This website may contain affiliate links and advertising so that we can provide recipes to you. Read my disclosure policy.

My Copycat KFC Coleslaw is so spot-on, you’ll think it’s the real deal! Crunchy, creamy, tangy, and perfect for any BBQ, everyone will want the recipe!

A Reader’s Review

“Loved this recipe. Really tasted like KFC’s coleslaw.”

– Debra

Reasons You’ll Love This Recipe

- Cost-effective: Skip the drive-through and enjoy the same crispy goodness for a fraction of the price, made right at home!

- Perfect Side Dish: This coleslaw is the perfect side to take to any barbecue, picnic, potluck, or family gathering this summer!

- Quality Control: When you make copycat KFC coleslaw, you can use fresher ingredients and adjust the recipe to fit dietary needs.

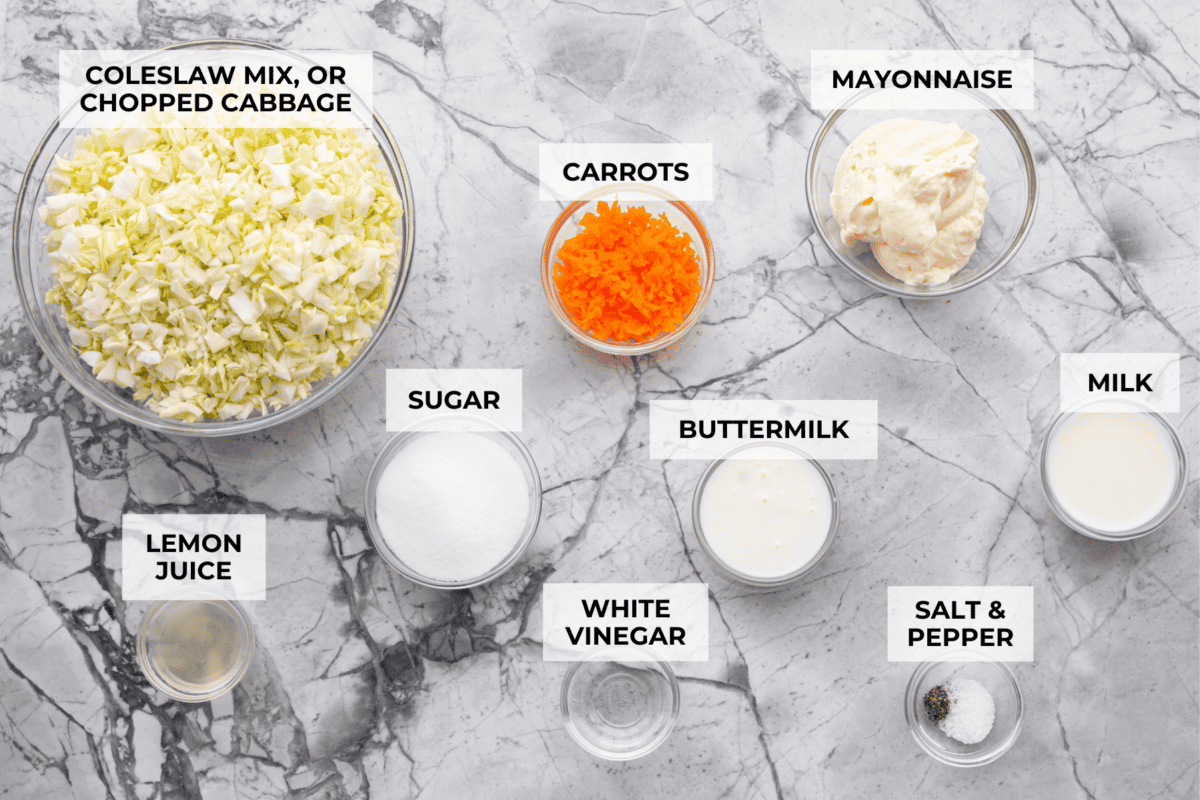

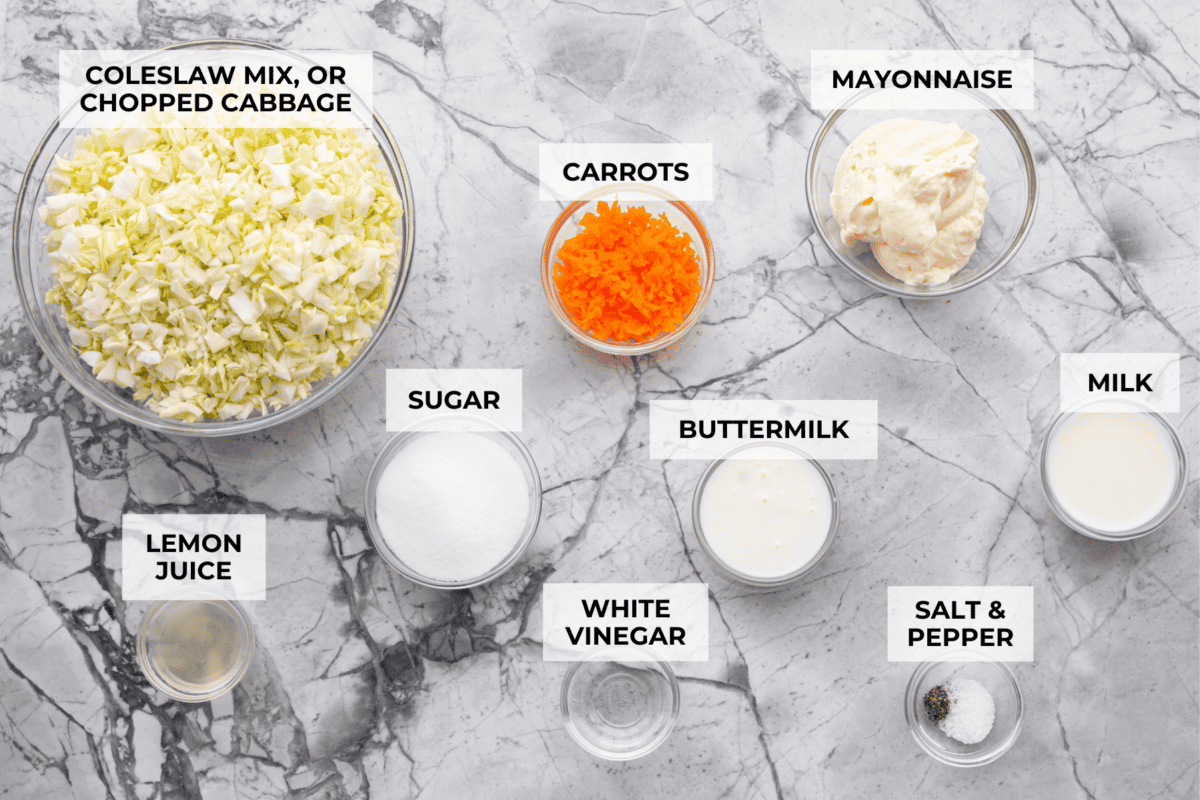

Ingredients for Copycat KFC Coleslaw

***No buttermilk on hand? No problem! You can easily make your own. Check out my How to Make Buttermilk post for a quick and easy guide!

How Do You Make Copycat KFC Coleslaw?

Why does KFC coleslaw taste so good? You guys, I think I’ve cracked the code! with this slaw recipe, you’ll get that Kentucky Fried Chicken finger-lickin’ good flavor!

- Creamy Coleslaw Dressing: Add the mayonnaise, buttermilk, milk, distilled white vinegar, lemon juice, granulated sugar, salt, and ground black pepper. Whisk until combined.

- Combine: Add chopped green cabbage or coleslaw mix and shredded carrots to a large bowl and toss until combined. Then, pour the dressing over the cabbage mixture.

- Toss and Chill: Toss and stir until the cabbage is evenly coated. Cover the bowl and chill the copycat KFC coleslaw in the refrigerator for at least 30 minutes before serving.

How Do I Prevent Soggy Coleslaw?

To prevent soggy coleslaw, toss cabbage with salt (about 1 teaspoon per pound), let it sit for 30 minutes, then rinse and pat it dry. The salt draws out moisture, keeping your cabbage firm and crunchy!

Leftover Copycat KFC Coleslaw

Coleslaw is always best served fresh! The longer it sits, the more water the cabbage will release, which can affect the texture.

- In the Fridge: Store in an airtight container in the refrigerator for up to 5 days. If it becomes watery, drain off the excess liquid before serving.

- DO NOT FREEZE: I don’t recommend freezing this KFC coleslaw copycat recipe—it’s just not the same once thawed!

More Delicious Copycat Recipes

Pin this now to find it later

-

Add 8 cups finely chopped green cabbage or coleslaw mix and ¼ cup finely chopped carrots or shredded to a large bowl and toss until combined.

-

Add the ⅔ cup mayonnaise, 2 tablespoons buttermilk, 2 tablespoons milk, 1 ½ teaspoons distilled white vinegar, 2 ½ teaspoons lemon juice, ⅓ cup granulated sugar, ½ teaspoon salt, and ⅛ teaspoon ground black pepper. Whisk until combined.

-

Pour the dressing over the cabbage mixture and toss until the cabbage is evenly coated.

-

Cover the bowl and chill the coleslaw in the refrigerator for at least 30 minutes before serving.

Updated March 24, 2025

Calories: 183kcalCarbohydrates: 13gProtein: 1gFat: 14gSaturated Fat: 2gPolyunsaturated Fat: 8gMonounsaturated Fat: 3gTrans Fat: 0.04gCholesterol: 9mgSodium: 285mgPotassium: 148mgFiber: 2gSugar: 11gVitamin A: 762IUVitamin C: 26mgCalcium: 40mgIron: 0.4mg

Nutrition information is automatically calculated, so should only be used as an approximation.

This story originally appeared on TheRecipeCritic