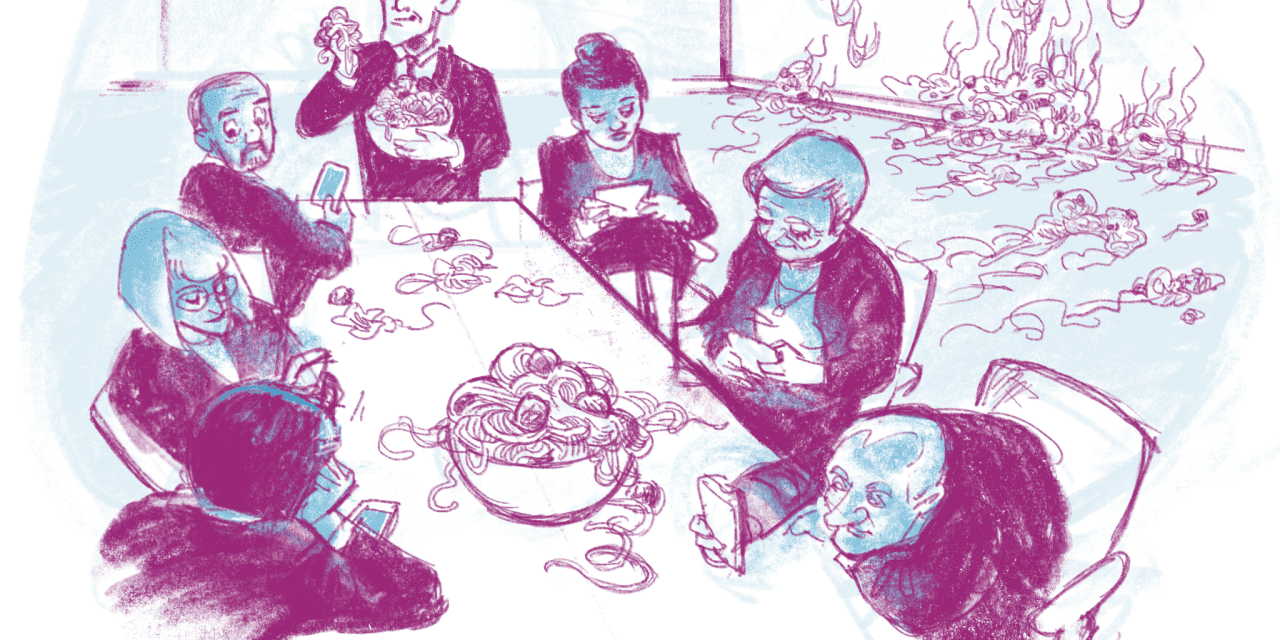

Nelson Peltz’s Trian Fund Management, which is headed for a showdown with Walt Disney Co. at the company’s annual shareholders meeting on April 3, upped the ante on Wednesday in a stinging letter that dismissed Disney’s latest moves as a “spaghetti-against-the-wall plan.”

“With the stock waning and Disney facing another proxy contest, Disney appears to again be trying to distract shareholders with what we see as a fanciful tale, claiming it has ‘turned the corner and entered a new era,’” Trian said in a letter to Disney shareholders, blasting the series of moves the company announced last week during its earnings report.

The media giant’s

DIS,

embattled board of directors announced a stock buyback of $3 billion — its first since 2018 — and declared a cash dividend of 45 cents a share, payable July 25. The dividend program had been suspended during the pandemic. Disney also guided to a 20% increase in earnings per share for fiscal year 2024, to $4.60, and announced it is investing $1.5 billion for an equity stake in Epic Games Inc., the publisher of the massively popular videogame “Fortnite.”

Read more: Disney’s stock pops on big earnings beat, dividend, lower streaming losses

In its letter, Trian, which owns $3.5 billion in Disney stock, castigated the company’s strategic gambits as a scheme, saying “Disney has lost money for its shareholders over a long period of time.”

“This time, Disney’s spaghetti-against-the-wall ‘plan’ includes a $1.5 billion-dollar strategic investment that, according to Disney’s own Chief Financial Officer, lacks a product roadmap or expected return targets, and a sports streaming venture that likely confused consumers, surprised important content partners and competes with the Company’s own services,” the letter said.

Trian Partners has proposed two members — Peltz and former Disney CFO James A. “Jay” Rasulo, to Disney’s 12-member board.

Another activist investor, Blackwells Capital, is beseeching Disney shareholders to elect its three nominees to the board of directors and to split the company into three parts focused on sports, entertainment and resorts.

Disney has flatly rejected both slates of nominees from the two activist investors.

Disney was not immediately available for comment on the letter. Shares of the company were flat in early afternoon trading Wednesday.

This story originally appeared on Marketwatch