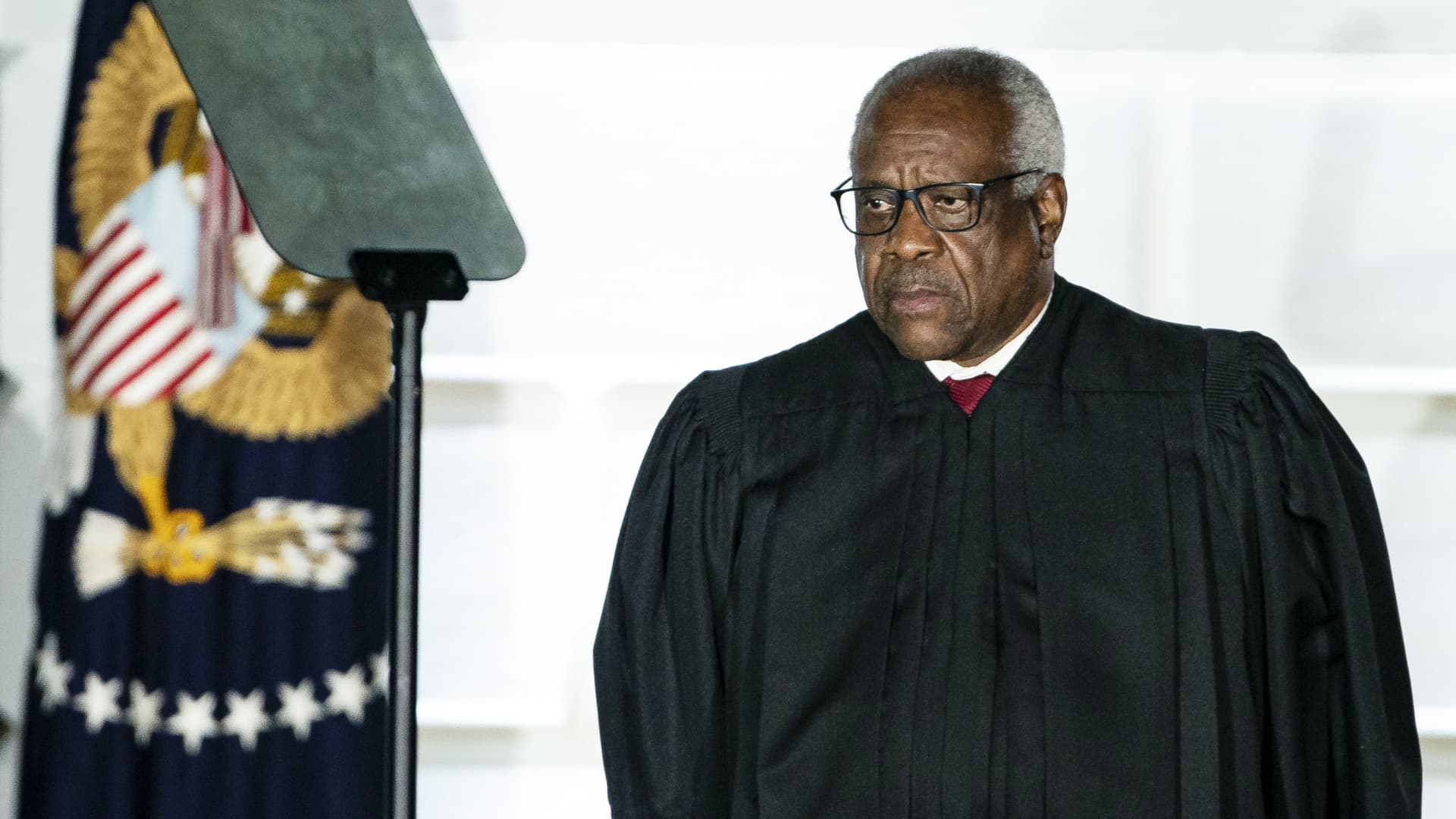

Clarence Thomas, associate justice of the U.S. Supreme Court, listens during a ceremony on the South Lawn of the White House in Washington, D.C., U.S., on Monday, Oct. 26, 2020.

Al Drago | Bloomberg | Getty Images

WASHINGTON — Billionaire real estate executive Harlan Crow’s super yacht was registered with U.S. and British maritime authorities as a pleasure vessel — and not commercial — during years when Crow also reported to the IRS that the mega yacht was a money-losing business venture, documents obtained by CNBC reveal.

How Crow uses his 160 foot yacht has drawn the attention of Senate Finance Committee investigators, who are probing Crow’s financial and personal ties to Supreme Court Justice Clarence Thomas.

Thomas and his wife Ginni Thomas have taken several cruises aboard the ship, the Michaela Rose, including trips around Indonesia and New Zealand. Thomas did not report the lavish trips as gifts on his government disclosure forms, saying he considered them to be personal travel with friends.

On Tuesday, Senate Finance Committee chairman Ron Wyden (D-Ore.) sent a 12-page letter to Crow’s attorney, detailing new evidence that he said, “raises serious concerns regarding the tax treatment of Mr. Crow’s luxury assets, including tax deductions related to the personal recreational use of his superyacht for his benefit and that of his wealthy and powerful friends.”

Sen. Ron Wyden (D-OR) speaks during a news conference after the first Democratic luncheon meeting since COVID-19 restrictions went into effect on Capitol Hill in Washington, April 13, 2021.

Erin Scott | Reuters

Tax records obtained by ProPublica show that the Crow family took millions of dollars worth of business tax deductions on the yacht between 2003 and 2015, through a company they reported to the IRS as an active yacht chartering business.

Rochelle Charter, Inc., which was formed by the Crow family to lease out the yacht, reported tax-deductible business losses in 10 of the 13 years for which ProPublic has records.

In order for business losses to be deducted from federal income taxes, a company must be engaged in an actual business with paying customers.

In his letter to Crow, Wyden wrote, “I fail to see how it is appropriate for a taxpayer to assert to the Internal Revenue Service that a superyacht with registrations indicating it is not engaged in trade can generate losses from purported for-profit yacht charter services.”

Asked by CNBC Monday to comment on the deductions, including whether there is evidence that the Michaela Rose has ever chartered the yacht or registered it as a commercial vessel, a spokesman for the office of Harlan Crow responded with a statement.

“Mr. Crow engages professional accounting firms to prepare his tax returns and complies with tax law in good faith. Any suggestion to the contrary is baseless and defamatory,” said the spokesman.

“This politically motivated fishing expedition is not based on any legitimate legislative effort. Congressional Committees are neither tax auditors nor law enforcement officers,” the spokesman said. “The targeting of a private citizen for political purposes is highly inappropriate and unconstitutional and sets a dangerous precedent.”

The Michaela Rose sails under a British flag. But it is not registered as a commercial charter vessel in the U.K.

“The Michaela Rose is registered solely as a Pleasure vessel under Part 1 of the UK Ship Register,” a spokesman for the UK’s Maritime and Coastguard Agency told CNBC.

British merchant shipping regulations state, “Pleasure vessels are vessels used for sport or recreational purposes and do not operate for financial gain.”

It’s a similar picture in the United States. Here, the Michaela Rose is registered as a “pleasure boat” and not as a commercial vessel, according to US government documents reviewed by CNBC.

Moreover, the Michaela Rose has not received a certificate of documentation that would permit her to engage in coastal trade in the United States, such as offering commercial charter boat trips, a US Coast Guard official told the Senate Finance Committee.

Without registering as a commercial vessel or obtaining certificates and waivers to allow the ship to engage in trade, it is unclear how the Michaela Rose carried out the commercial chartering business that would be necessary if the vessel were going to qualify for the tax deductions taken by Crow’s company.

“Any effort to mischaracterize a yacht used as a pleasure craft as a business is a run of the mill tax scam, plain and simple,” wrote Wyden.

An attorney for Crow did not respond to a request by CNBC to provide evidence that Crow has ever rented out the yacht, or that he registered it as a commercial vessel in any jurisdiction.

Crow renovated the yacht after the death of his mother in 2014, updating the interior to a more contemporary style. According to ProPublica, Crow’s tax information for that year showed a $1.8 million loss from the company that operates the yacht, Rochelle Charter.

This story originally appeared on CNBC