Image source: M&S Group plc

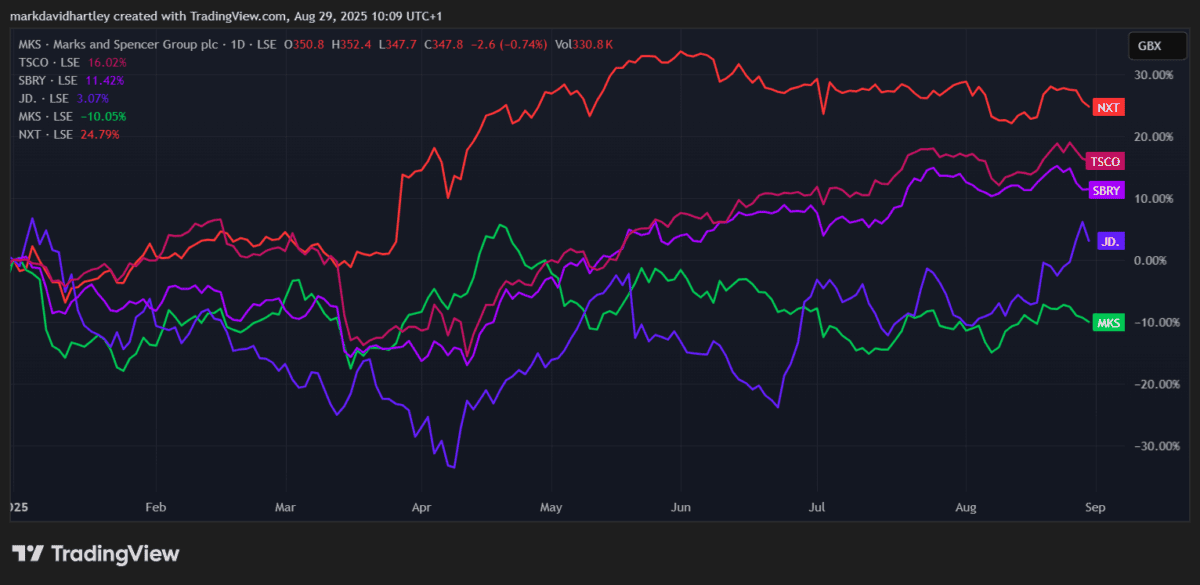

After a fantastic 2024, Marks and Spencer’s (LSE: MKS) shares have taken a hammering in 2025. They are down 8% year-to-date, making them the worst-performing retail stock on the FTSE 100.

That’s a worse showing than Next, Sainsbury’s, Tesco and even JD Sports, which has struggled in the past year.

But before I get carried away, it’s worth looking at the bigger picture. Over five years, it’s still the best performer of the lot — up a remarkable 206%. So is this slump just a temporary wobble, or is it a sign of something deeper? I decided to dig deeper.

Recent developments

The most obvious headwind is the fallout from the April cyber hack. In early August, M&S resumed click-and-collect orders for clothing after a painful four-month pause. That disruption was costly — analysts estimate the total impact could reach about £300m in lost operating profit.

Still, there are positives. Food sales rose 6.7% year-on-year in the 12 weeks to 9 August. Research firm NielsenIQ reported that grocery growth accelerated to 4.3% as the worst of the cyberattack’s impact faded.

In other words, shoppers still seem loyal to the brand.

Margins however, remain razor-thin. Net margin sits at just 2.14%, while return on capital employed (ROCE) is 5.26%. Earnings growth has slumped 32.5% year on year, though revenue climbed nearly 6% over the same period. On the balance sheet, debt and equity are finely balanced at roughly £2.93bn apiece.

One glimmer of hope lies in valuation. The stock’s trailing price-to-earnings (P/E) ratio of 24.7 looks steep, but the forward P/E drops to 14.8, suggesting earnings are expected to improve once the cyber fallout is behind it.

Looking ahead

Management clearly sees growth opportunities. M&S plans to invest £340m in a new automated distribution centre in Northamptonshire. Expected to open in 2029, the site should create more than 2,000 jobs and streamline logistics.

Meanwhile, analysts remain cautious. In a note on 26 August, Deutsche Bank lowered its price target from 450p to 435p, citing concerns about UK consumer resilience. Interestingly though, it still labels M&S a ‘preferred stock’ relative to peers such as Next, which it views less favourably.

The risks

Marks and Spencer’s business model is unusual in that it straddles two very different markets. On one hand, it competes with premium food retailers like Waitrose and the top-end own-label ranges from Tesco and Sainsbury’s.

On the other, it’s fighting for market share in fashion against both budget retailers such as Primark and H&M, and online giants like ASOS and Boohoo.

This dual positioning leaves the company vulnerable on both sides. Rising costs could erode already thin food margins, while changing consumer trends might make it harder to defend its mid-market fashion business. Add in fierce competition, and it’s clear the path forward won’t be smooth.

Should I sell?

Despite the rocky start to 2025, I’m not rushing for the exit. M&S has reinvented itself before, and its long-term track record shows that management knows how to adapt. The cyberattack was a major setback, but it looks like the business is already recovering.

For me, it’s still a stock to consider buying. If anything, the recent dip could be a chance for long-term investors to pick up shares in this British retail icon at an attractive valuation.

This story originally appeared on Motley Fool