Late October marked the start of “one of the most aggressive rallies” in markets over the last few decades, with “massive” returns across assets into year-end turning bond losses into gains, according to Deutsche Bank Research.

“It was a positive year for most financial assets, but in several cases the gains were almost entirely driven by the final two months,” said Deutsche Bank Research’s Jim Reid, in a note Tuesday. “If we’d have stopped in late-October, then bonds would still have been on track for a third consecutive annual loss.”

The rally in the final two months of the year was fueled by favorable “seasonals” as well as investors’ rising hopes for a “soft landing” and interest-rate cuts in 2024, according to the note. Bonds rebounded to finish 2023 in positive territory while the S&P 500 surged 26.3% last year on a total return basis.

DEUTSCHE BANK RESEARCH NOTE EMAILED JAN. 2, 2024

“Bonds finally recovered after two consecutive annual losses, with Bloomberg’s global aggregate up +5.7% in total return terms,” Reid wrote. ”But that was only thanks to the year-end surge, since they were still negative for the year until mid-November.”

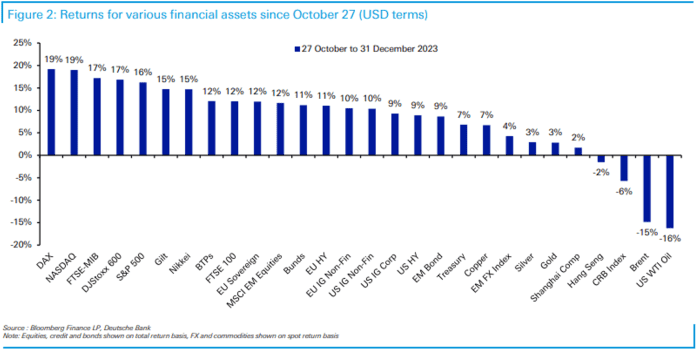

Here’s what happened across assets in the market rally from Oct. 27 to the end of 2023, according to Deutsche Bank.

DEUTSCHE BANK RESEARCH NOTE EMAILED JAN. 2, 2024

“The seasonals worked a charm last year,” said Reid. “When we look back on 2023 we’ll just see the final numbers but those final 9 weeks really drove returns.”

Meanwhile, the U.S. stock market was kicking off 2024 on a mostly downbeat note as Treasury yields rose based on early afternoon trading Tuesday. The Dow Jones Industrial Average

DJIA

was up 0.2%, but the S&P 500

SPX

was trading down 0.4% while the Nasdaq Composite

COMP

dropped 1.3%, according to FactSet data at last check.

In the U.S. bond market, Treasury yields were climbing, with the rate on the 10-year Treasury note

BX:TMUBMUSD10Y

up about six basis points at around 3.94% in early afternoon trading Tuesday. Bond yields and prices move in opposite directions.

This story originally appeared on Marketwatch