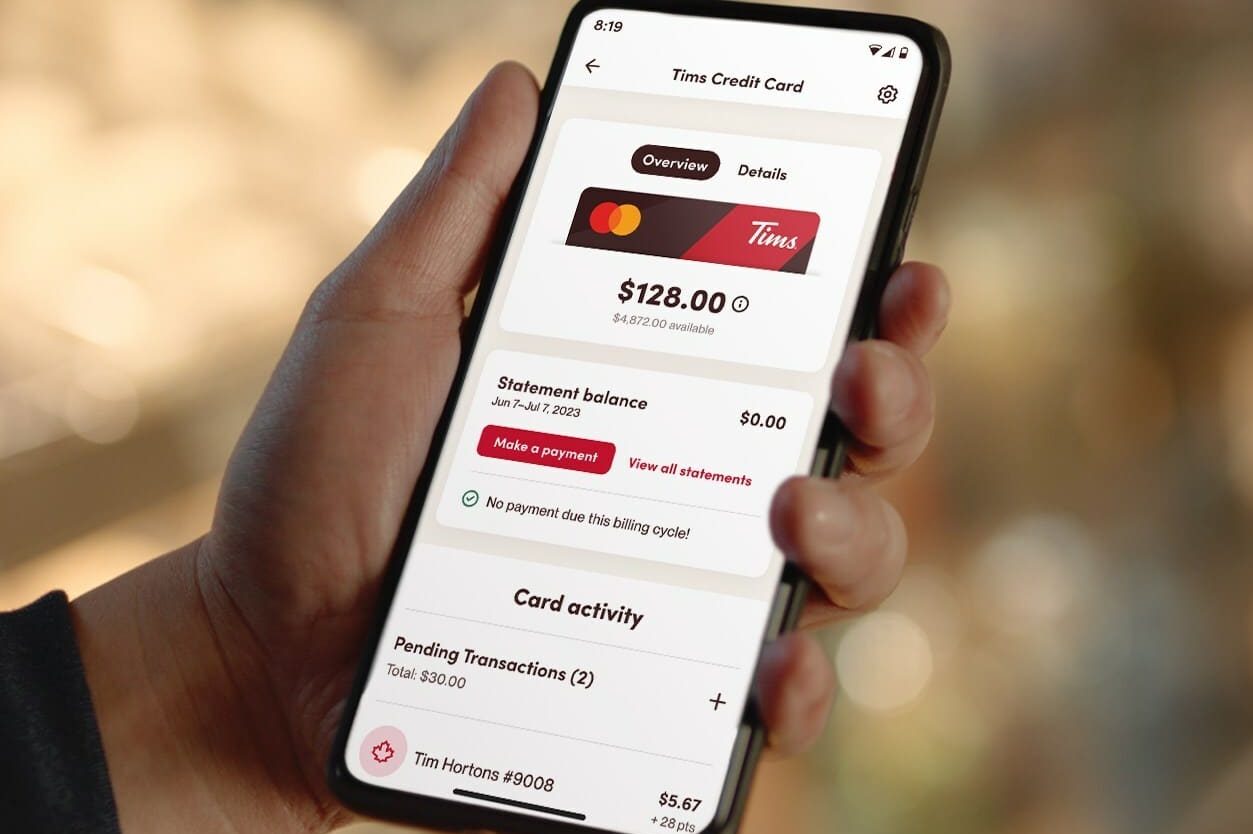

Today, Tim Hortons announced the upcoming launch of the Tims Credit Card, a new Mastercard product powered by Neo Financial. The card isn’t available for consumers yet, but there is currently an option to put your name on a waitlist for when it officially launches.

The new credit card exclusively earns Tims Rewards points, which can be redeemed for items at Tim Hortons restaurants.

The New Tims Credit Card

Today, Tim Hortons announced details of the upcoming debut of the Tims Credit Card, a product from Tims Financial which is powered by Neo Financial. There is currently a waitlist available for the card, which will become available to consumers in the coming months.

The Tims Credit Card, which is a Mastercard product, comes with no annual fee, and exclusively earns Tims Rewards points which can be redeemed for donuts, coffee, and other items at Tim Hortons restaurants.

The earning rates for the Tim Hortons Card are as follows:

- Earn up to 15 Tims Rewards points per dollar spent at Tim Hortons restaurants

- Earn up to 5 Tim Rewards points per dollar spent on groceries, gas, and public transit

- Earn 1 Tims Rewards point per $2 spent elsewhere

It’s worth noting that Costco and Walmart are excluded from the 5x category earning bonus, and purchases made at either location will earn the base rate of 1 point per $2 spent.

The card can be applied for, approved, and managed entirely through the Tim Hortons app on your smartphone.

For Canadians with limited to no credit history, including students and newcomers, there will be a separate, secured version of the Tims Credit Card to help with building credit. The card comes with different earning rates, which are as follows:

- Earn up to 14 Tims Rewards points per dollar spent at Tim Hortons restaurants

- Earn up to 2 Tims Rewards points per dollar spent on gas, groceries, and transit

- Earn 1 Tims Rewards point per $4 spent elsewhere

Both the secured and unsecured versions of the Tims Credit Card come with the following insurance coverage:

- Extended warranty of up to one extra year

- Purchase protection

- Mastercard Zero Liability, which offers protection against unauthorized transactions on your card

Anyone interested in applying for the card can add their name to a waitlist on the Tims Financial website. Once the product becomes available, they will be notified.

Is the Tims Credit Card a Good Deal?

The Tims Credit Card offers category spending bonuses at Tim Hortons restaurants, as well as for groceries, gas, and transit. Otherwise, the base earning rate on the card is 1 Tims Rewards point per $2 spent, or 0.5 Tims Rewards Points per dollar spent.

As the name might suggest, Tims Rewards points may only be redeemed for products at Tim Hortons restaurants, such as bagels, donuts, coffee, and sandwiches, amongst others.

If you have very strong brand loyalty for Tim Hortons, then the elevated earning rate of 15 Tims Rewards points per dollar spent at Tim Hortons restaurants may be attractive. You’ll need to scan your Tims Rewards loyalty card at the time of transaction to qualify for this earning rate.

However, on the unsecured version of the Tims Credit Card, the earning rate of 5 points per dollar spent on gas, groceries, and public transit isn’t necessarily a true 5x earning rate.

For example, 340 Tims Rewards points are required to redeem for a classic donut, which retails for around $1.49. In this example, 1 Tims Rewards point is equivalent to about 0.44 cents.

Furthermore, to earn the 340 points required for a donut, you’d have to spend $68 (CAD) at a qualifying grocery station, gas station, or other eligible merchant. The amount needed to earn enough points for a donut would decrease at Tim Hortons restaurants, but if you were earning the base rate, you’d need to spend $680 (CAD) to earn enough points for a donut.

In other words, you’d have to spend a fair bit of money just to earn $1.49 (CAD) in value from your card, which isn’t ideal.

Unless you have a significant amount of spending to do at Tim Hortons restaurants, the earning rates offered on the Tims Credit Card aren’t very competitive.

In the vast the majority of cases, you’d be better off making purchases with another no-fee cash back credit card, and then using the cash back earned to offset purchases as you wish. This way, you aren’t shoehorned into having points that you can only redeem at Tim Hortons, but you could also choose to do so if you are so inclined.

For example, if you were to instead use a BMO CashBack Mastercard for purchases at grocery stores, you’d earn 3% cash back. You’d need to spend just $50 (CAD) at a grocery store to earn enough points to pay for a donut, which is already superior to the Tims Credit Card.

In fact, even using a basic card with an earning rate of 1% cash back, you’d earn enough cash back for over four times as many donuts as you would for the equivalent spending on the Tims Credit Card.

There are a number of other true 5x-earning credit cards out there that come with annual fees. However, many of these cards come with transferable points that could be used for statement credits or for travel, and again you wouldn’t be limited to redeeming exclusively at Tim Hortons.

Conclusion

Tim Hortons has released details of the Tims Credit Card, a Mastercard product powered by Neo Financial. The card is currently taking names for a waitlist, and will make its debut in the future.

There are category earning multipliers for purchases made at Tim Hortons restaurants, gas stations, grocery stores, and public transportation. The points can exclusively be redeemed for products at Tim Hortons restaurants.

In sum, this isn’t necessarily the most exciting credit card product to debut in the recent past. Even if you tend to spend a lot of money at Tim Hortons, there are other credit card products available that can provide you with an elevated earning rate and points that can be redeemed in multiple ways.

This story originally appeared on princeoftravel