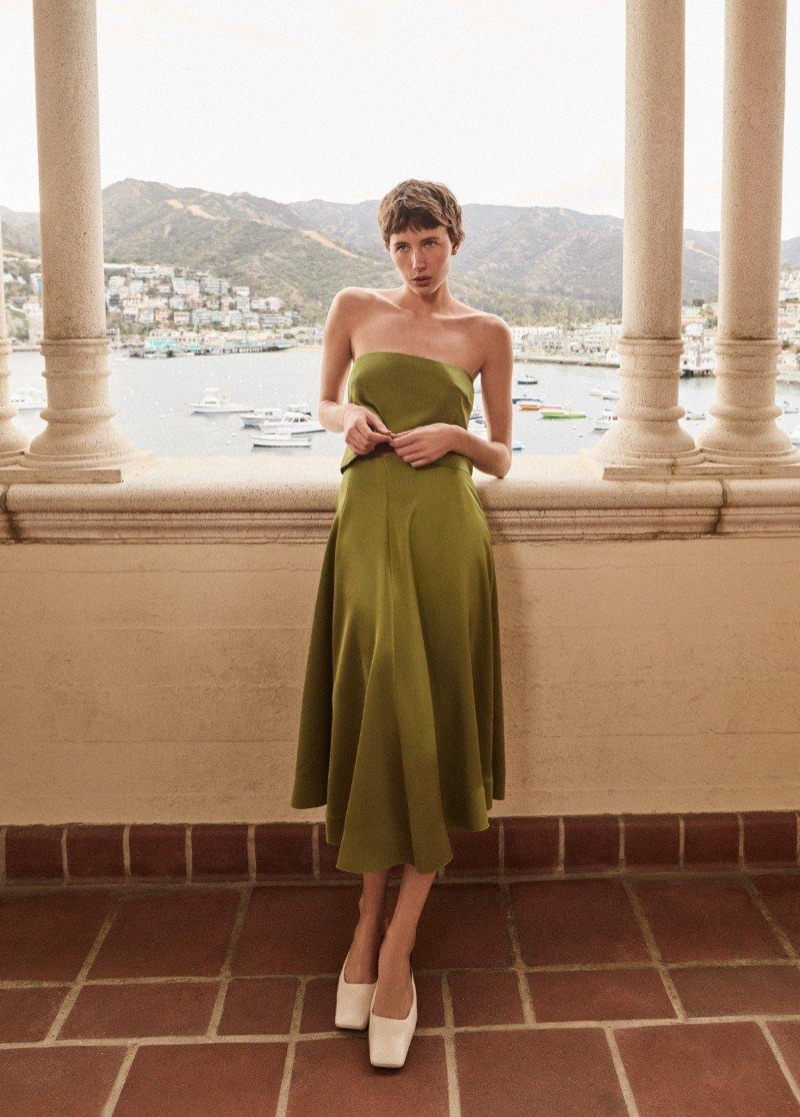

Vince’s spring 2025 campaign transports us to Catalina Island, California. Here, the cliffs, ocean views, and historic Catalina Casino set the perfect stage for a collection that mixes past and present. Shot by Emma Summerton, the campaign stars model Nora Svenson.

Vince Spring 2025 Campaign

The collection embraces a mid-century aesthetic with A-line silhouettes, check patterns, and tailored outerwear that feel both polished and relaxed. Cropped flare pants, square-toe mules, and A-frame tops channel the 1960s, adding a retro touch to modern styling.

The looks exude understated luxury, whether lounging indoors in a sleek black bandeau and high-waisted trousers or exploring the island in a soft blue jacket and wide-leg pants.

From rocky shores to grand ballrooms, the settings highlight the versatility of the collection that embraces day to night dressing. With a mix of refined tailoring and fluid shapes, Vince proves that timeless style never fades.

This story originally appeared on FashionGoneRogue