It’s looking like an upbeat start to fearful February as investors look past a hawkish Fed and put their faith in the last of Big Tech results coming after the close.

“An immaculate landing is fully priced in, and only downside risks remain,” warns our call of the day from wealth managers Bireme Capital, who discuss sticky inflation and “unsustainable” fiscal policy, in a just-published December investor letter.

But Bireme, founded in 2016 by two MIT classmates Ryan Ballentine and Evan Tindell, stands out even more for the axe it has taken to its Big Tech holdings.

In late 2020, the managers recall how they hailed Apple, Amazon, Microsoft, Facebook and Alphabet as “transcenders,” gobsmacked by lower earnings multiples for many of those versus the Nasdaq-100 and often lower valuations. In 2023, they jumped at the chance to buy Meta

META

at $110/share as well as Netflix

NFLX,

as many transcenders got shredded, alongside more speculative businesses.

But the “massive gap between intrinsic value and market price has been mostly realized,” they say, rattling off their fresh changes.

“We have sold our Netflix

NFLX

position, and significantly pared our Meta position. We remain short Tesla

TSLA

– a car company with car company margins, having an increasingly difficult time masquerading as a tech company with tech company margins – and have added a short position in Apple

AAPL

– a low-growth company trading at a high-growth valuation,” says Bireme.

They explain that the “Magnificent 7 and their ilk still have transcendent businesses,” but valuations are no longer that reasonable.

“Given today’s unprecedented concentration, the fortunes of the major equity indexes – and the fortunes of hundreds millions of Americans via their retirement savings and pensions – are increasingly tied to the performance of a few increasingly overextended stocks.”

The Apple short came about in the third quarter of last year, meaning Bireme missed a year-end bounce for many tech stocks. Apple rose 48% in 2023 and is down 4% so far this year. They also bet against Arm Holdings

ARM

in the second half of last year, saying valuations were too rich and its aims to raise chip prices could backfire.

The team also took a short position on C3 ai

AI,

slamming the provider of AI enterprise software for cash burning and changing its names to suit “whatever hot new trend they were supposedly capitalizing on.” Better bets are Snowflake

SNOW,

GitLab

GTLB

or Datadog

DDOG,

they say. C3.ai soared 156% in 2023, but has lost 13% so far this year.

Apart from tech, Bireme weighed in on consumer staples, noting a new position in British American Tobacco

BTI

UK:BATS,

which they say is cheap, with much to offer when it comes to next-generation products. They shorted Clorox

CLX,

citing long-term headwinds and price rises that came as fewer products were sold, alongside “overpriced” Tootsie Roll Industries

TR.

“Consumer trends do not bode well for sugary treats that are terrible for your teeth,” they say. “With staples stocks still less than 10% from all-time highs, we expect the sector to continue to underperform.”

The markets

Stock futures

ES00

YM00

are up, led by tech

NQ00,

with Treasury yields

steady. Gold

GC00

is falling, and the pound

GBPUSD

is falling ahead of a Bank of England policy meeting where no change is expected.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,845.65 | -0.99% | 3.35% | 1.59% | 15.93% |

| Nasdaq Composite | 15,164.01 | -2.23% | 4.51% | 1.02% | 24.29% |

| 10 year Treasury | 3.946 | -17.51 | -5.26 | 6.53 | 54.80 |

| Gold | 2,060.10 | 1.93% | 0.44% | -0.56% | 6.90% |

| Oil | 75.96 | -1.48% | 4.92% | 6.49% | -0.05% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

After the close, Amazon

AMZN

may deliver eye-popping growth, while hopes are high for Meta

META

and Apple

AAPL.

Merck & Co.

MRK

beat earnings estimates, as Shell

SHEL

set the table for Exxon earnings on Friday with a fresh buyback and beat.

Plus: Big Tech got a grilling on Capitol Hill over kids’ online safety

Following New York Community Bancorp’s

NYCB

profit warning, tied in part to U.S. office-loan woes, Japan’s Aozora Bank

JP:8304

sunk as it cut the value of some of its loans in that sector.

Weekly jobless claims and fourth-quarter productivity are due at 8:30 a.m., followed by the Institute of Supply Management’s manufacturing survey and construction spending at 10 a.m., plus auto sales

Tesla

TSLA

is cutting prices on several Model Y EVs in China, following up recent price cuts there.

Best of the web

Flextirement could be the answer to a looming boomer/Gen X brain drain

Spain’s Catalonia spending $2.6 billion to survive without rain.

Steakhouses are being asked to serve less meat.

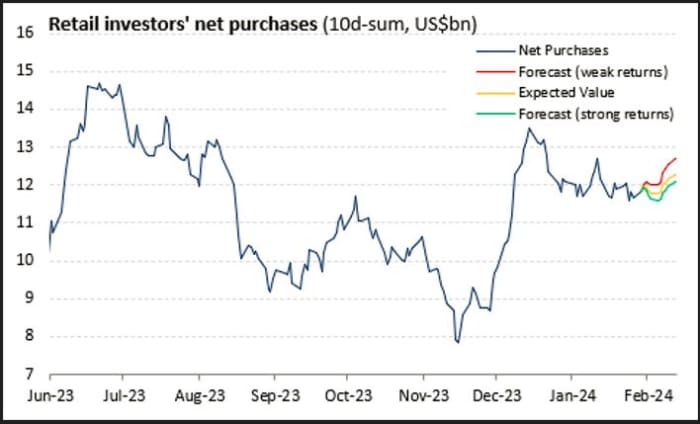

The chart

Retail investors to the rescue?

As of 30 Jan. ’24; Source VandaTrack, Vanda Research

Vanda Research analysts used machine learning algorithms and several years of data to forecast future retail flows. They say their above chart that indicates retail flows in coming weeks will likely stay robust. “Thus, while downside flow risks from systematic institutional investors are currently a concern given the elevated starting point, equities should be able to rely on retail demand in the near term if trading gets choppy.”

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

Random reads

Cut-price airline offers “grans go free” to Europe deal.

The claw chooses. Queensland toddler rescued from Hello Kitty prize machine.

X confessions. “Elmo opened a tap and the darkness poured out.”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

This story originally appeared on Marketwatch