China’s smartphone market has continued to decline so far in 2024, and local resellers such as Huawei have overtaken Apple’s iPhone.

After coming top in China overall in 2023, Apple has dropped to fourth place in the first six weeks of 2024, according to Counterpoint Research. The post-holiday period always sees a significant drop in sales for all resellers, though, and what may be more significant is the decline in China’s smartphone market.

Apple’s success in the last quarter of 2023 had led to what seemed to be a stemming of the years of decline in China’s overall sales. Counterpoint’s latest figures say that China’s market declined 7% year over year in these first six weeks of 2024.

However, Counterpoint notes that the same period in 2023 “saw abnormally high numbers with significant unit sales being deferred from December 2022 due to production issues, magnifying the negative YoY comparison.”

Counterpoint publishes comparative figures of the growth or decline of individual brands within China, but that’s a nonsense. It shows Huawei growing by 64%, while Apple dropped a huge 24%, but the figures are not remotely comparable.

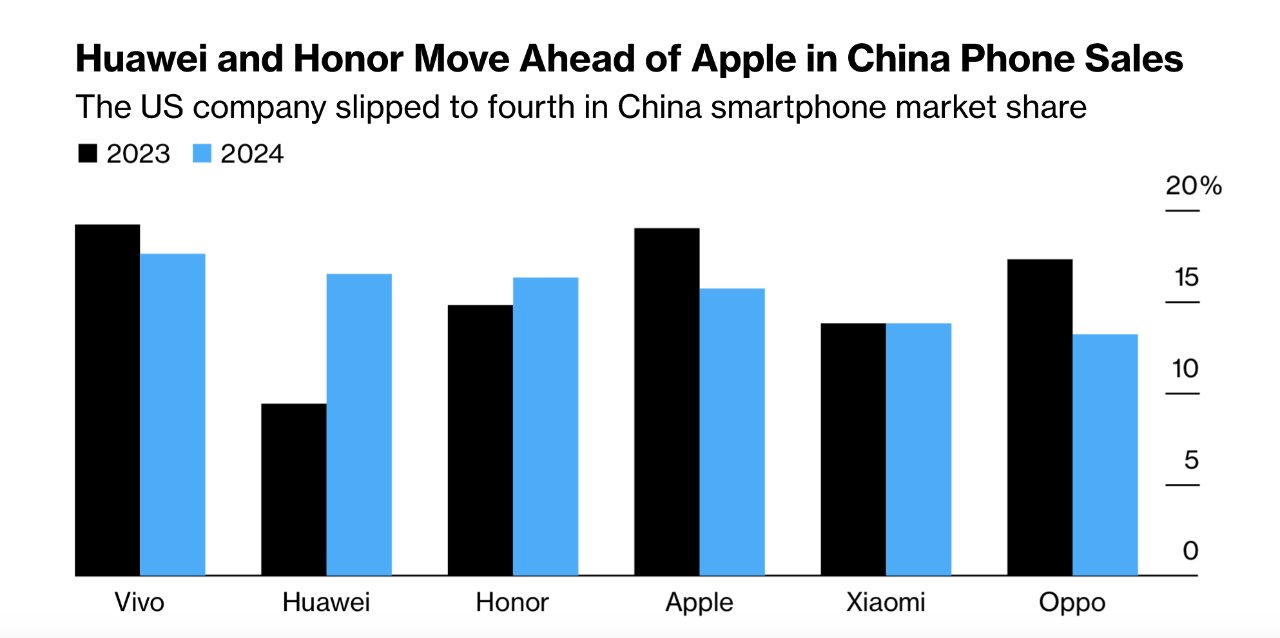

More revealing and useful is that Apple’s 24% drop is from a 19% market share at the same point in 2023, and is now on 15.7%. Huawei was on 9.4% at this point in 2023, and is now on 16.5%.

“Primarily, [Apple] faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of OPPO, vivo and Xiaomi,” said Mengmeng Zhang, senior analyst. “Although the iPhone 15 is a great device, it has no significant upgrades from the previous version, so consumers feel fine holding on to the older-generation iPhones for now.”

The figures put Huawei ahead of Apple, but only fractionally, and not as markedly as the 64% growth versus 24% decline suggests.

China’s top-selling smartphone manufacturer for the first six weeks of 2024 was Vivo on 18% market share. Second place was Huawei, then came Honor on 16%.

Counterpoint analysts ascribe Vivo’s success to how it has targeted the more budget-conscious end of the smartphone market. It also says that overall, sales are down because of a lack of consumer confidence.

While this is not the end of the decline that was hoped for Counterpoint still sees some better news coming.

“The previous year period was already quite depressed, but as far as Apple is concerned, there is more wriggle room in the short term,” said analyst Ivan Lam. “The aggressive promotions before Women’s Day are just one example.”

China’s Women’s Day holiday is on Friday, March 8. Ahead of it, major resellers in the country have been lowering prices on the iPhone 15 range.

This story originally appeared on Appleinsider