Image source: Getty Images

The Stocks and Shares ISA is an effective ways to target a retirement income over time. The annual £20,000 investment allowance is more than enough for the vast majority of Britons. With them, not a single penny is due in tax on any capital gains an investor makes, or on dividends they receive.

This gives individuals more financial firepower to grow their wealth over time. But how large would someone’s ISA need to be to generate a steady passive income of £20,000 a year?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building that ISA

To reach this goal, individuals have a wide range of options. Three of the most popular are:

- To buy an annuity that delivers a guaranteed income for life

- To invest the pension pot in high-yield dividend shares

- To draw down a set percentage of their portfolio a year

Another option is to combine one or more of these choices. For instance, someone could use half their ISA to buy an annuity for peace of mind, and to put the rest in dividend-paying stocks. The latter route carries more uncertainty, but it can also deliver a higher income while also leaving scope for portfolio growth.

The size of the nest egg some needs for a £20k annual income would differ depending on the strategy they chose. But how large would they need if they chose to go down the drawdown route?

Let’s say we have a retiree who wishes to withdraw 4% of their portfolio each year. At this rate, they could expect a regular passive income for about 20 years before the pot runs dry.

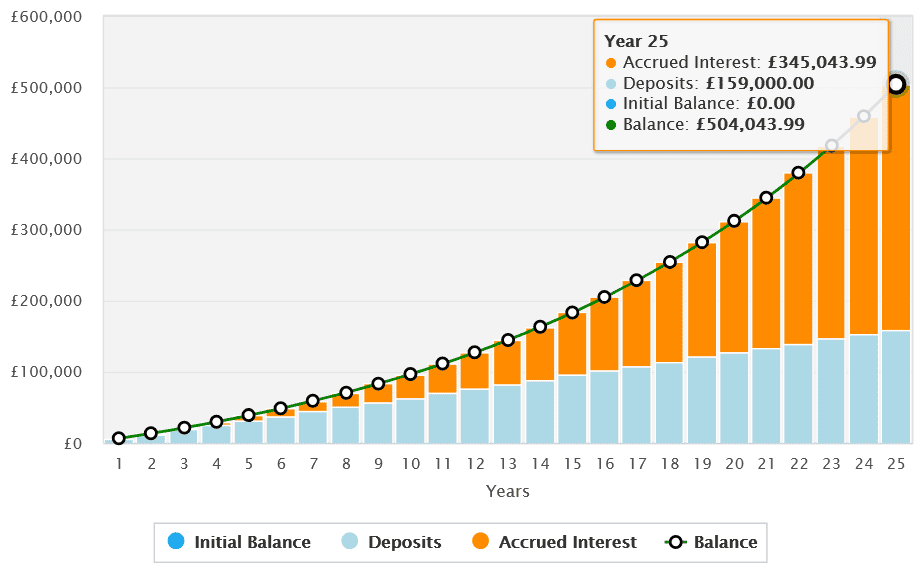

To achieve this level of income, they would need a pot worth £500,000. On paper, that looks like a huge number. But with a tax-efficent Stocks and Shares ISA — along with a commitment to regular investing — it’s more than attainable.

Investing £530 a month over 25 years at an average yearly return of 8% could build a portfolio of this size, although this isn’t guaranteed.

Diversifying to build wealth

Today, ISA investors have thousands of UK and overseas shares to consider to target that sort of return. They also have a plethora of investment trusts and exchange-traded funds (ETFs) to help them reach their goals.

Funds like the iShares FTSE 250 (LSE:MIDD) are simple and low-cost ways to build a diversified portfolio. And this one, which provides exposure to the entire UK mid-cap index, allows investors to spread risk across a variety of sectors and different types of shares (namely growth, dividend and value stocks).

Some of the ETF’s largest holdings are luxury fashion house Burberry, precision instrument maker Spectris and online broker IG.

Returns could disappoint during broader economic downturns, as they have in previous years. Yet over time, it’s proved a resilient way to build wealth. Since its creation 21 years ago, this iShares ETF has delivered an average annual return of 8.6%. If this continues, our investor putting £530 here each month could achieve their £20k annual income earlier than planned.

Past performance is no guarantee of future returns. But I’m optimistic a well diversified portfolio — whether through a fund or trust like this, or by buying individual shares — could set investors up for a healthy retirement income.

This story originally appeared on Motley Fool