Sandy Huaman makes $20 to $24 an hour, including tips, working part-time as a receptionist and server at a Culver City hotel. Last year, she paid about $4,000 in taxes.

At a workshop in Koreatown last week, a volunteer tax preparer helped her apply for earned income tax credits and a child tax credit. Now, the 35-year-old single mother is getting back all the taxes deducted from her paycheck.

She intends to use her refund to visit her ailing godmother in her native Peru and save the rest.

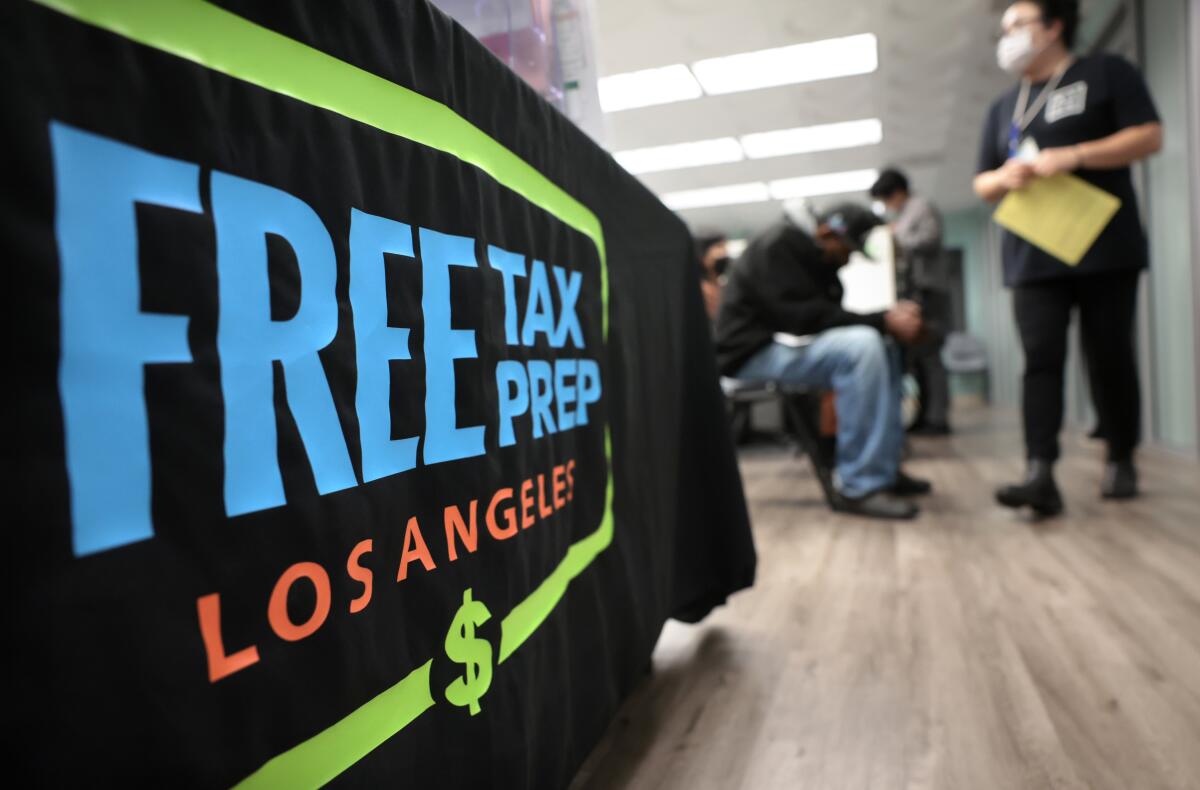

Across Los Angeles County, hundreds of IRS-certified volunteers at Free Tax Prep L.A. sites are helping low- and moderate-income workers file their returns this season. A major goal of the initiative — funded by the city of L.A., the L.A. County Department of Consumer and Business Affairs and Koreatown Youth + Community Center — is to help those who qualify get back some of what they’ve paid in taxes.

A major way that is done is through the earned income tax credit, which brings some wiggle room to household budgets and a small reprieve to workers living paycheck to paycheck. Unlike other public benefits, the cash is unrestricted, meaning recipients can use it however they see fit.

“It’s really like a breath of fresh air for them,” said Audrey Casillas, assistant director of Koreatown Youth + Community Center.

But hundreds of thousands of eligible Californians don’t claim the federal and state benefit, leaving millions of dollars on the table each year.

“It’s vastly underutilized and unclaimed, but … there’s a ton of research that still credits [the earned income tax credit] as one of the most powerful ways to lift people out of poverty,” said Abigail Marquez, general manager of the city of L.A.’s Community Investment for Families Department.

Volunteer tax preparer Lidia Sebastian helps a client with her taxes at the Koreatown Youth + Community Center. A major goal is to help those who qualify get back some of what they’ve paid in taxes.

(Wally Skalij / Los Angeles Times)

On a recent Wednesday evening at Koreatown Youth + Community Center, signs urged people to #ClaimWhatIsYours as relaxing, ambient music streamed from an iPad.

Janet Hernandez, 26, was among the first to meet with a volunteer tax preparer.

She didn’t qualify for the earned income tax credit, but as a graduate student studying counseling psychology at Mount St. Mary’s University, she could get about $1,000 through a federal lifetime learning credit that helps pay for undergraduate, graduate and professional courses.

“That’s actually a nice refund,” the tax preparer told Hernandez.

Hernandez first learned about the free tax assistance via Instagram and has attended the past four years.

As one of nearly 20 city-administered family resource centers, Koreatown Youth + Community Center also offers financial education and coaching, credit-building services and incentivized savings programs. Hernandez has attended financial courses there and got bonus funds from the organization when she opened her first savings account.

She intends to deposit half her refund into the savings account, which she hasn’t tapped yet.

“The rest of it?” said Hernandez, who also works part-time as an usher at the Los Angeles Music Center. “Maybe I’ll treat myself.”

Workers who made less than $63,398 last year may qualify for the federal earned income tax credit, which is one of the government’s largest antipoverty programs. They also may be eligible for a state credit if they earned less than $30,950.

But some people aren’t aware of the credits or miss out due to language and cultural challenges, said Marquez. Some don’t seek out help with their taxes, often because of the expense or bad experiences with unscrupulous preparers.

Some are concerned that an infusion of cash could impact their public food and housing benefits, while some undocumented workers who file taxes with Individual Taxpayer Identification Numbers are afraid to accept government funds.

A little over 71% of eligible Californians claimed the federal credit in tax year 2020, according to the IRS.

Just 54% of food-stamp-enrolled households claimed the state credit in 2017, leaving $71 million in state funds on the table, according to an analysis of state tax forms and records by the California Policy Lab at UC Berkeley.

For many people, filing taxes and claiming credits could be a powerful step toward greater economic security.

“For some of them, this is essentially the biggest check that they get in a year,” said Amanda Rodriguez, asset-building coordinator at Koreatown Youth + Community Center, who also prepares taxes during the events.

Huaman was still in high school when she attended her first tax preparation workshop at Koreatown Youth + Community Center more than 15 years ago.

She enrolled in the organization’s matched savings program — save $400, get $100. Then she enrolled in its financial workshops, learning the dangers of racking up credit card debt.

It was information she might not have learned at home. Her mother, who worked seven days a week as a housekeeper, saved some cash at home, preferring not to put “everything in a bank.”

This year, Huaman plans to convert her tax-advantaged personal savings plan into a Roth IRA, from which she can withdraw contributions, generally without paying taxes or penalties.

“It’s mostly for my daughter, so whenever I need it, it’ll be there for her expenses,” she said.

Clients wait to have their taxes done at the Koreatown Youth + Community Center. For many people, filing taxes and claiming credits could be a powerful step toward greater economic security.

(Wally Skalij / Los Angeles Times)

Aliza Katz, 17, and her father, Mayer Bick, are among the roughly 250 volunteer tax preparers at Koreatown Youth + Community Center, with about 10 helping at each event. Some are fluent in Spanish, Korean, Tagalog or Japanese.

Father and daughter passed an ethics test and underwent basic tax law training, which can take 15 to 20 hours. They have returned for a second year because they enjoy combining their interest in math and taxes to help people.

“Our tax system, if people knew what was available, actually is a way to help people, particularly low-income people,” said Bick, an investment banker by day.

The most gratifying part is telling people they are receiving a large refund, said Aliza, a junior at Shalhevet High School.

Adaly Ugalde, a mother of four adult children, works part-time as a community educator. Aliza typed Ugalde’s information into a computer as her father looked over her shoulder.

Aliza hit a snag, so a Koreatown Youth + Community Center employee helped finish the filing.

They determined that Ugalde, 62, would receive a refund of about $3,500 — money she typically uses to pay off debts, saving the rest for expenses and emergencies.

She’s working less frequently these days, so she intends to use this year’s refund to cover her family’s $900 rent.

“That is my No. 1 priority, but there are many priorities,” Ugalde said.

This article is part of The Times’ equity reporting initiative, focusing on the challenges facing low-income workers and efforts being made to address the economic divide in California. More information about the initiative and its funder, the James Irvine Foundation, can be found here.

This story originally appeared on LA Times