Image source: Getty Images

Asia’s economic troubles have weighed upon HSBC‘s (LSE:HSBA) share price in recent years. But with the bank’s emerging markets experiencing an upturn, the FTSE 100 company has finally swept higher again.

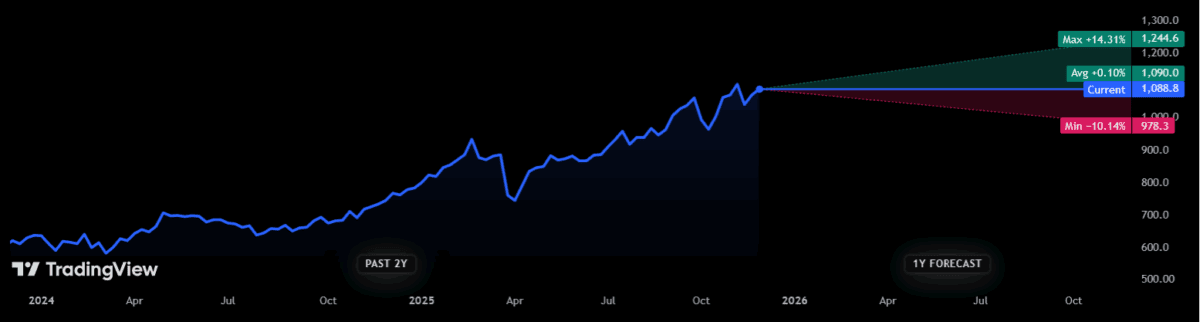

At £10.88, HSBC shares are up 39% so far in 2025. But could the banking giant be running out of steam?

Fourteen different brokers currently have ratings on HSBC. They have slapped a 12-month price target of £10.89 on the company, up fractionally from today’s levels.

As you’d expect, there are some major differences among City projections. But estimates are largely positive. One analyst reckons HSBC’s share price will leap 14.3% over the next year to £12.44.

With the bank also offering a 5% forward dividend yield over the period, this suggests investors today could enjoy a total return approaching 20%.

But what could propel HSBC shares over the next 12 months? Here are four possible price drivers.

1. China optimism

China’s economy faces problems like a weak property sector and subdued consumer spending. These pose natural ongoing risks to cyclical companies like banks.

But things are looking up for Asia’s largest economy, and subsequently for the broader continent. This bodes well for HSBC, which makes roughly 75% of profits from Asian customers.

In recent days, Standard Chartered raised its 2026 growth forecasts for China, to 4.6% from 4.3%. This encouraging update follows the country’s forecast-beating GDP growth in quarter three.

2. Buybacks resume

HSBC has one of the best balance sheets among the UK’s listed banks. At 14.5%, its CET1 capital ratio is robust, giving it scope to invest for growth and return ample cash to investors.

Nevertheless, share buybacks are on hold for the next few quarters as the bank focuses on acquiring the remaining stake in Hong Kong’s Hang Seng Bank for $13.6bn. This has naturally disappointed some investors.

That said, City analysts expect HSBC to keep delivering healthy dividend growth over the near term. If it can complement this with further share price repurchases before the end of next year, its shares could fly.

3. Growth areas outperform

HSBC’s Asian expansion is focusing on fee-based, high-growth areas like trading and wealth management. It’s a strategy that’s paying off handsomely, and one that’s gaining importance as interest rate cuts impact margins at its traditional banking business.

Fees and other income at Wealth leapt 39% in the last quarter, HSBC’s latest financials showed. The growth potential here is considerable in 2026 and beyond, reflecting low product penetration and robust economic growth across Asia.

The bank has guided for “double-digit percentage average annual growth in fee and other income in Wealth over the medium term“. Signs of fresh momentum in 2026 could be a significant share price driver.

4. Rock-bottom share price

Given HSBC’s low valuation, there’s a good chance of more share price gains on signs of further operational progress.

Its price-to-earnings (P/E) ratio is 9.9 times for 2025 and 9.3 times for 2026. Both readings are below the value benchmark of 10 times.

Both P/Es are also below what Lloyds shares command, of 13 times for this year and 10.1 for next. Considering HSBC’s superior growth outlook, this suggests the Asian bank’s shares are a snip.

This story originally appeared on Motley Fool