Image source: Getty Images

Palantir Technologies (NASDAQ: PLTR) stock has a habit of exploding higher after an earnings reports. This has seen it rise by a mind-boggling 780% in two years!

The AI software firm reports Q2 earnings on 4 August. Should I snap up some shares before this event?

Booming AI business

Palantir develops software that enables organisations to analyse and act on large volumes of data. Its massive customer base includes the likes of the US Army, CIA, NHS England, Airbus, and Ferrari.

Recently, it has been the company’s Artificial Intelligence Platform (AIP) that has supercharged the business and share price. AIP integrates large language models (LLMs) and other AI tools directly with an organisation’s private data and workflows.

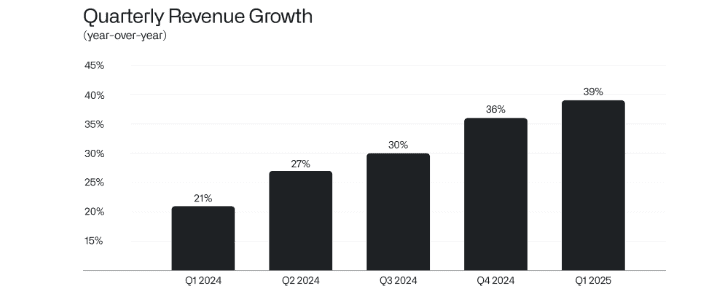

The surge in contracts signed for AIP has been most pronounced across the pond. In Q1, US revenue jumped 55% year on year to $628m, with US commercial revenue rocketing 71%. Overall revenue increased 39% to $884m.

Impressively, Palantir closed 139 deals of at least $1m, 51 of at least $5m, and 31 deals of $10m or more during the quarter. Adjusted free cash flow came in at $370m, good for a very healthy a 42% margin.

The main reason for the stock’s incredible ascent skywards is that the quarterly rates of revenue growth have been accelerating. Whenever this happens, investors understandably get very excited (especially when it’s been driven by AI).

Co-founder and CEO Alex Karp commented: “This is a level of surging and ferocious growth that would be spectacular for a company a tenth of our size. At this scale, however, our ascent is, we believe, unparalleled.”

Have I missed the boat?

Obviously this is all very impressive stuff. But whenever I look at Palantir, I can’t help feeling pangs of regret. That’s because I was kicking the tyres on this stock a couple of years ago when it was at $9. But I never invested.

Now, I can’t help feeling like I’ve missed the boat, as Palantir has a massive $373bn market cap. This makes it the 21st-largest company in the US, ahead of Coca-Cola, McDonald’s, and Bank of America.

Moreover, it’s trading at 126 times sales, which just seems ridiculous to me. Why so? Because Wall Street currently has around 30%-35% growth pencilled in for the next three years. While that’s undoubtedly impressive, it doesn’t justify 126 times sales, in my opinion.

At this valuation, I see a lot of risk. If AI spending suddenly slows, or earnings come in slightly light, the stock could sell off heavily.

Also, a lot of the growth Palantir is seeing right now relates to the US, and the CEO has been incredibly critical of Europe not embracing AI. He reportedly said that it’s “like people have given up“, when speaking about Europe’s AI ambitions.

Therefore, much of Palantir’s growth rests on the US (and pockets elsewhere, like Saudi Arabia). A US recession sparked by tariffs is therefore a near-term risk to growth.

My move

My view here is that Palantir is a world-class software company with an enormous long-term opportunity in AI. However, the stock is trading far too expensively for me to feel comfortable investing today.

If there was a major pullback in the share price, however, that would be a different matter.

This story originally appeared on Motley Fool