Image source: Getty Images

The S&P 500 has been rocked by volatility lately. In fact, it’s down 8.7% in just under a month! That’s a sharp fall for the benchmark index and means $4trn has been wiped out since its peak in February.

It also means that an investor who had ploughed 10 grand into an S&P 500 index fund a month ago would be down 7.5%. In other words, they’d now have about £9,250 (discounting exchange rates). While not disastrous, that’s probably not what they were expecting after just four weeks.

Zooming further out though, the index is over 140% higher than it was during the Covid crash five years ago. And it has nearly tripled over 10 years, including dividends.

So it’s important to remember that four weeks is merely the blink of an eye in the context of the stock market.

What’s going on lately?

The market hates uncertainty, as the old saying goes. And President Trump brings lots of that to the table, with almost daily tariff threats against trade partners.

These have centred on China, Canada, and Mexico. But Trump says the EU was “formed to screw the United States” and has also threatened it with 25% tariffs. The UK seems to be an afterthought for now.

Is anyone really surprised by all this? After all, we had the first Trump administration to go on. In late 2018, I remember my portfolio dropped more than 30% in the space of a few weeks when he initiated a trade war with China.

So I was baffled when the US market took off like a rocket after the November election. And my outlandish prediction in January that Tesla stock would drop 40% this year might actually come true (it’s currently down 45% year to date).

Market corrections offer opportunities

But with the Nasdaq Composite now already deep in correction territory (down more than 10%), and the S&P 500 not far behind, I think there are attractive buying opportunities emerging for my portfolio.

One stock I’ve been watching is Amazon (NASDAQ: AMZN). To my shame, I’ve never owned shares of the e-commerce and cloud computing juggernaut.

The stock has more than doubled in five years and is up around 900% over a decade!

However, it has fallen 20% in a month, leaving it looking cheap(ish) on some metrics. For example, the shares are currently trading for about 12 times next year’s expected operating cash flow, which is significantly cheaper than previous years.

Naturally, a potential US recession might impact the company’s e-commerce division. This is the main risk I see here, along with rising international competition from cheap shopping apps like Temu.

However, I’m increasingly bullish on Amazon’s position in artificial intelligence (AI). It’s aggressively incorporating generative AI into its AWS platform, while seeing a huge opportunity in AI agents. These are advanced AI programmes capable of independently performing tasks and making decisions.

AWS is well-positioned to dominate a significant part of this growing market by supplying both computing power/storage and the specialised tools necessary to build and operate AI agents.

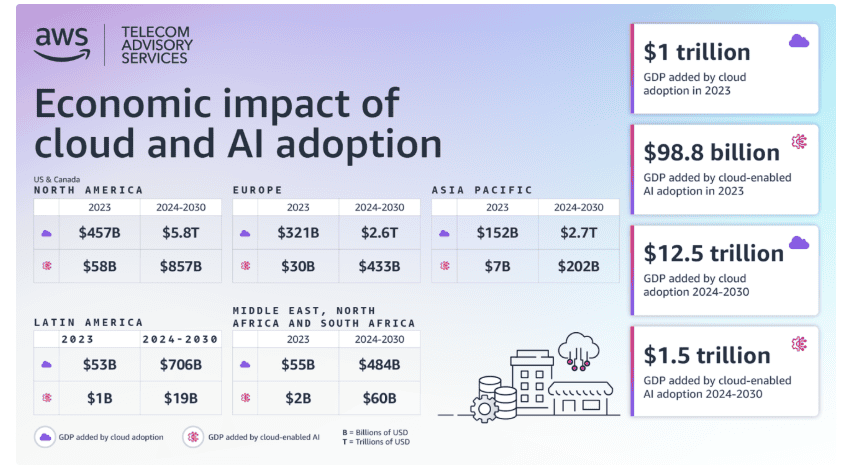

Last year, revenue at AWS jumped 19% to $107.6bn, up from $45bn in 2020. And it looks set to rise even higher as global adoption of cloud services and AI usage motors on.

This story originally appeared on Motley Fool