Apple’s quarterly results for the third fiscal quarter of 2025 are arriving on July 31. With ever-changing tariff policies affecting supply chains, here’s what to expect from a traditionally quiet quarter for the company.

Apple’s third-quarter results are usually the quietest and the lowest of the year. With holiday seasonality affecting sales, Q3 tends to be the low point with little to look forward to, save for speculation on the upcoming iPhone generation.

The reference to “quietest” here is more one of relativity to the rest of the year. For a company of Apple’s size, there are still a lot of things happening in this period.

The full results will be published by Apple on July 31, followed by the typical call with investors and analysts.

With the prospect of Apple dealing with tariff changes among other issues, the period will be an interesting one for investors and observers.

Last quarter: Q2 2025 details

In the second quarter, Apple’s revenue of $95.4 billion was up 5% year-on-year from the $90.75 billion reported in Q2 2024. This was also above the Wall Street Consensus, which believed Apple would haul in $94.42 billion as an average.

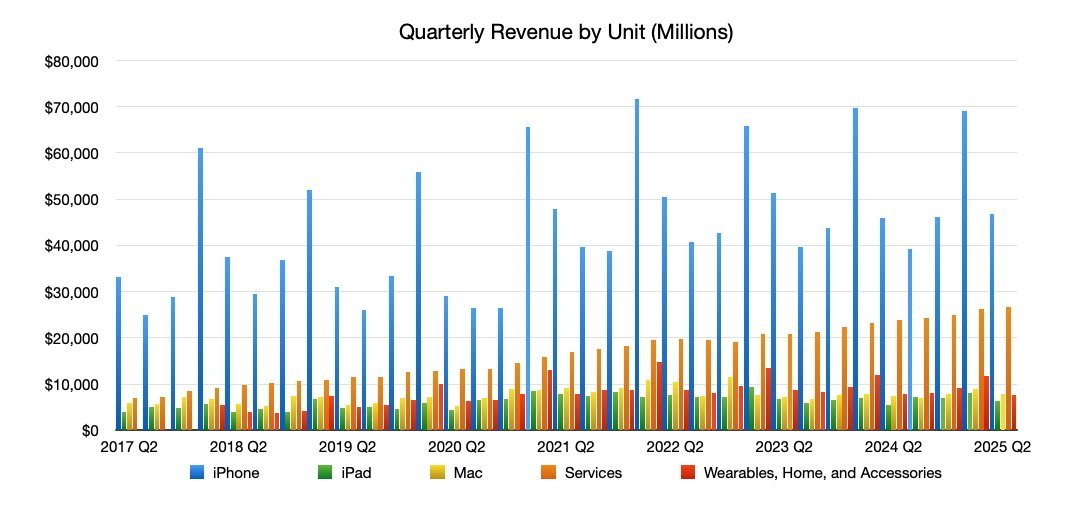

On a per-unit basis, iPhone revenue of $46.84 billion was up from $45.96 billion in the year-ago quarter. Mac revenue was $7.95 billion, up marginally year-on-year from $7.45 billion.

The iPad revenue went from $5.56 billion in Q2 2024 to $6.4 billion, with Wearables, Home, and Accessories down to $7.5 billion from $7.9 billion. The ever-dependable Services arm continued its long run of growth, reporting $26.6 billion for Q2 2025 versus $23.9 billion in Q2 2024.

Apple’s board of directors declared a cash dividend of $0.26 per share of common stock. The Earnings Per Share is listed at $1.65.

Apple largely continued to benefit from post-holiday sales of fall product launches, including the iPhone 16 range. However, in the quarter itself, it saw the introduction of the iPhone 16e, 11th-gen iPad, M3 versions of iPad Air, the M4 MacBook Air, and an updated Mac Studio.

While product launches are beneficial, they’re more likely to benefit the following quarter, as they will only apply to part of Q2 itself.

The quarter also had to contend with the ongoing effects of the tariff battle, where the administration of President Donald Trump applied tariffs against all other countries. It’s a topic that will almost certainly apply to Apple’s financials for the coming years.

Year-ago quarter: Q3 2024

The Q3 2024 results beat expectations by a considerable margin. Revenue hit $85.78 billion, up from the $81.80 billion it reported for Q3 2023, and beating Wall Street expectations of $84.54 billion.

The earnings per share of $1.40 was up from the Q3 2023 $1.26.

Revenue from iPhone was at $39.3 billion, down from $39.67 billion year-over-year, while iPad at $7.16 billion was up from the $5.79 billion in the year-prior quarter. Mac revenue moved from $6.84 billion in Q3 2023 to $7.01 billion.

Wearables, Home, and Accessories saw a shift down from $8.28 billion in the year-ago quarter to $8.09 billion. Services continued its growth, moving to $24.2 billion from $21.21 billion in Q3 2023.

It was a quarter that saw Tim Cook highlight the inbound updates introduced during the 2024 Worldwide Developers Conference, including Apple Intelligence. Apple went on to struggle with some implementation points.

Tariffs and Europe: What happened in Q3 2025

Apple didn’t introduce new products during the period, but there was one major element that can still have a major impact on the quarter’s financials.

The White House was attempting to apply so-called “reciprocal tariffs” on countries around the world, with a considerable focus on China. The battle inevitably led to Apple’s stock being battered with investors pulling funds from Wall Street, as President Trump threatened triple-digit tariff hikes against China.

Eventually, the tariff fight settled down, with Apple and other tech companies set to benefit from lower “semiconductor” tariffs. However, despite a 90-day pause on implementing tariffs, what was set in place was still higher than had been applied to imports before the tariff war began.

During the Q2 2025 call with investors, Tim Cook said that the tariffs could add $900 million to Apple’s costs for the Q3 fiscal quarter. It was an unusual admission, and an estimate that was made long before other changes were made to the U.S. tariff situation.

The tariffs are the main issue affecting Apple’s financial status, but there’s also regulatory activity in Europe to deal with.

The EU has repeatedly threatened an anti-competition fine over non-compliance with the Digital Markets Act, with a comparativelymodest $570 million applied against the company. While the fine was seemingly low to try and avoid retaliation from Trump, the White House still complained about it.

Apple has since appealed the fine, though the company may also take some steps to appease the EU in the future. Those steps are now expected to be accepted by the EU, and prevent the threatened daily fine against the company.

Meanwhile, the EU has also seemingly dropped plans for a Big Tech tax, presumably to help grease the wheels on a favorable U.S. trade deal.

Wall Street consensus

The Wall Street consensus refers to a survey of analysts. The results are averaged out to give a general opinion of where investors and analysts are leaning in their quarterly forecasts for Apple.

Yahoo Finance

In the estimates published by Yahoo Finance as of July 18, 28 analysts offered an average revenue estimate of $88.64 billion. The estimated range goes from a high of $90.1 billion to a low of $86.92 billion.

For the earnings per share, a group of 29 forecasts an average of $1.42, with a high of $1.47 and a low of $1.32.

TipRanks

On July 18, TipRanks offered its own consensus figures. The revenue forecast is at $90.025 billion, with a range from $86.92 billion to $92.82 billion. The earnings per share is expected to be $1.42, with a range from $1.32 to $1.54.

Analyst expectations

Ahead of the results and call, analysts offer their own forecasts of what they think Apple will be declaring in its financials. Depending on the firm and the analyst, these hot takes include both positive and negative opinions about Apple.

Morgan Stanley

Shared with AppleInsider on July 21, Morgan Stanley expects Apple to have a solid quarter, raising its estimates and expecting healthy upside across most product categories. Revenue is anticipated to be $90.7 billion.

The iPhone revenue is currently expected to be 2% above Wall Street expectations, thanks to shipment and average selling price (ASP) improvements. iPad and Mac estimates have risen by 9% and 1% respectively, again via stronger than expected demand.

After a lack of Services guidance from the March quarter call, there are apparently investor concerns over Services growth deceleration. However, Morgan Stanley is raising its Services forecast by 11.6% year-over-year, with similar growth for the App Store itself.

Looking ahead to the September quarter, growth is expected to “trough” with implications that iPhone 17 prices in September will go up.

Morgan Stanley rates Apple as Overweight with a price target of $235.

Goldman Sachs

On July 24, Goldman Sachs believed that Apple will have some surprising results for investors. It will beat revenue and growth expectations, the firm says, with Services being a big driver.

Services will grow 11% year-over-year in Q3, one of the few hard-number predictions states, thanks to robust spending in the App Store. The sustained growth is offsetting slower hardware sales cycles, in part due to the typically higher profit margins involved.

That said, there are still expectations of strong growth for iPhone iPad, Mac, and wearables. Better gross margins are anticipated too, thanks to easing tariff-related costs.

As for the quarter ahead, there’s optimism from U.S. carrier promotions to drive iPhone sales, with the iPhone 17 Air a potential highpoint.

JP Morgan

Investment firm JP Morgan also predicts that Apple will have surprising results, and overall is positive about the company’s medium-term future. That positive outlook is tempered by many concerns over iPhone 17 demand, though, and no expectation that Apple Intelligence will drive sales.

Yet JP Morgan is looking further ahead than most other analysts. Despite short-term concerns, the company expects Apple to do sufficiently well that JP Morgan will raise its stock price target — if only eventually.

Deepwater Asset Management

Long-time analyst Gene Munster wrote on July 28 that Apple’s revenue expectations should be in line, or slightly above, the Wall Street Consensus. In better news for Apple, based on a 2.2% growth rate over the last three quarters, that should pour water on the negative view of a 0.8% revenue shrink in the next quarter.

The iPhone business has “stabilized,” in his view, with 2.1% year-over-year growth expected for the quarter. As for the next, the iPhone 17 Air may help push growth beyond the 5.7% expected full-year growth following release, due to being a new form factor.

As for AI, Apple’s delay on a new Siri isn’t as big of a deal, since Munster doesn’t believe any other smartphone producer has conquered smartphone AI yet either. However, as Apple has set a “low bar” for the year ahead, it has also managed to raise the bar of expectations for whenever it eventually brings out its new Siri.

TD Cowen

On July 28, TD Cowen forecasts that Apple will have manufactured 48 million iPhones in the June quarter, versus its previous forecast of 43 million. September quarter shipments may grow, with it increasing its prediction from 50 million to 54 million.

AI won’t offer any uplift for the iPhone 16 or iPhone 17 ranges in particular, but that Apple Intelligence has until the end of 2026 to prove itself as a compelling feature. With Google expected to launch the Pixel 10 with more AI features on August 20, TD Cowen feels Apple will need to keep up or be left behind.

The iPad, Mac, and Wearables segments should dip in the June quarter before rising by mid-single digits in the September quarter. Services will still be a strong part of the balance sheet, with growth expected to be more than 11% for the quarter.

Bank of America

In Bank of America’s pre-earnings note, it believes Apple will achieve an in-line result, with $90.2 billion in revenue marginally above its Street consensus of $89.3 billion. The EPS is expected to land at $1.45 versus $1.43 for the Street.

Investor pressure will mostly fall on tariff uncertainty, the U.S. DoJ browser investigation with Google, the slow progress of AI, and App Store headwinds. Gross margins will also be important, with a guide of 46%.

For future quarters, the September period will benefit from a better product mix with higher average selling points. New models on the way including the iPhone 17 Air should help boost iPhone, Mac, and iPad sales, even with a meaningful impact from tariff changes.

BoA maintains a Buy rating for Apple, with a price target of $235.

This story originally appeared on Appleinsider

-xl-xl-xl.jpg)