Image source: Getty Images

The BT (LSE:BT.A) share price has risen an impressive 23% in the year to date. And City analysts don’t think the FTSE 100 stock is done yet.

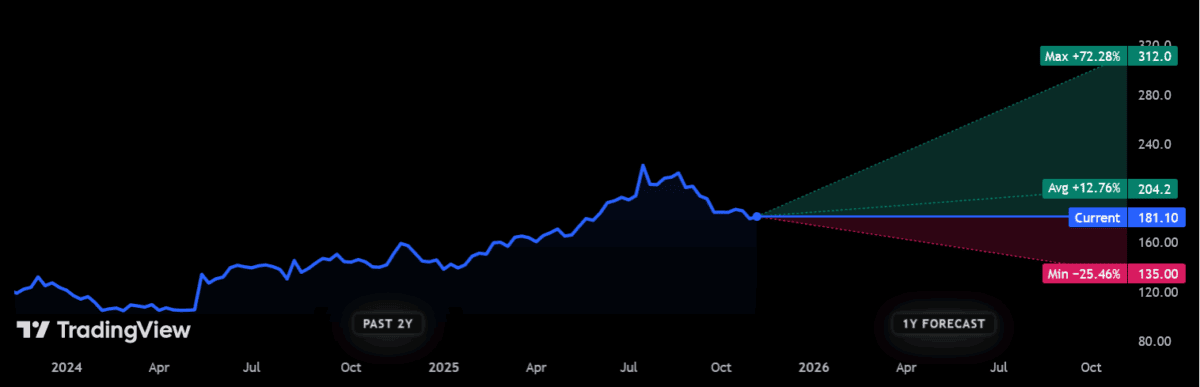

BT shares were last changing hands at 181p per share. If forecasts are correct, they will surge through the 200p marker over the next year, to 204.2p per share. That would represent a 12% rise from current levels.

When one also factors in predicted dividends, investors in BT could realise a total return of 16% to 17% during the next 12 months. But how realistic are these forecasts?

Progress

Firstly, it’s important to say that brokers aren’t unanimously bullish in their estimates. That 200p-plus target is an average among the 15 forecasts currently on offer from the analyst community.

One analyst believes BT’s share price could drop more than a quarter between now and next Remembrance Day. Having said that, another reckons it could print price gains north of 70% over the period.

What do City analysts believe could drive the company ever higher? Bulls reckon BT’s restructuring programme will not only help it continue its impressive cost-cutting strategy. They see it as a way of streamlining its product ranges to help it rescuscitate its dragging revenues.

BT’s restructuring plan achieved a robust £1.2bn worth of savings in the 18 months to September, smashing forecasts.

Optimism also abounds over the firm’s high-margin Openreach infrastructure division as new fibre connections continue to grow. It’s on course to connect 25m premises by the end of next year, and 30m by the close of the decade.

Problems

Yet while BT’s been making progress on these fronts, I fear the stock may be running out of road as problems continue elsewhere.

It’s still shown no way of overcoming its continued sales problems — adjusted revenues dropped again in the six months to September, by 3%, with reversals recorded across its Consumer, Business, and International divisions. Against a backdrop of increasing competition and a weakening UK economy, I can’t see its revenues issues easing any time soon.

At the same time, capital expenditure continues to tick up, rising 8% in the half year. This means that net debt is also heading steadily higher, up another 3% year on year to end September at £20.9bn.

It makes for even more grim reading when one considers the cost of BT’s enormous pension deficit. This is costing the company around £800m a year.

Expensive

There’s also a valuation problem I feel may limit further gains for BT’s share price. This year’s rapid ascent leaves it trading on a forward price-to-earnings (P/E) ratio of 10.3 times.

That’s above the 10-year average of 8.8 times. Given the enduring problems the business faces, this emerging premium is especially hard to fathom.

Added to this, BT shares now also command a price-to-book (P/B) ratio of 1.4. This is up from below one just 14 months ago, and indicates that the firm trades at a premium to its asset values.

I wouldn’t be surprised if BT’s share price were to continue rising. But I think the odds are stacked against it, so I’d rather buy UK shares that offer much lower risk.

This story originally appeared on Motley Fool