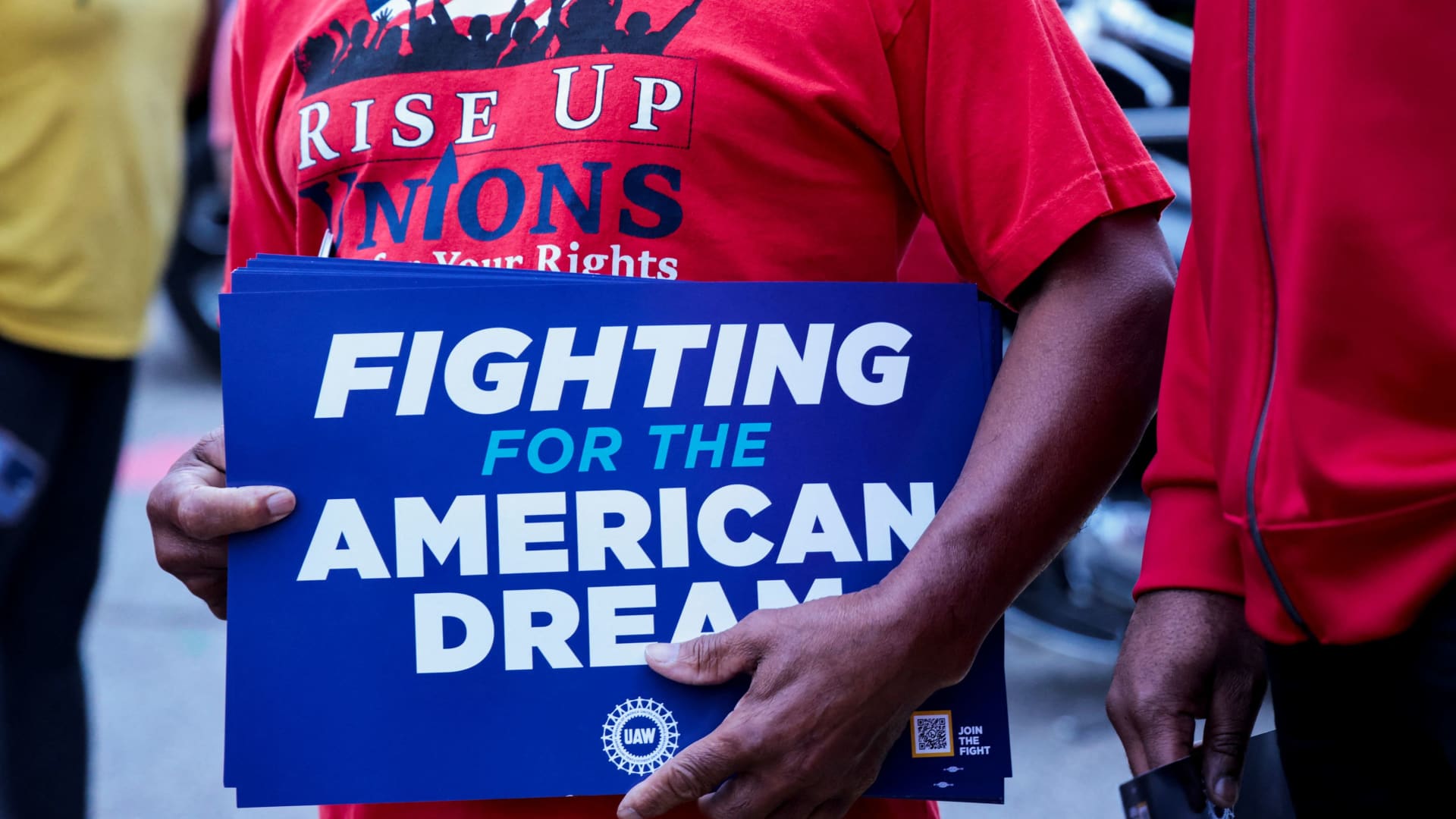

A United Auto Workers union member holds a sign outside the Stellantis Sterling Heights Assembly Plant to mark the beginning of contract negotiations in Sterling Heights, Michigan, on July 12, 2023.

Rebecca Cook | Reuters

Many Americans long for the days when companies guaranteed workers income in retirement.

That includes Sara Schambers, a fourth-generation Ford auto worker and member of the United Auto Workers union, who saw her grandparents retire with financial security. But after obtaining a permanent position in 2012, the same benefits have not been available to her.

“Without a pension and post-retirement health care, you have people leaving this company after 30 years’ service with nothing more than a, ‘Have a nice day, hope the stock market doesn’t crash,'” Schambers told Senate leaders during a hearing in Washington, D.C., on Wednesday.

In an emailed statement, a Ford spokeswoman said the company “provides a very competitive 401(k) plan for our UAW-represented employees.”

“The company contributes 10% of employee base wages, plus $1 per hour worked (capped at 2,080 hours a year), with zero employee contribution required,” she said. Plan participants may choose lower-risk investment options if they want to minimize their exposure to stock market fluctuations.

More than three-quarters of Americans, 77%, say the unavailability of pensions is making it harder to achieve the American Dream, according to a new report from the National Institute on Retirement Security.

Meanwhile, 83% say all workers should have a pension to be independent and self-reliant in retirement.

How the move from pensions to 401(k)s affects workers

Over the past four decades, nongovernment employers have been shifting from providing pensions, otherwise known as defined benefit plans, to defined contribution plans such as 401(k)s.

Pensions typically pay lifetime retirement benefits based on factors such as an employee’s salary and years of service. The employer takes responsibility for the investments made on the employee’s behalf, including the risk as to whether adequate funds will be available to pay the benefits owed. Pension employees traditionally receive steady monthly checks once they retire, though plans may offer lump-sum distributions.

More from Personal Finance:

78% of near-retirees failed or barely passed a basic Social Security quiz

Why Social Security beneficiaries may owe more taxes on benefits

62% of adults 50 and over have not used professional help for retirement

In contrast, 401(k)s and other defined contribution plans mostly require employees to oversee their contributions and investment selections. While employers may help with matching contributions or features that automatically nudge employees to save more, the amount of income employees may ultimately receive as income in retirement is unknown.

With the shift from pensions to 401(k)s, the responsibility for saving for retirement has transferred from employers to workers.

Yet, some research suggests workers still fare best when the responsibility for retirement savings falls on the employer.

‘Workers want to have the choice to retire or not’

Most Americans, 79%, now say the U.S. is facing a retirement crisis, up from 67% in 2020, according to the NIRS.

The median retirement savings for all households is just $39,000, according to Teresa Ghilarducci, professor of economics at The New School for Social Research and author of the book, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy.”

A lack of adequate retirement funding has forced many Americans to work longer.

“Workers want to have the choice to retire or not, and they can only do that with good pensions,” Ghilarducci said at an NIRS event on Tuesday.

Yet, others argue the switch to a defined contribution system has been successful in helping Americans build wealth.

Americans have amassed $41.5 trillion in inflation-adjusted retirement assets, an increase of 330% over the past 35 years, noted Rachel Greszler, senior research fellow at The Heritage Foundation, a conservative think tank.

“When not managed properly, defined benefit plans can end up like Ponzi schemes,” Greszler said at Wednesday’s Senate hearing.

Neither Social Security nor multiemployer pensions can pay benefits as promised, she noted. Social Security’s trust funds face insolvency in the next decade, which may prompt across the board benefit cuts of more than 20% if Congress does not act sooner.

To shore up Social Security, the average American household would have to pay at least $3,000 per year more in taxes, money that would better be invested in personal accounts, Greszler argued.

At the Senate hearing, Sen. Bill Cassidy, R-La., pointed to another reason why a move to pensions may not necessarily be best for today’s workers. Those benefits offered by the federal government include a vesting period of five years, which may preclude workers who switch jobs frequently — or who are laid off by their companies — from participating. Defined contribution plans such as 401(k)s, however, are portable from job to job.

A return to pensions?

Some employers are considering a return to pensions, notably with IBM shifting from a 401(k) match to a defined benefit contribution.

Yet, “only a handful” of other major companies would be likely to follow IBM’s lead to reopen their defined benefit plans, a recent analysis from the Center for Retirement Research at Boston College found.

Still, that isn’t stopping Schambers, the auto worker, from hoping to have pensions reinstated in the next round of union contract negotiations.

“Our next UAW contract expires in 2028,” Schambers said. “And we’re ready to fight like hell for real retirement security, for a pension and post-retirement health care.”

Don’t miss these stories from CNBC PRO:

This story originally appeared on CNBC