Image source: Getty Images

It’s no secret that Nvidia (NASDAQ: NVDA) stock has been one of the best market performers of all time.

Up around 72,300% in 20 years, it has made patient, long-term shareholders an absolute fortune. And founder Jensen Huang one of the world’s richest people!

Naturally, it will be a tall order for other stocks to repeat such eye-popping returns over the next two decades. But at any point in time, there are shares hiding in plain sight that go on to become 10-baggers, or even 100-baggers.

In other words, the stock grows 10 or 100 times in value!

Where might these potential fortune-makers be? Let’s turn to an investment fund that backed Nvidia many years ago to see what its managers think.

Searching for outliers

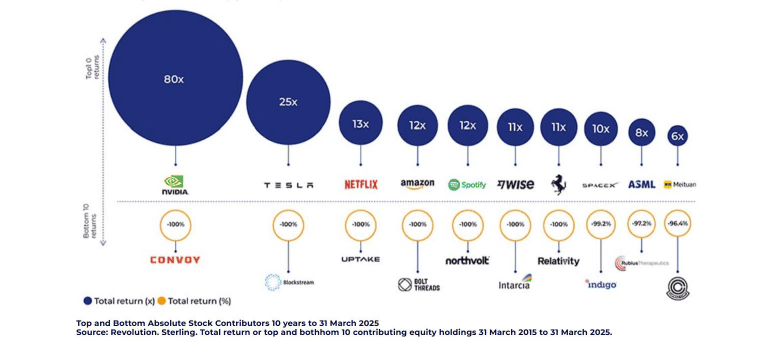

Scottish Mortgage Investment Trust (LSE: SMT) is a FTSE 100 firm that spends much of its time hunting for the next Nvidia. It first invested in the AI chipmaker back in 2016, and has since made over 80 times its money on that position.

Best and worst returns for Scottish Mortgage in the past 10 years:

Note, these calculations only go up to 31 March. Since then, Nvidia’s share price has jumped 47%, meaning the return would now be over 100 times.

However, Scottish Mortgage has been reducing its Nvidia position this year. Manager Tom Slater explains: “A world built on $70,000 chips and 60% margins isn’t likely to endure. So we reduced our position, not because we admire the company any less, but because we’re disciplined. We look for asymmetric outcomes, and at a $3.5trn valuation it’s much harder to make exceptional returns.”

This points to a risk that Nvidia’s pricing power — and therefore margins — might come under pressure in the years ahead. While these are valid concerns, it’s also worth noting that Scottish Mortgage hasn’t sold its entire Nvidia holding.

The company’s products are also applicable to massive adjacent growth markets, particularly self-driving cars and humanoid robots. But the reduction suggests the managers see lower returns ahead due to Nvidia’s juggernaut stature.

The next generation of winners?

So, what else is Scottish Mortgage backing today? Well, some holdings, including SpaceX and Stripe, are still unlisted. So investors can’t buy shares of those yet.

Recently, it’s been loading up on Meta Platforms and Taiwan Semiconductor Manufacturing (TSMC). But with their already enormous market caps, these aren’t exactly what I’d call hidden gems.

In the table below then are 10 growth stocks that are in the top 30 holdings, each with market caps below $100bn. In other words, they’re not already tech mega-caps, and Scottish Mortgage appears to have strong conviction in their growth prospects.

| Company | What It Does | Market Cap |

|---|---|---|

| Sea Limited | Southeast Asian e‑commerce, fintech and gaming | $88bn |

| Snowflake | Cloud‑based data warehousing and analytics | $74bn |

| Roblox | Online gaming platform | $70bn |

| Cloudflare | Web performance and security services | $66bn |

| Coupang | South Korean e‑commerce platform | $55bn |

| Insulet | Maker of the Omnipod insulin delivery system | $21bn |

| Wise | Cross-border money transfers | £11bn |

| Tempus AI | AI-driven cancer diagnostics and precision medicine | $10bn |

| Aurora Innovation | Autonomous vehicle technology | $9bn |

| Oddity Tech | Tech-powered beauty platform | $4.bn |

Foolish takeaway

Of course, there’s no guarantee that these will prove to be the next big winners. Most are investing heavily for growth and therefore not optimised for profits. Some may remain loss-making forever.

Meanwhile, the Scottish Mortgage team might fail to identify the next generation of outliers, which would damage investor confidence in its strategy.

However, I feel these stocks can be used as a springboard for further research. If any succeed wildly, they have the potential to make patient growth investors a lot of money.

Alternatively, more risk-averse investors could consider Scottish Mortgage shares.

This story originally appeared on Motley Fool