With Japan’s smartphone market declining 3.5% year over year at the end of 2023, Apple’s iPhone still continued to account for around half of all sales.

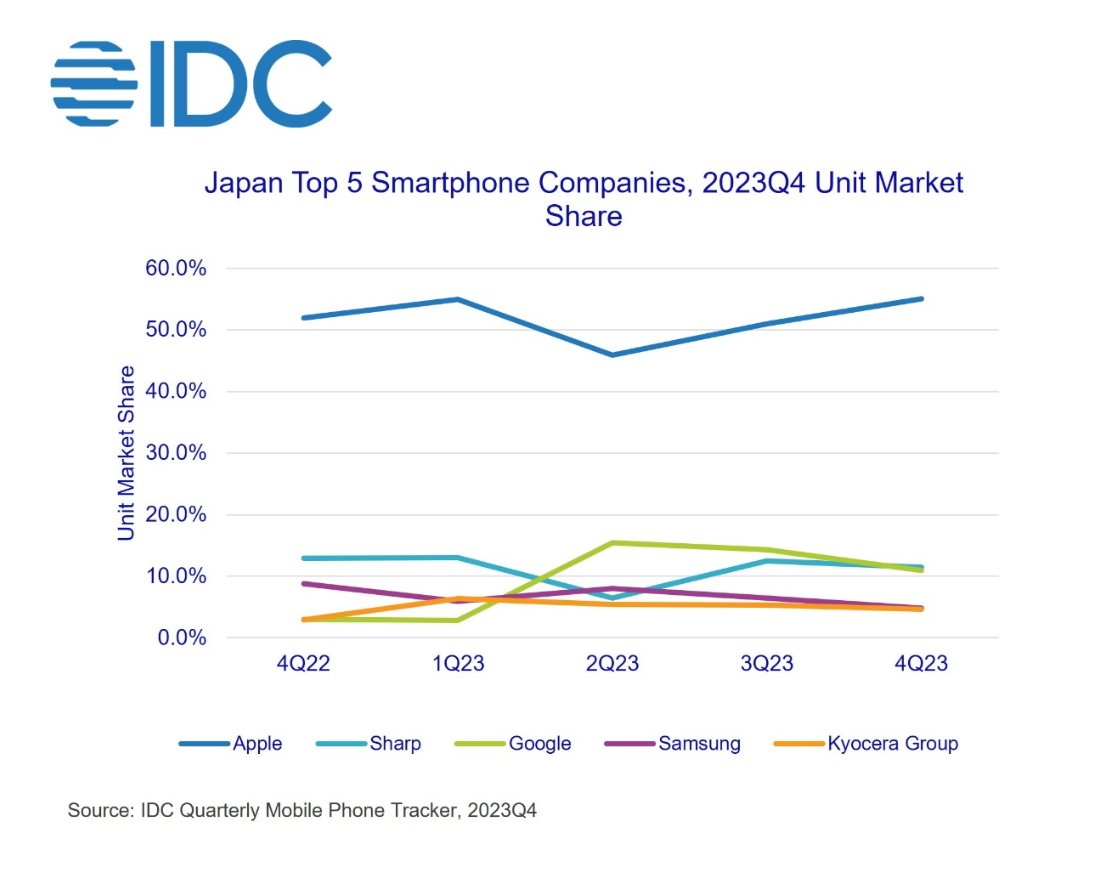

It’s 12 years since Apple’s iPhone first topped the smartphone sales chart in Japan, and in recent years it has regularly managed to sell between 49% and 51% of all smartphones in the country. According to IDC, that percentage figure continues for Q4 2023, with Apple accounting for 51.9% of the market.

However, the overall sales of smartphones decreased by 3.5%, to 8.3 million devices, compared to the same time in 2022. IDC says that all four quarters of 2023 saw YoY declines, but Q4 was the only quarter to exceed 8 million smartphones shipped.

“The demand started to improve in the second half of the year, led by Apple,” wrote IDC analysts, “indicating a diminishing impact of inflation due to the weakening yen and carrier inventory adjustments.”

Despite that improvement, and IDC’s reporting of “strong demand for [Apple’s] iPhone 15 series,” the contracting market meant Apple’s sales declined 6% in 2023. That was the least decline of the top five smartphone manufacturers.

With one exception, all vendors declined in Q4 2023 YoY. Nonetheless, Apple’s 51.9% market share is better than the rest of the top five and also all other vendors, combined.

However, Google went from a 1.5% market share in 2022, to a 10.7% share in 2023, taking it into third place. That makes it the only vendor to improve its sales, growing by 527%.

“Japan has been a market where local vendors have been exceptionally strong,” Masafumi Inbe, Market Analyst, IDC Japan said. “However, amid intensifying competition in the smartphone market, local vendors in Japan are gradually finding it difficult to compete with global vendors in terms of product development and competitiveness, including foldable smartphones and AI smartphones.”

The Japanese firms in the top five include Sharp, in second place with 10.9% market share. Kyocera Group, which is Japanese, and Lenovo, which includes Japan’s Fujitsu, are tied for fifth place with 5.4%

While not directly comparable, Japan’s 3.5% decline in Q4 2023 is at least better than the 7% fall China has seen YoY in the first six weeks of 2024.

This story originally appeared on Appleinsider