Image source: Getty Images

More and more investors are using artificial intelligence (AI) models for investing guidance and stock tips. I remain sceptical about these new technologies for such purposes, given their proclivity for strange reasoning and providing inaccurate information. But I thought I’d join in and ask ChatGPT to find me five FTSE 100 dividend stocks to buy.

I’ve decided to make things interesting, too, by choosing a selection of Footsie shares myself. My plan is to compare the performance of my handpicked portfolio — taking into account dividend income and share price movement — with that of ChatGPT.

Let’s get started.

The two portfolios

| ChatGPT | Royston Wild |

|---|---|

| British American Tobacco (25%) | M&G (25%) |

| BP (20%) | Aviva (20%) |

| National Grid (20%) | Reckitt Benckiser (20%) |

| HSBC (20%) | Segro (20%) |

| Unilever (15%) | SSE (15%) |

As you can see, the machine’s portfolio is pretty nicely balanced across cyclical and non-cyclical industries. It’s a strategy that can effectively balance risk and deliver reliable passive income over time. Accordingly, it’s a tactic that I’ve adopted for my own theoretical portfolio.

There’s also a couple of FTSE 100 companies in ChatGPT’s portfolio I really like myself. Despite high operational costs, I’m confident National Grid‘s defensive operations will provide a stable dividend income. HSBC‘s a stock I hold in my real-life portfolio, owing to its strong balance sheet and exposure to fast-growing (if volatile) emerging markets.

My five-stock mini selection also contains Aviva, which I currently own in my Self-Invested Personal Pension (SIPP). Another one in my virtual portfolio is Segro, a real estate investment trust (REIT) that pays 90% of annual rental profits out in dividends.

Renewable energy producer SSE and consumer goods giant Reckitt Benckiser round off my list and provide added defensive ballast, protecting the portfolio against possible volatility.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A FTSE dividend star

I chose to make M&G (LSE:MNG) the single largest holding for my exercise. At 7.5%, it currently has the fourth-highest dividend yield on the FTSE 100 index.

Unlike many high-yielders, though, the dividend picture here is built on sturdy foundations. Shareholder payouts, which have long outstripped those of most other UK shares, have also risen every year since the company was spun out of Prudential in 2019.

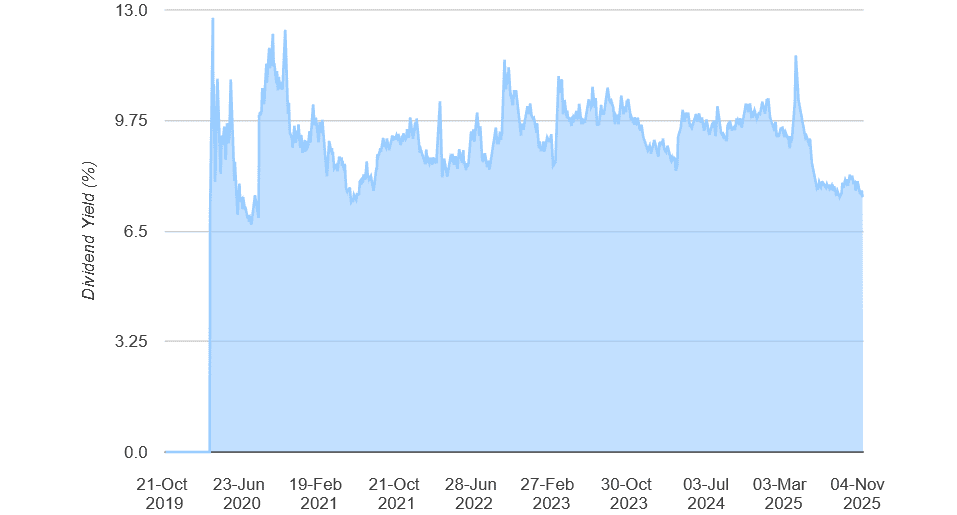

Its yield history is shown below:

M&G’s proud dividend record’s built on stunning cash generation and robust balance sheet. As of June, its Solvency II capital ratio was 230%, the highest level among its UK peers.

Slowing sales are a near-term threat to M&G’s share price amid tough conditions. But I don’t think this should impact dividends. I expect cash rewards to rise steadily over time as demographic changes drive demand for investment and retirement products.

Beginning today, I’ll be monitoring the performance of my five-share virtual portfolio, and comparing it with the returns of ChatGPT’s selection of dividend holdings. Watch this space for future updates.

This story originally appeared on Motley Fool