Shares of regional banks were hit especially hard on Tuesday after an inflation reading came in surprisingly strong, raising more concerns about potential fallout to commercial real estate from higher interest rates.

The SPDR S&P Regional Banking ETF

KBE

tumbled 4.2% on Tuesday, cementing its lowest close since Nov. 30, 2023, according to Dow Jones Market Data.

“The market got ahead of itself on the soft-landing scenario,” said Rich Hill, head of real-estate strategy and research at Cohen & Steers, a real-estate-focused investment firm with about $83 billion in assets under management. “I think we are getting a dose of reality.”

Hill expects inflation to head lower in 2024, but isn’t counting on a smooth path to the Fed’s 2% annual target. He also foresees potential for more pain at regional and small banks, particularly for lenders without adequate loan-loss reserves that will face a wall of maturing loans and falling commercial real-estate market values.

“I would be surprised if there wasn’t more failures,” Hill said, adding that as borrower delinquencies rise, lenders need new appraisals that reflect today’s lower property values, which suggests more write-downs on soured property debt at banks.

From October: ‘Banks fail. It’s OK,’ says former FDIC chair Sheila Bair

Weak links

Investors’ focus has returned to regional banks since New York Community Bancorp Inc.

NYCB,

reported a surprise loss on two property loans in the fourth quarter, boosted its lost-loss reserves and opened the door to potential loan sales.

Community banks have an estimated 25.7% direct exposure to commercial real estate as a share of assets, versus 4.4% for large banks and roughly 18% for regional and small banks, according to Moody’s Analytics. New York Community Bancorp, by contrast, has about a 43% exposure, albeit mostly in multifamily loans.

New York Community Bancorp had more than 43% of its assets tied up in commercial real estate, while community banks have about 26% exposure to the sector, according to the FDIC.

Moody’s Analytics

Banks should be “pretty well” able to weather the storm if problems remain primarily in the office sector, said Matt Reidy, director of commercial real-estate economics at Moody’s Analytics, in a phone interview.

“Do we think all the pain is over for banks? No.” Reidy said. But Reidy also thinks the bulk of the problems in commercial real estate look limited to office space, as far as potential losses lenders will likely face.

Office exposure isn’t reported as it own category, unlike multifamily or construction loans, but is instead lumped up with other property loans such as hotels and retail.

Debt wall builds

Costlier debt since 2022 has weighed on commercial property values, even in the apartment sector, where occupancy rates have remained robust.

Many lenders have responded by extending or modifying maturing loans on their books in the past year. But that also has an estimated 20% of the outstanding $4.7 trillion of commercial real-estate loans now set to come due this year, a 28% increase from last year, according to the a survey from Mortgage Bankers Association released on Monday.

“These extensions and modifications have pushed the amount of CRE mortgages maturing this year from $659 billion to $929 billion,” said Jamie Woodwell, head of commercial real-estate research at MBA.

Giving borrowers more time to refinance, however, doesn’t remove major obstacles for many borrowers, namely that interest rates remain elevated and property values already have fallen an estimated 21% in January from peak levels, according to Green Street’s Commercial Property Price Index.

Office prices were pegged as 35% below peak levels and apartment values off by 28%.

‘Guilt by association’

“It’s like trying to contain a forest fire,” said Bryce Doty, senior portfolio manager at Sit Investment Associates, about the impact of higher interest rates on banks with maturing commercial real-estate loans. “If rates were lower, it would be like a rainstorm to come and put the fire out.”

Doty expects the Fed to meaningfully lower rates only in the fourth quarter of 2024, a backdrop in which he thinks avoiding exposure to a broad basket of regional banks in an exchange-traded fund format makes sense.

“You really need to go bank by bank,” Doty told MarketWatch. But he also sees opportunity in discounted senior bonds of regional banks that don’t have a lot of office exposure. “You can see their stock or bonds have been hurt from guilt by association.”

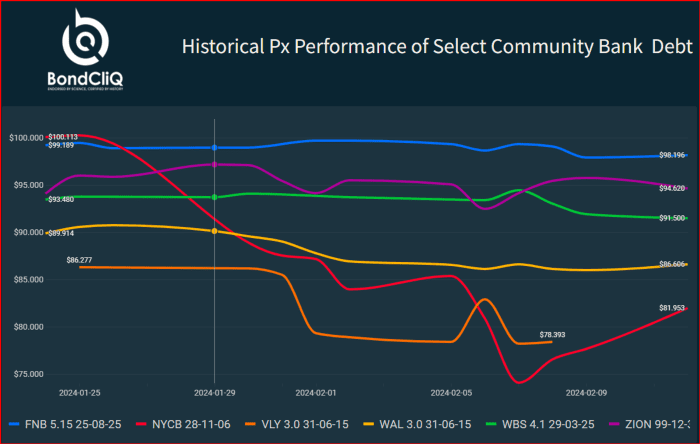

While trading volumes were muted Tuesday in the wake of inflation data and a Northeast snowstorm, bonds issued by a several regional banks have been relatively stable since New York Community Bancorp reported its loan losses, according to BondCliQ data.

Investors in bonds issued by several regional bank have been steady in the wake of New York Community Bancorp’s fourth-quarter earnings jolt.

BondCliQ

Cohen & Steers thinks the worst is likely behind public real-estate investment trusts, especially in the months since the benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

touched a 16-year high of nearly 5% in October. The benchmark rate was at 4.32% on Tuesday.

Private markets for commercial real estate typically lag public markets, which is a reason why Hill sees good opportunities ahead for Cohen & Steers to buy assets at attractive valuations, especially in open-air retail centers.

But Hill isn’t convinced that multifamily properties will escape even further valuation declines. “It could be a good opportunity to buy assets in the future, but the market might be a little bit surprised where valuations go over the next 12 months.”

The S&P 500 index

SPX

and Dow Jones Industrial Average

DJIA

fell 1.4% on Tuesday, while the Nasdaq Composite Index

COMP

shed 1.8%, according to FactSet.

Read next: Here’s the investor playbook for making money in commercial real estate as Fed delays rate cuts

This story originally appeared on Marketwatch