It’s Friday, the dog days of summer, and traders are nervous.

That’s not surprising. At Jackson Hole 12 months ago Federal Reserve Chair Jerome Powell gave a speech of just 8 minutes in length that many reckon was the trigger for the stock market’s slump to October lows.

U.S. inflation was above 8% then, and it’s 3.2% now, so is there really a need for Powell to be similarly hawkish this year? We shall see at 10:05 a.m. Eastern when he is expected to take the podium.

Should his comments cause another move higher in bond yields then growth stocks may be expected to suffer, providing another reason for investors to consider switching to value, a move proposed by Vanguard’s Capital Markets Model research team led by Kevin DiCiurcio.

Vanguard defines value stocks as those with lower prices in relation to their enterprise book or accounting values, lower expected and historical growth rates and relatively high dividend yields.

Crucially, Vanguard says that the relationship between value and growth is currently at an extreme level, very similar to that seen in 2020.

“Now, as then, investors in aggregate are very enthusiastic about growth stocks—notably, technology shares—and seem to have limited interest in value stocks, including financial, industrial, and health care companies,” says DiCiurcio.

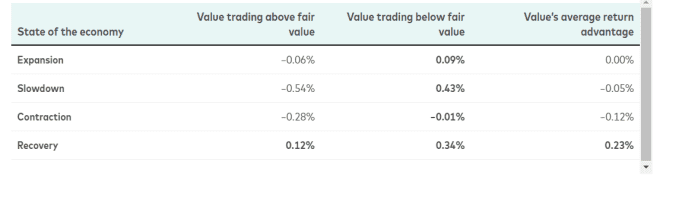

Such extremes usually provide contrarian opportunity. The chart below shows Vanguard’s estimates of the fair value of value stocks relative to growth stocks.

Source: Vanguard

Vanguard says that when the historical, actual ratio exceeds the upper limit of its estimated fair-value range, the chance for market-beating returns appears to be larger in growth stocks. When that ratio is below the lower limit of the range, such opportunity appears to be larger in value stocks.

This is shown in the three instances of extreme valuations pictured. After an overvaluation in 1993, value shares underperformed growth by a cumulative 8 percentage points on their three-year trundle back to the median of Vanguard’s estimated fair value range, shown as the dark yellow prediction ratio line.

But the extreme undervaluation of value stocks during the tech bubble of 2000 was followed by value outpacing growth by 59 percentage points over a year until reaching fair value.

Similarly, another undervaluation in 2020 resulted in a 46 percentage point outperformance for value over about 20 months.

So what’s the outlook now? Well, value is again notably underperforming in relative terms, says Vanguard: “The Russell 3000 Growth Index, for example, returned 32% year-to-date as of July 31—more than three times the 9% return of the Russell 3000 Value Index.”

Furthermore, market performance across the dozen U.S. business cycles since 1980 suggests another potential reason for optimism on value, says DiCiurcio.

“On average, value has outperformed during economic recoveries, historically speaking, So, if you believe that the Federal Reserve may have engineered a soft landing—that we’re going to sidestep a recession and that the economy’s next move is an acceleration—the case for value is strengthened.”

Source: Vanguard

“Given relative valuations and economic conditions, an overweight to value stocks could help offset the low broad-market returns we expect over the next decade,” DiCiurcio says.

Markets

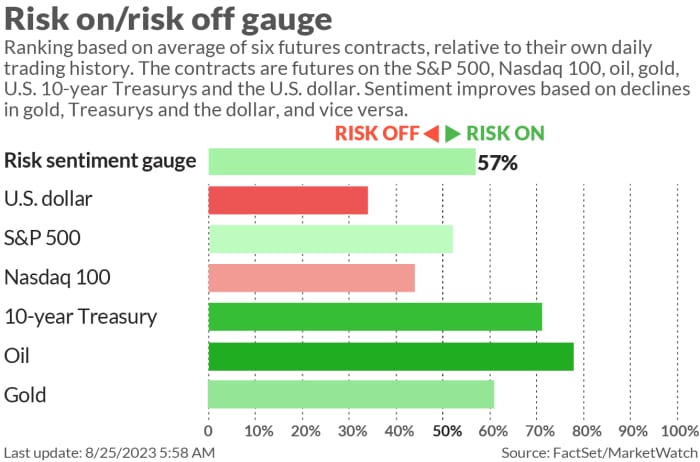

U.S. stock-index futures

ES00,

NQ00,

are a bit higher while benchmark Treasury yields

BX:TMUBMUSD10Y

nudge higher. The dollar

DXY

is near a 3-month high, while oil prices

CL.1,

rally, and gold

GC00,

is little changed around $1,918 an ounce.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

Economic data on Friday include the University of Michigan’s final reading of consumer sentiment for August, which is due at 10 a.m. Eastern.

European Central Bank President Christine Lagarde is also due to make a speech at Jackson Hole on Friday. She’s expected to start at 3 p.m. Eastern.

China’s finance ministry said it would provide tax breaks for home buyers.

Wall Street funds are discussing a potential bankruptcy plan for WeWork.

Shares of Workday

WDAY,

are gaining 3% in premarket action after the software company reported quarterly earnings that beat analyst estimates.

But Domo

DOMO,

stock is plunging more than 25% after the cloud-data software company’s outlook soured its better-than-expected results.

Hawaiian Electric Industries

HE,

shares are diving 19% after the company said late Thursday that it is suspending its dividend, starting in the third quarter, “to further increase its cash position,” following the Maui wildfires. Maui County separately sued the company, saying the utility negligently failed to shut off power.

Watches of Switzerland

WOSG,

WOSGF,

investors really do not like the news that Rolex has bought another retailer.

Best of the web

China imports record amount of chipmaking equipment.

The secret weapon hackers can use to dox nearly anyone in America for $15.

VinFast, Arm and other index orphans miss out on billions from passive investors.

The chart

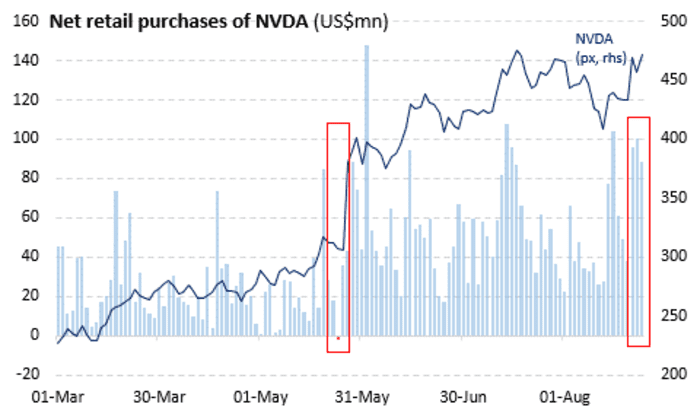

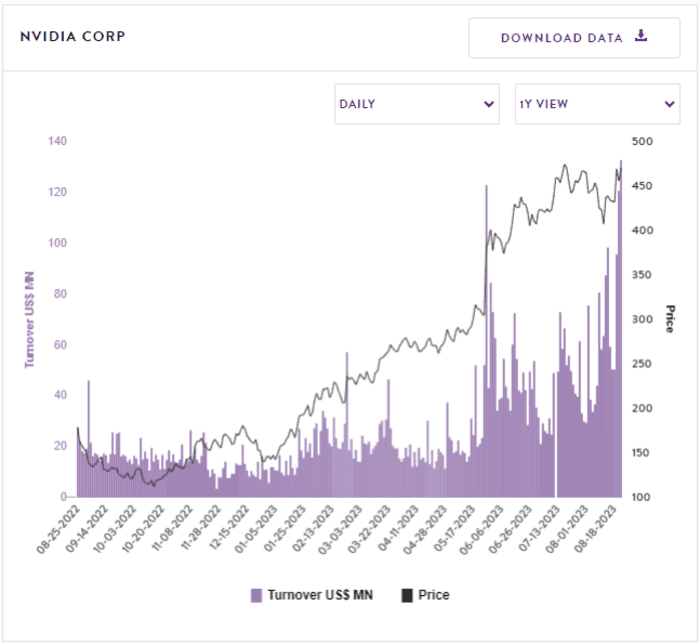

Why did Nvidia stock give up pretty much all of its 8% pop at Thursday’s opening bell, even though results again blew passed expectations? Sure, the market as a whole sold off. But perhaps the charts below from Vanda Research give a more precise answer. They show that unlike the previous earnings blowout, retail investors had piled into Nvidia before Wednesday night’s release, and snapped up loads of call options too.

Source: Vanda Research

“To us that suggests that NVDA may not experience as large of an increase in cash equity purchases or OTM Call option turnover in the days ahead, and instead retail traders may seek to allocate to recently lagging AI beneficiaries such as

AMD,

MRVL,

” said Vanda Research.

Source: Vanda Research. OTM Call option turnover (daily, U.S.$ million)

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Random reads

The rescue of a $50 million Da Vinci masterpiece.

Talk about the fun police: Biden’s alcohol czar says two beers a week is a limit.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton

This story originally appeared on Marketwatch