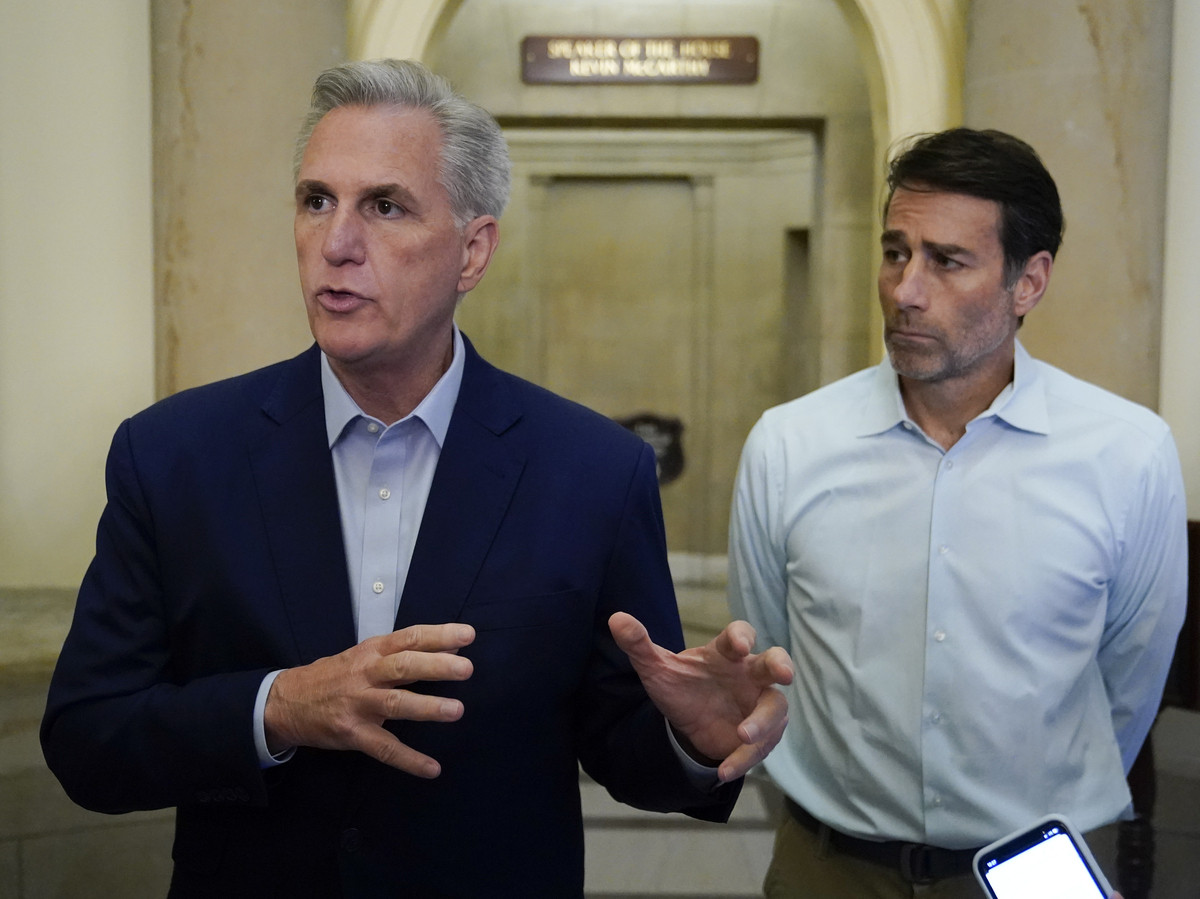

Speaker of the House Kevin McCarthy and Louisiana Rep. Garret Graves speaks with members of the press after participating in a phone call on the debt ceiling with President Biden on Sunday.

Patrick Semansky/AP Photo

hide caption

toggle caption

Patrick Semansky/AP Photo

Speaker of the House Kevin McCarthy and Louisiana Rep. Garret Graves speaks with members of the press after participating in a phone call on the debt ceiling with President Biden on Sunday.

Patrick Semansky/AP Photo

House Speaker Kevin McCarthy and President Biden are expected to meet Monday afternoon for a face to face meeting on addressing the debt limit — with less than two weeks for lawmakers to pass a bill to avoid an unprecedented default.

The designated negotiators for the two leaders had a series of stops and starts to their talks on Friday through the weekend — all while Biden was attending the G-7 summit in Japan. The president cut the second half of the trip short so he could be back in D.C. for continued negotiations with congressional leaders.

McCarthy said he had a “productive” phone call with Biden on Sunday and that the pair agreed to an in-person meeting the day after Biden returns to D.C. The White House has confirmed the plan for Monday’s meeting.

“I think we can solve some of these problems if he understands what we’re looking at, but I’ve been very clear to him from the very beginning — we have to spend less money than we spent last year,” McCarthy told reporters.

The Biden administration and House Republicans have each doubled down on their own red lines while simultaneously blaming the other side for stymied progress and stressing the need to avoid defaulting on the nation’s debt.

McCarthy has repeatedly said that including work requirements for able-bodied adults without dependents enrolled in federal safety net programs like food stamps is a must-have for his conference. That provision is included in a bill House Republicans passed last month that addresses raising the debt limit.

Progressive Democratic lawmakers were concerned when Biden suggested last week there was a possibility he would consider that proposal.

“I’m not going to accept any work requirements that go much beyond what is already — what I — I voted years ago for the work requirements that exist,” he said. “But it’s possible there could be a few others, but not anything of any consequence.”

There have been signals that there are general areas where both parties would compromise on a potential deal — including $60 billion in unspent COVID-19 relief money and permitting reform — which would make both oil and gas projects as well as green energy projects happen more expeditiously.

Treasury Secretary Janet Yellen has repeatedly warned lawmakers that the clock is ticking — the U.S. could run out of money to pay its bills as early as June 1. That puts a major crunch time on both chambers of Congress. McCarthy has said that the House would need 72 hours before it would vote on any bill, before it heads to the Senate.

What a default could means for the U.S. economy

The U.S. has never defaulted on its debt before.

In 2011, during a similar standoff over raising the debt ceiling, the threat of a default alone sent markets into a freefall. Ratings agencies downgraded the U.S. from its top AAA credit rating to AA+ as a result of the debate.

Most economists agree an actual default could result in a recession. A default would severely affect financial markets, increase mortgage rates and interest rates on credit cards, could cause government workers and Social Security recipients to go unpaid, and could make it difficult for businesses and citizens to borrow money.

Treasurys, which are held by countries around the world and used as collateral in financial transactions, are viewed as some of the safest investments worldwide.

Yellen declined on Sunday to specifically state which bills would go unpaid.

“If the debt ceiling isn’t raised, there will be hard choices to make about what bills go unpaid,” she told NBC’s Meet the Press.

This story originally appeared on NPR