Image source: Getty Images

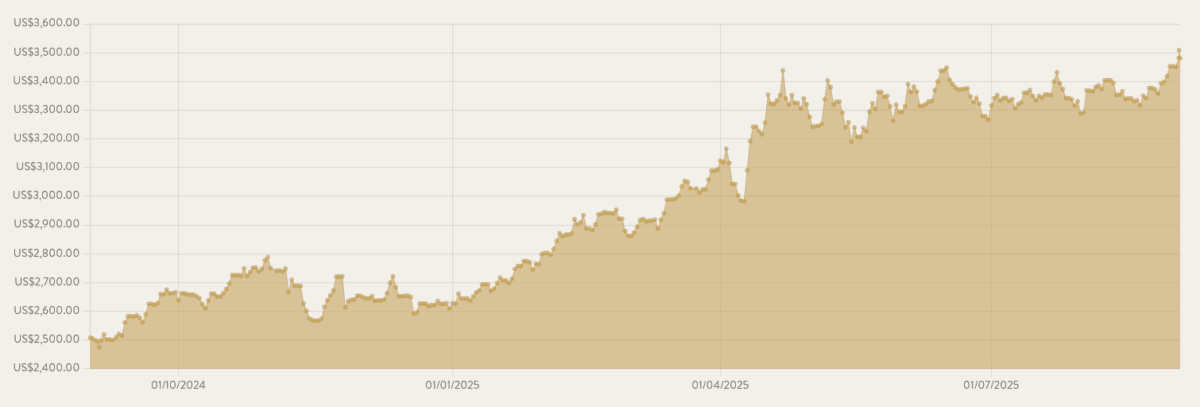

Gold prices are surging again, hitting new record highs above $3,509 per ounce earlier on Tuesday (2 September). After falling in the wake of gold’s previous peak in April, gold stocks and exchange-traded funds (ETFs) are back on the charge.

The yellow metal’s latest upswing is being driven by speculation over Federal Reserve interest rate cuts and the future independence of the US central bank. Further gains are widely expected — JPMorgan has tipped gold prices to average $3,675 by the fourth quarter, and $4,000 by the middle of 2026.

The omens look good for gold stocks and funds, although of course, further price rises cannot be guaranteed. Here are three to consider in the current market.

The easy route

The simplest way is to purchase an ETF that owns physical gold (in this case, bars that are locked up in vaults). This saves investors the trouble of having to store and sell the metal themselves. It also removes the need for them to buy gold-producing shares to get exposure to the precious metal.

The iShares Physical Gold (LSE:SGLN) is one I think demands serious attention. It’s the UK’s largest gold fund, with total assets above $18.7bn, and enjoys exceptional liquidity, making it easier for investors to open and close positions.

Furthermore, its total expense ratio is a very attractive 0.12%. Only the Xtrackers Physical Gold fund has a lower cost (0.11%).

But remember that prices may naturally fall if gold reverses course.

A cheap gold stock

As I say, individuals can also capitalise on buoyant gold prices by considering shares in metal producers. Brazilian miner Serabi Gold (LSE:SRB) is one that’s caught my eye.

Holding gold shares is riskier than physical metal or bullion-backed ETFs. They can fall when gold prices fall, and also if operational problems occur. Serabi, for instance, could retrace if its drive to double production over the next few years encounters issues.

However, this strategy can also mean higher returns, as producer profits can rise far more sharply than the gold price during bull markets. What’s more, holding gold shares can also provide an added bonus of dividend income. The dividend yield at Serabi is a solid 3.8%.

Today the shares trade on a forward price-to-earnings (P/E) ratio of 3.9 times. This cheapness provides substantial scope for further price rises, in my view.

Best of both worlds

There are clearly advantages and disadvantages to buying gold-tracking funds and bullion-producing shares. I think one attractive way to balance the risk and reward of both options is to look for an ETF than holds shares in many different gold companies.

This is a strategy I’ve actually chosen myself by buying the L&G Gold Mining ETF (LSE:AUCP). This fund holds shares in 37 different gold companies, which helps reduce the impact of shocks experienced by individual companies on shareholder returns. But it doesn’t eliminate those risks, of course.

I like this particular fund because of its focus on larger mining companies like Newmont Mining and AngloGold Ashanti. These businesses tend to be much more stable than junior miners, while still providing the possibility of substantial capital gains.

It’s delivered an 80.6% return over the last 12 months. That’s substantially better than the 38.9% increase that gold prices have enjoyed over the period.

This story originally appeared on Motley Fool