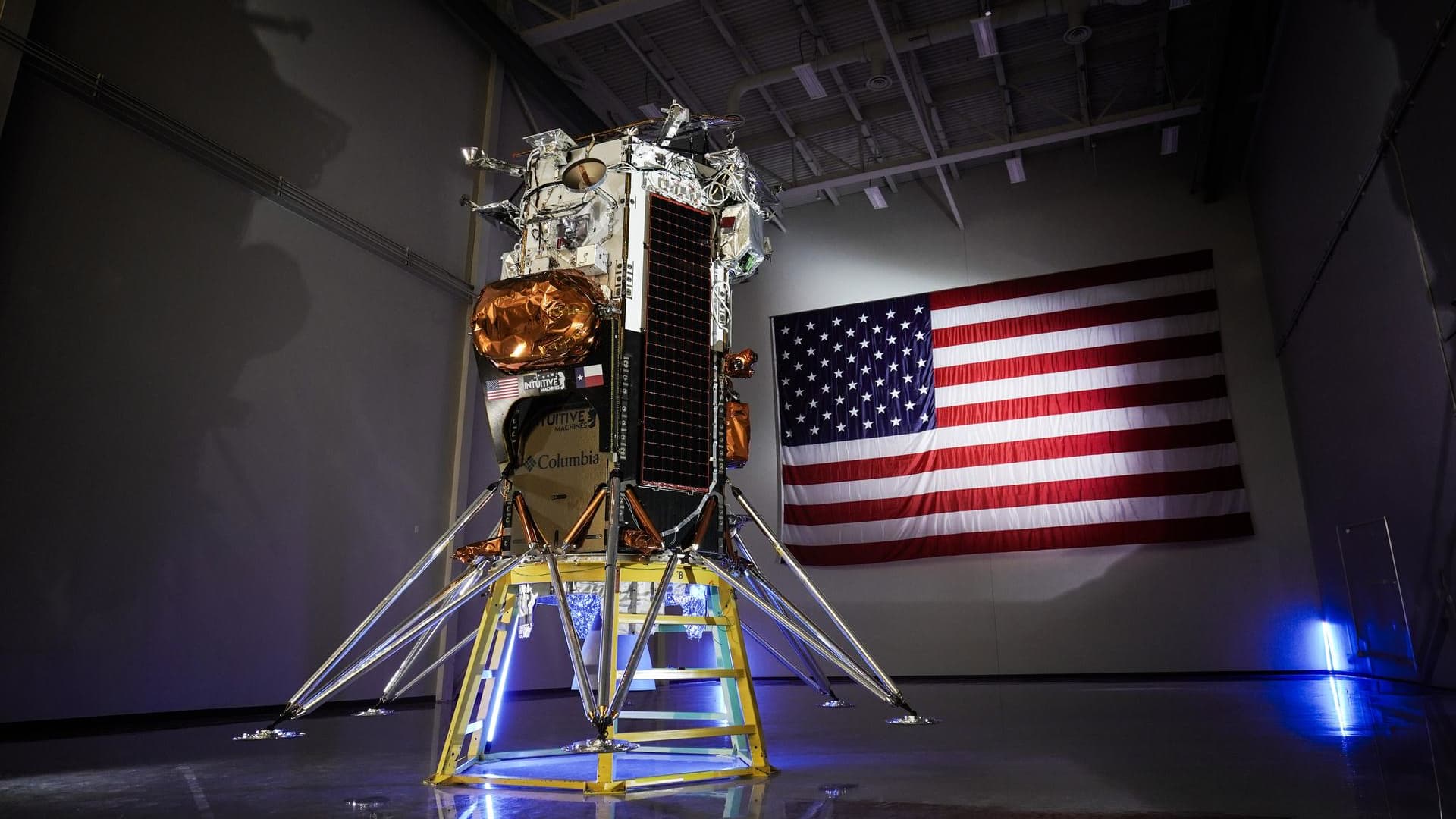

Intuitive Machines’ Nova-C lunar lander on display at NASA’s Marshall Space Flight Center.

NASA

Shares of Intuitive Machines surged in premarket trading on Friday after the company’s successful first moon landing.

Intuitive Machines’ cargo moon lander, “Odysseus,” became the first privately developed spacecraft to land on the lunar surface on Thursday – as well as the first U.S. spacecraft to soft land on the moon in over 50 years.

The Houston, Texas company confirmed that the IM-1 mission lander was standing upright and sending data back to Earth.

“Odysseus has found his new home,” Tim Crain, Intuitive Machines’ CTO and IM-1 mission director, said from the company’s mission control.

Intuitive Machines stock ripped 30% higher in premarket trading from its previous close of $8.28 a share.

The company’s stock has already been rallying over the past month as excitement built in the lead up and progress of the IM-1 mission. Intuitive Machines went public via a SPAC a year ago and shares had steadily slid to all-time lows near $2 in January.

Intuitive Machines stock over the last 5 days.

Wall Street analysts emphasized to CNBC ahead of the landing that the unprecedented nature of the event could lead to volatile momentum trading.

“We’ve never witnessed a publicly traded company go through [a moon landing attempt]. So this is new, not just for investors, but for us analysts as well,” Cantor Fitzgerald’s Andres Sheppard said before the landing.

The IM-1 lander “Odysseus” in lunar orbit on Feb. 21, 2024.

Intuitive Machines

The Odysseus lander carried 12 government and commercial payloads — six of which are for NASA under an $118 million contract through the agency’s Commercial Lunar Payload Services (CLPS) initiative.

Intuitive Machines has already won two more CLPS contracts for future lander missions, with IM-2 expected to launch as early as the second half of this year.

Additionally, the company has part of a five-year $719 million contract to provide engineering services to NASA’s Goddard space center in Maryland. Analysts expect the Goddard contract is worth about $11 million per month in revenue for Intuitive Machines.

This story originally appeared on CNBC