Image source: Getty Images

Ceres Power (LSE:CWR) is the best-performing stock in the FTSE 350 over the past six months — and it’s not even close. It’s up 519% in this period and a staggering 699% since early April. It joined the FTSE 250 index last week.

I last wrote about Ceres at the end of July, when I said the stock might be underappreciated at 143p and therefore worth considering. Fast-forward just three months, the share price is now at 380p!

Zooming further out, though, the stock is still 76% lower than a 2021 peak of 1,576p. So, could it have further to run?

Back in vogue

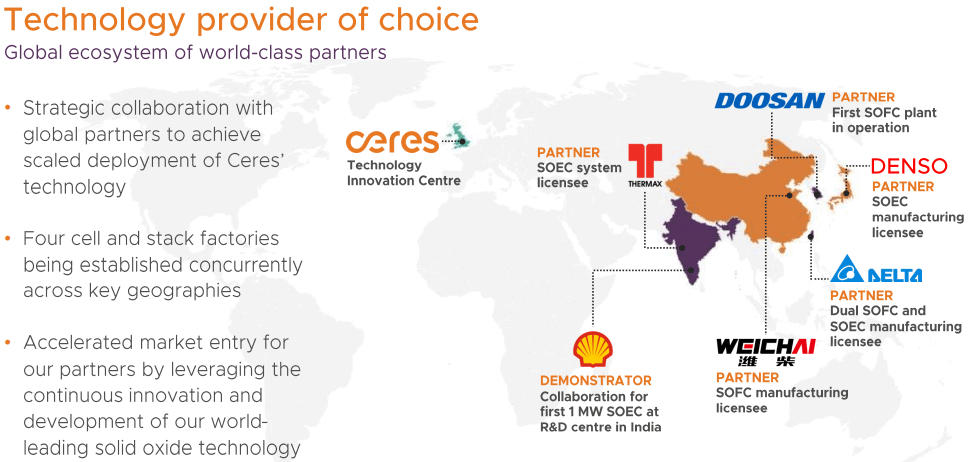

Ceres is a clean energy company that has developed advanced solid oxide fuel cell technology for hydrogen and electricity production. But rather than doing the heavy grunt work of manufacturing and distribution, the firm licences its fuel cell design to partners worldwide.

This capital-light approach holds the promise of higher profitability one day. It’s an important differentiator.

Hydrogen stocks are back in vogue after a few years in the wilderness. Bloom Energy, which is a market leader in building hydrogen fuel cell systems, is up 452% year to date (and more than 1,000% in 12 months).

The key catalyst driving these shares higher is artificial intelligence (AI). Or, more specifically, the numerous data centres that are being built worldwide to support the explosive growth in power-hungry AI systems. Fuel cell stacks allow the generation of cleaner, reliable electricity onsite.

Strap in for a turbulent ride

Now, it’s important to note that Ceres is still someway behind Bloom Energy, which is close to entering consistent profitability. In 2024, Ceres reported a £28.3m net loss on revenue of £52m. And analysts don’t expect bottom-line profits to materialise before 2028.

Moreover, while six out of the seven brokers covering the stock (85% of them) rate it a Buy, the average share price target among them is 276p. This is roughly 27% below the current level.

Another thing worth highlighting is that manufacturing licencing deals can result in lumpy financial results. In September, Ceres lowered its 2025 sales guidance to £32m, citing uncertainty over “timing of revenue recognition“.

Further to run?

Based on the current £57.4m revenue forecast for 2026, the stock’s forward price-to-sales multiple is around 12.5. So this isn’t a cheap share, as things stand.

Over the longer term though, I think there’s a lot to like here. The company already has excellent manufacturing partnerships across Asia with Doosan Fuel Cell in South Korea, Thermax in India, and Japan’s Denso.

In July, Doosan entered mass production using Ceres’ technology. And today (5 November), China’s Weichai Power (Ceres’ largest shareholder) said it will build a manufacturing facility to produce cells and stacks to help power AI data centres. Revenue from this will likely be booked in 2026.

Looking ahead, I think the stock’s run could continue, and Goldman Sachs agrees. The bank has just hiked its price target to 480p from 246p, adding Ceres to its European conviction list.

Investors should expect significant volatility. But I still think the stock is worth considering for the long term, especially on dips.

According to Goldman Sachs, AI will drive a 165% rise in data centre power demand by 2030.

This story originally appeared on Motley Fool