Inflation has wreaked havoc on households and businesses in the past few years, but Americans expect the annual increase in prices to return to close to prepandemic levels.

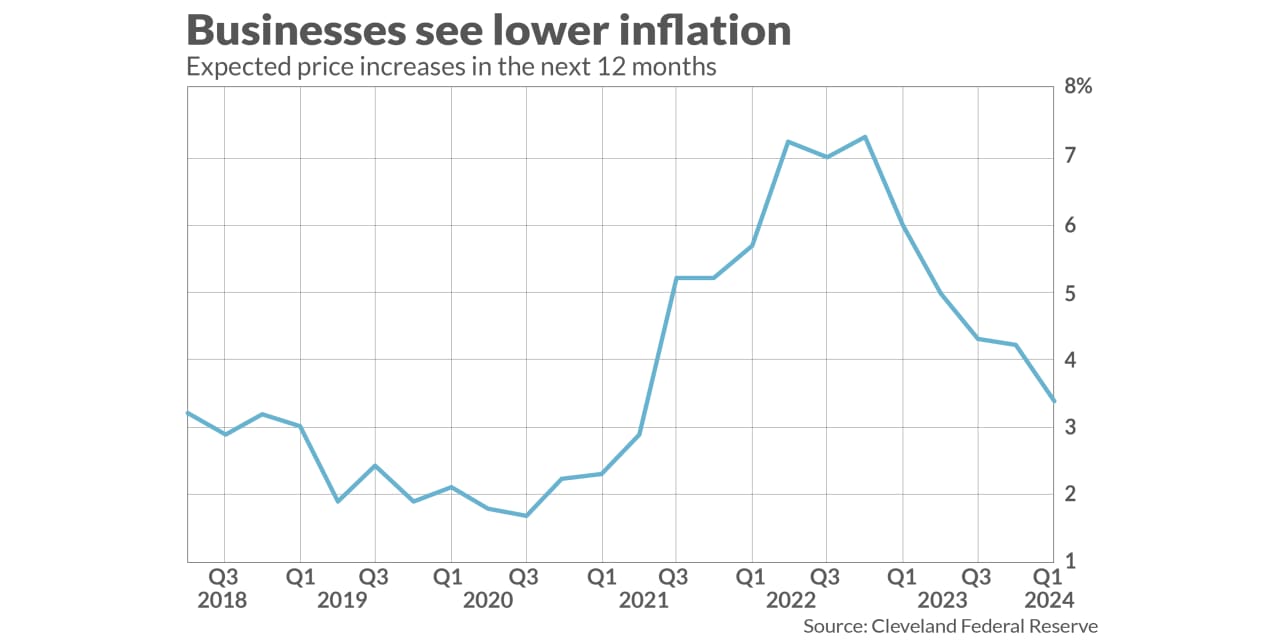

The latest evidence to support their optimism is a four-times-a-year survey by the Cleveland Federal Reserve of business leaders. Top executives expect the rate of inflation to taper to an average of 3.4%, using the consumer-price index, in the next 12 months.

The good news is, the CPI is already there.

The rate of inflation in the 12 months that ended in December was already at 3.4%, and it’s expected to drop to 2.9% in the January report, due out Tuesday morning.

A better measure of future inflation, however, was somewhat higher. The core CPI, which omits food and energy, stood at a 12-month rate of 3.9% at the end of 2023.

A long-running survey of consumers, meanwhile, also found that Americans expect inflation to continue to decelerate toward prepandemic levels.

Households expect 2.9% inflation in the next year, the consumer sentiment survey found.

What both of these surveys show is that inflation expectations are what the Federal Reserve likes to refer to as “well anchored.” In other words, nobody expects inflation to move up or down much from current levels.

The Fed, of course, wants inflation to return to 2% a year. It’s not there yet, but the central bank’s job will be easier if consumers and businesses both think it will succeed in reaching its target. That’s because inflation expectations — whether high or low — often feed on themselves.

And: Yes, that Big Mac meal may cost $18 — but there’s one good reason for it

This story originally appeared on Marketwatch