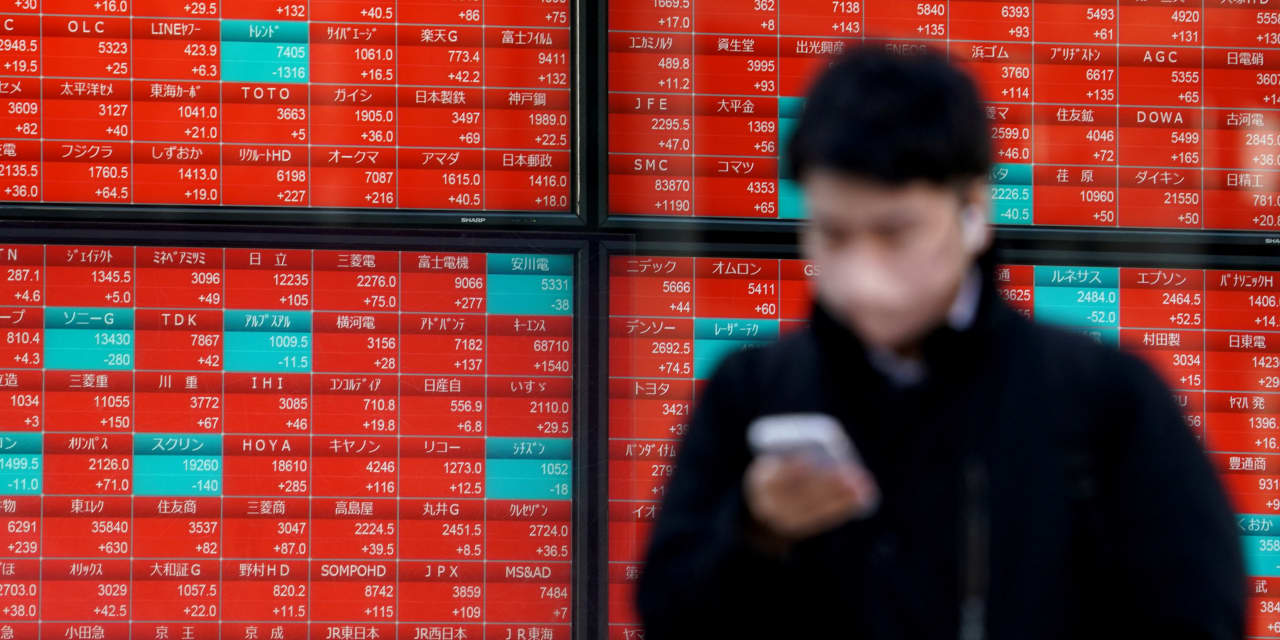

The Nikkei 225 has finally surpassed its peak from 1989 after more than 34 years. Many other countries are still waiting.

Of the 84 international equity benchmarks tracked by the Deutsche Bank team, Japan experienced the longest stretch without reaching a new high, at least so far, according to a chart shared with MarketWatch on Thursday. Still, roughly 30 countries have waited a decade or more for a fresh record, with some down more than 50% or more from their previous peak.

“In our [all-time-high] solar system it has been like Pluto now for many years,” said Deutsche Bank’s Jim Reid about Japan.

Only a few have come remotely close to matching Japan’s record-free stretch. As the chart below shows, Italy, Portugal, Greece, Finland and Cyprus are among an elite group still languishing below their dot-com era highs of nearly 25 years ago.

DEUTSCHE BANK

Meanwhile, the list of countries that have gone between 15 and 20 years without a fresh stock-market record is much longer. It includes Ireland, whose stocks are trading within 10 percentage points of a fresh all-time high, and China, which has struggled mightily since COVID-19, and remains roughly 60% below its 2007 peak, according to Deutsche Bank’s data.

Some of these countries might appeal to value-conscious investors. But Reid urged buyers to be cautious.

Many European indices have seen weak returns since the dawn of the century, he pointed out. Trying to time a turn in this trend could prove fraught.

Japan’s Nikkei 225

JP:NIK

rallied 2.2% Thursday to finish at 39,098.68, taking out the Dec. 1989 peak of 38,916. In the U.S., the S&P 500

SPX

and Dow Jones Industrial Average

DJIA

were on track to book fresh record highs on Thursday, while the Nasdaq Composite

COMP

is nearing its own record from November 2021.

The Nikkei finally reclaiming its bubble-era peak marked the latest milestone in what has been a stunning comeback for struggling Japanese stocks. The Nikkei 225 was one of the few international equity benchmarks to beat the S&P 500 in 2023 when its performance is measured in yen, not U.S. dollars, according to FactSet. In 2024, Japanese stocks are already the best performers among their developed-market peers.

Also see:

After 34 years, Japan’s Nikkei 225 completes a roundtrip

European stocks hit new record for first time in two years as Nvidia sparks semiconductor rally

This story originally appeared on Marketwatch