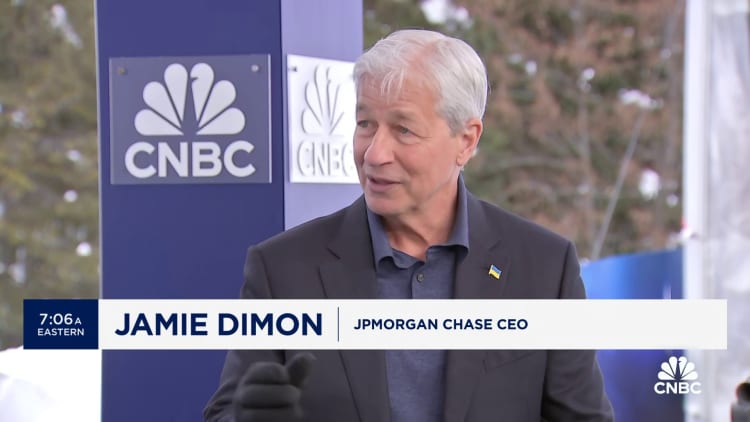

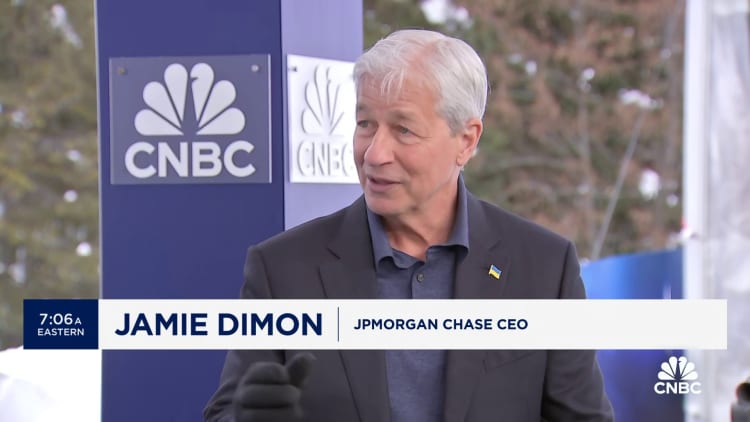

DAVOS, Switzerland — Bitcoin does nothing, JPMorgan Chase CEO Jamie Dimon said Wednesday on the sidelines of the World Economic Forum.

“I call it the pet rock,” he added.

Dimon is a long-time bitcoin critic. The bank chief said in 2021 at peak crypto valuations that bitcoin was “worthless,” and he doubled down on that sentiment last year in Davos, Switzerland, when he told CNBC that the digital currency was a “hyped-up fraud.”

Bitcoin is trading just above $42,700, up more than 100% in the past year.

“This is the last time I’m talking about this with CNBC, so help me God,” Dimon said. “Blockchain is real. It’s a technology. We use it. It’s going to move money, it’s going to move data. It’s efficient. We’ve been talking about that for 12 years, too, and it’s very small.”

“I think we waste too many words on that,” Dimon added.

The bank chief went on to distinguish bitcoin from the other class of cryptocurrencies, the ones by which blockchain has enabled the use of smart contracts. Smart contracts are a programmable piece of code written on a public blockchain, such as ethereum, which executes when certain conditions are met, negating the need for a central intermediary.

“There’s a cryptocurrency which might actually do something,” Dimon said of smart chain-enriched blockchains. “You can use it to buy and sell real estate and move data — tokenizing things that you do something with.”

“And then there’s one which does nothing,” Dimon said of bitcoin, though he added that there were real use cases for the virtual coin, which included upward of $100 billion a year caught up in fraud, tax avoidance and sex trafficking. “I defend your right to do bitcoin,” Dimon added, saying, “I don’t want to tell you what to do. So my personal advice would be don’t get involved. … But it’s a free country.”

The world’s largest cryptocurrency, with a market cap of more than $830 billion, was cemented as an asset class last week when the U.S. Securities and Exchange Commission approved the creation of bitcoin exchange-traded funds.

Some of the biggest names in asset management, including BlackRock, Franklin Templeton and WisdomTree, have launched their own spot bitcoin ETFs last week. For the $30 trillion advised wealth management industry, the floodgates could be about to open. Analysts at Standard Chartered anticipate fund inflows in the range of $50 billion to $100 billion in 2024.

When asked what he made of Larry Fink changing his view on bitcoin as BlackRock jumped into the spot ETF business, Dimon said, “I don’t care. So just please stop talking about this s***.”

“I don’t know what he would say about blockchain versus currencies that do something versus bitcoin that does nothing,” Dimon added. “But you know this is what makes a market. People have opinions, and this is the last time I’m ever going to state my opinion.”

This story originally appeared on CNBC