“There is no magic level of yields that, when reached, will automatically draw in enough buyers to spark a sustained bond rally.”

That was Barclays’ head of macro research, Ajay Rajadhyaksha, warning clients Wednesday that only a stock selloff will stem the bond bleeding. Add to that Pimco co-founder Bill Gross, who notes that “spooked” retail investors have started dumping their massive holdings in bond exchange traded funds.

Also read: Gross says investors should shun stocks and bonds and buy this asset instead

The sum of all that is that patience for this to play out, even if you get the call:

@Fullcarry

H/T to Kevin Muir of the Macro Tourist newsletter for spotting the above, which brings us to our call of the day, from his Wednesday interview with Harris “Kuppy” Kupperman, founder of hedge fund Praetorian Capital, who sees no bottom for bonds and prefers “real economy” investments instead.

A penchant for trading in manias, Kupperman nailed last year’s tech selloff but got burned on Russian trades. His Praetorian Capital Fund still returned 11% plus it had triple digit gains in 2020 and 2021, and is up 16% so far in 2023.

As for the bond market, he says it’s “not panicky at all.”

He said the bottom can’t be in while 10-year Treasury bonds are still inverted relative to shorter-term bonds, and said there’s no reason why the yield can’t go to 6%, a median area for the last 50 years, and then probably overshoot that.

Read: The chart that has one strategist convinced bond market is divorced from fundamentals

“I wouldn’t be surprised if it got back to the teens,” which he sees happening over time “unless our government has some fiscal sanity,” said Kuppy.

“Think how ridiculous it is that we’re running an effectively 8% nominal GDP, 8% deficits in the boom, probably like teens in the next recession…payroll tax was up 9% year over year for Q3, so the economy is really strong. So how is the 10 [year Treasury yield] at 4% and change? It makes no sense. It should have a 6% handle.”

But a 6% yield is a problem for the Wall Street guys it will make “insolvent,” due to the leverage they use — borrowing money to trade elsewhere. “And so you have these Wall Street guys crying and crying and crying, but my friends in the real economy, I mean it hasn’t been better for them. It really is a one percenter depression, that’s all it is,” he said.

Kupperman sees high yields causing pain at some point because many businesses have to fund themselves. “They did 5-year bonds in 2021 and 2022 and you know they’ve got three or four years left on it and are putting it back to work in money markets and actually earning a positive carry. That’s not sustainable long term.” (Positive carry refers to when benefits of holding an asset exceed its costs.)

Kupperman says he’d keep close eye on the banks for signs of trouble, noting that Goldman Sachs

GS,

“is in freefall” — the stock has been dropping since September.

“You have lots of sectors in the economy that are going to do just fine and you have lots of sectors that are going to be terrible and I think you’re not really going to see a stock market crash as much as a giant sector rotation,” he said.

The manager, for his part, is more bullish on the real economy, and he’s been a fan of uranium for awhile. His uranium bets center on his view that the world will eventually decide on nuclear power as the best compromise for baseload power generation.

The world isn’t going to run out because it’s plentiful, but “there appears to be a gap period where for a few years, the deficits will simply overwhelm the ability to ramp up production. I think that there will be a super-spike in the uranium price…that will stun everyone, he said in a recent blog post, after attending an industry conference where he said no one seemed to care about a big shortage.

Read: What World War II can tell us about the current stock-market environment

The markets

Stock futures

ES00,

NQ00,

are down while bond yields

BX:TMUBMUSD30Y

BX:TMUBMUSD10Y

choppy. Oil prices

CL.1,

BRN00,

are down another 1% after Wednesday’s rout. The dollar

DXY

is down and Europe markets

XX:SXXP

are a little shaky.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Rivian

RIVN,

is down 8% after the EV maker said it will offer $1.5 billion worth of “green” convertible senior notes, as preliminary sales estimates just met forecasts.

Clorox shares

CLX,

are down 4% after the bleach maker slashed its outlook following cyberattack disruptions.

BlackBerry stock

BB,

is up nearly 3% after the tech group said it will spin off and publicly list its Internet-of-Things business.

Dell

DELL,

said it will add $5 billion to its share buybacks, and plans to grow its quarterly dividend by 10% or more annually through 2028.

Amazon

AMZN,

and Microsoft

MSFT,

are facing a competition probe in the U.K. over cloud services.

Data showed weekly jobless claims rose slightly to 207,000, but they remained near pandemic-era lows. Meanwhile, the trade deficit for August dropped 9.9% to $58.3 billion. Cleveland Fed President Loretta Mester is due to speak at 9 a.m., San Francisco Fed President Mary Daly will speak at 12 noon, then Fed. Gov. Michael Barr at 12:15 p.m.

Best of the web

America’s factory boom brings billion-dollar projects to tiny towns.

This $4 trillion market is stuck in a rut.

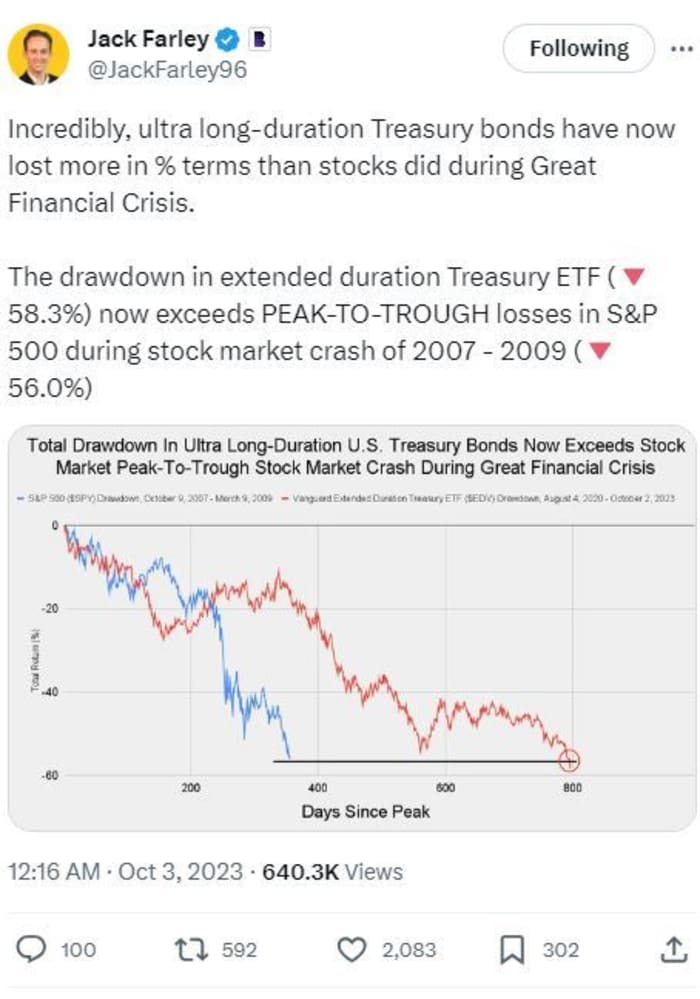

The chart

Here’s a chart from Jack Farley, video journalist at Blockworks, who recently offered up this chart showing the extent of the selloff on ultra-long Treasury bonds.

@JackFarley96

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir Technologies |

|

TTOO, |

T2 Biosystems |

Random reads

Tokyo urges Halloween revelers to stay away from the site of a tragic accident last year.

806 Jr, or a 70 pound bear cub, aims to be the champion of chonk.

Victoria Beckham says she’s a “working class” girl. David Beckham is not so sure.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

This story originally appeared on Marketwatch