Image source: Getty Images

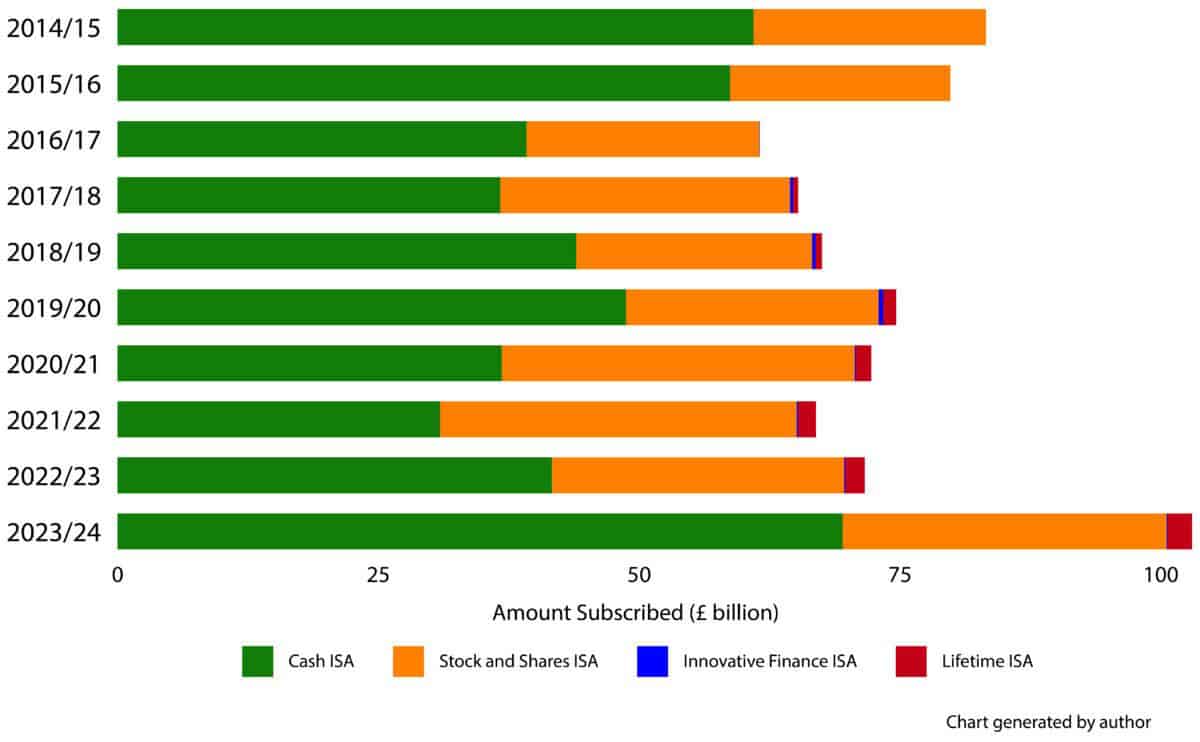

Britons cannot get enough of Cash ISAs. In the 2023/24 tax year, the latest HMRC data highlights that savers have squirrelled away nearly £70bn into such tax-free products. This is a whopping £28bn increase on the previous year.

Cash ISAs are a great way of saving for the long term. But with the interest rate on such products falling over the past year, is this really the best option for those looking to build a sizeable nest egg?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

HMRC stats

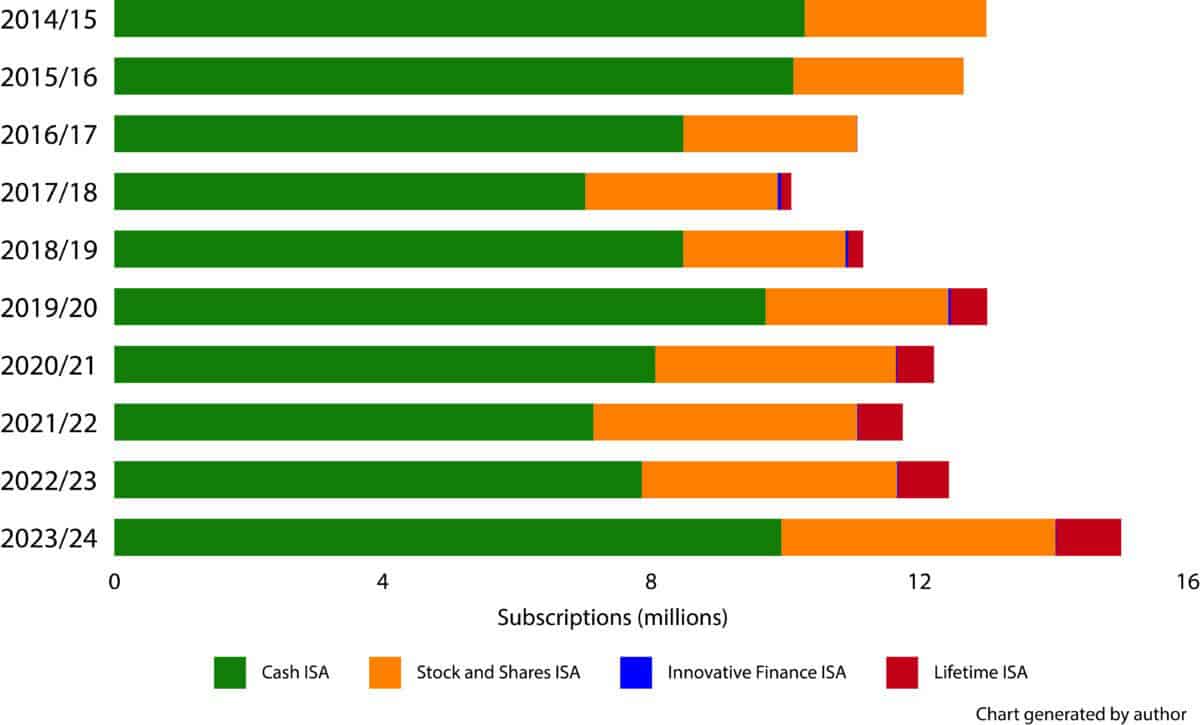

Last week HMRC published its annual savings statistics and they paint a picture of frenzied activity. The following chart highlights the extent of this buying spree. The number of new Cash ISAs soared by 2.1m. This completely dwarfed that of new Stocks and Shares ISAs (283,000) and Lifetime ISAs (209,000).

HMRC data

The extent of the surge in cash deposits is brought to life by the below chart. As the Bank of England bank rate reached its peak during the 2023/24 tax year, locking in returns of around 5% completely tax- and risk-free, was the main allure for savers.

HMRC data

Compound returns

Even though interest rates are now declining, early insights from major ISA providers such as Aviva and Phoenix Group highlight the continuation of this upward trend into this tax year.

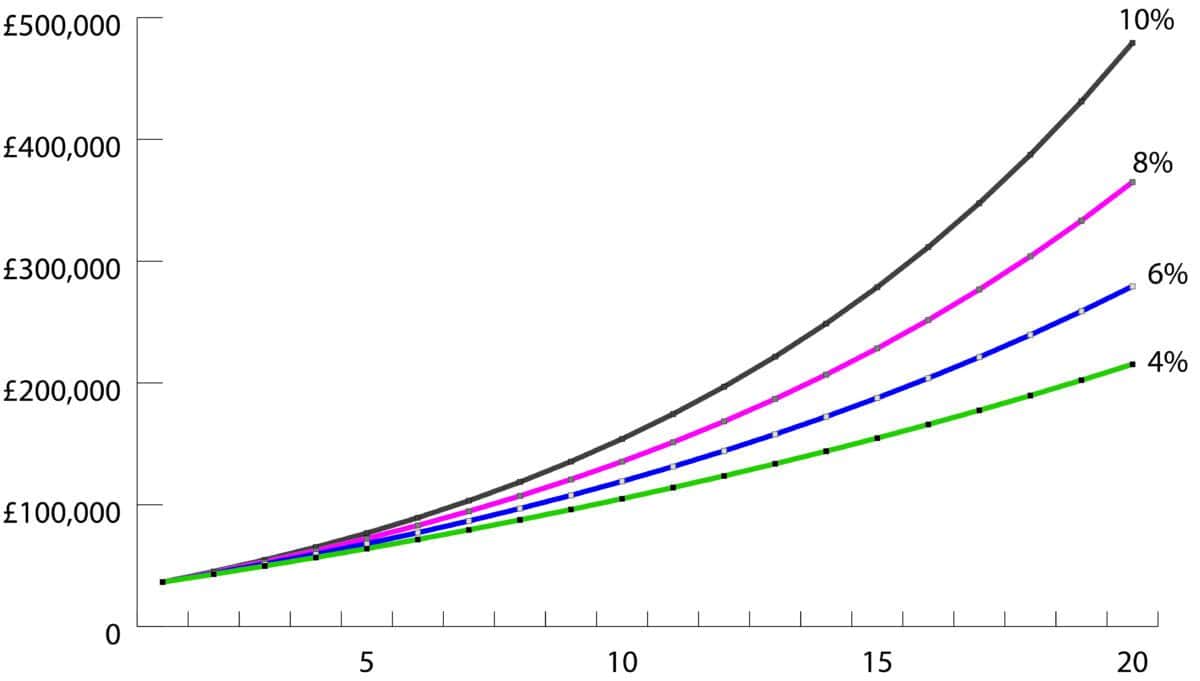

Today, the Bank of England’s base rate stands at 4%. Year to date, however, the FTSE 100 is up 11%. Over the long term, the FTSE 100 has generated average annualised returns of 6.5% and the S&P 500 10.5%.

The average ISA value for individuals earning an average wage, is £31,536. The following chart plots that initial investment with a further £5,000 yearly contribution for the next 20 years. As one can see, small changes in yearly returns lead to vastly different final pot sizes. This is due to the magic of compounding.

Chart generated by author

High-yielding stock

Personally, I prefer a Stocks and Shares ISA over a Cash ISA for this very reason. I own a mixture of passive funds tracking the performance of a major benchmark, together with a diversified portfolio of individual shares.

Picking individual stocks can be daunting for many, but the opportunity to receive a dividend is a big draw for me. Aberdeen (LSE: ABDN) is one such stock.

The FTSE 250 asset manager currently offers a dividend yield of 7.7%. With over £500bn of assets under management or administration, I believe it offers a compelling growth story.

interactive investor, its direct-to-consumer offering, has taken the investing world by storm. And as the above HMRC stats show, a desire to take control over one’s personal finances continues to accelerate.

In addition to ISAs, the business has seen remarkable growth in its SIPP portfolio. On average, balances in such accounts are higher than ISAs.

However, the stock currently stands at multi-year lows due to outflows from its various funds. This remains an ongoing issue, and a clear risk for the business.

Despite the risks, I continue to like Aberdeen. Its funds remain the investment vehicle of choice for over 50% of independent financial advisers. Its deep partnership with this cohort provides it with extraordinary growth potential. As long as its share price remains in the doldrums, I will continue to add more for my Stocks and Shares ISA portfolio.

This story originally appeared on Motley Fool