner for his party’s nomination as he seeks a November rematch with President Joe Biden.

Washington Watch: New Hampshire GOP primary: Haley tries to turn the tide, as Trump cruises toward the 2024 nomination

Trump is campaigning amid numerous legal woes. Trump faces charges in Washington, D.C., and Georgia’s Fulton County in election-interference cases and was indicted last year in a hush-money case and a classified-documents case. He has denied wrongdoing and argued the prosecutions are politically motivated, while repeating false claims about his 2020 election loss.

Biden faces low approval ratings, including within his own party. An ABC News poll this week found 57% of Democrats and Democrat-leaning independents would be satisfied with a Biden nomination, while 72% of Republican-aligned adults would be satisfied with having Trump as their party’s nominee.

Meanwhile, worries over U.S. political dysfunction are on the rise. Last year’s federal debt-ceiling showdown and the subsequent ouster of Kevin McCarthy from his post as speaker of the House underlined concerns among some investors that confidence in U.S. institutions and governance was beginning to erode.

See: What U.S. political dysfunction means for the stock market and investors

As the election draws near, an increasingly contentious political backdrop could be a recipe for higher market volatility. A contested election result, could drive that volatility even higher, Malik said.

Presidential election years also mean investors should be prepared for an avalanche of charts and tables analyzing historical market performance around the quadrennial event.

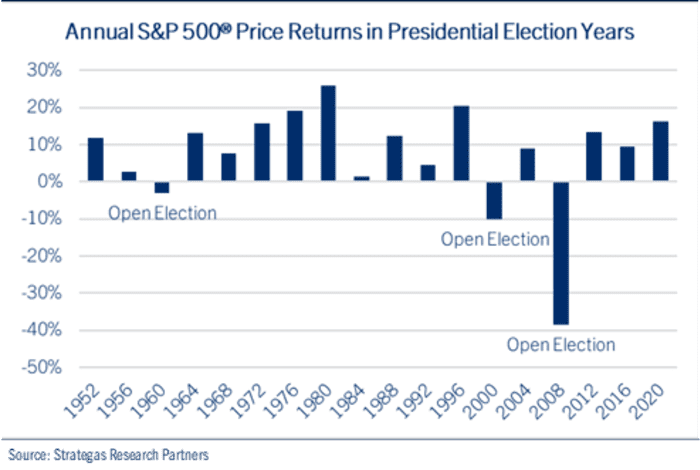

Acknowledging the “risk of a jinx,” John Lynch, chief investment officer at Comerica Wealth Management, highlighted the one below showing that stocks have never posted a yearly decline when an incumbent president — win or lose — ran for re-election. That includes 2020, when stocks suffered a February-March crash triggered by the onset of the COVID-19 pandemic, but soon recovered to post a yearly gain.

Strategas Research Partners

Going back to 1952, the index has suffered a yearly fall in an election year only three times — 1960, 2000 and 2008. All three were years were “open” election years, with no incumbent running for re-election, Lynch noted.

Still, the performance of the market, in as far as it reflects the economy, may also be telling about a candidate’s prospects. Lynch noted that every president who managed to avoid recession in the two years before their re-election went on to win a second term, while every president that experienced recession in that stretch ended up losing.

He noted that stocks typically outperform in presidential election years when the incumbent wins. After all, a strong economy and market likely means voter sentiment is behind the sitting president.

The pattern in years when incumbents lose, meanwhile, tends to involve a pair of selloffs, one during the height of primary season in early spring and another following the party conventions in late summer.

That’s left the stock market with seemingly strong predictive power, Lynch said.

In 24 presidential elections since 1928, the direction of the index has telegraphed the election outcome, Lynch said, citing data from Strategas. If the S&P 500 was positive in the three months leading up to the election, the incumbent or the candidate of the incumbent’s party won. Of the four times the indicator was incorrect, the index rose but the incumbent party’s candidate still lost.

U.S. stocks saw a strong rally in 2023, in keeping with the so-called presidential cycle that typically sees solid gains in the third year of a president’s term. Equities consolidated to begin the new year, but finished last week on a strong note, with the S&P 500 logging its first record close in more than two years.

See: After S&P 500’s new record high, here’s what history says could happen next

The Dow Jones Industrial Average

DJIA

also logged a record close, rising 0.7% for the week, while the Nasdaq Composite

COMP

saw a 2.3% weekly advance as tech shares reasserted their leadership.

The strong tech performance, meanwhile, may reflect concerns about the staying power of the consumer, said Nuveen’s Malik. The firm contends the combination of cyclical risk and politically inspired volatility offers a case for playing defense.

That includes focusing on stocks of dividend growers — companies that have consistently raised their dividends over time — as well as global infrastructure plays that stand to see further benefits from trends favoring reshoring, nearshoring and other changes to supply chains.

Dividend-growth and global infrastructure stocks have historically weathered down markets relatively well, Malik said, emphasizing Nuveen’s concerns about the potential for a drawdown following the “remarkably strong” equity rally seen over the final two months of 2023.

This story originally appeared on Marketwatch