Image source: Getty Images

I’m a big believer in diversifying an ISA portfolio across different types of companies. Here are two stocks — one US tech giant and a medium-sized UK drinks firm — that I think are worth considering right now.

Limitless digital labour

Salesforce (NYSE: CRM) is a global leader in cloud-based customer relationship management (CRM) software. While the firm is already a $262bn giant, it’s the growth opportunity in agentic artificial intelligence (AI) that’s really exciting here.

AI agents are systems that don’t just respond to user commands, but can autonomously plan and complete tasks to achieve specific goals. In other words, a form of digital labour, built to automate tasks like customer support, sales follow-ups, and marketing.

CEO Marc Benioff says AI agents are “very different than anything that’s ever happened.” And the company’s Agentforce platform, launched in 2024, already has more than 4,000 paid customers and $100m in annual recurring revenue.

By the end of 2025, Salesforce aims to deploy 1bn AI agents to its clients. What I like here is that it already has a massive customer base to work with (Salesforce led all CRM vendors with a 20.7% market share in 2024). Agentforce customers include SharkNinja, Indeed, and PepsiCo.

Furthermore, the firm generated free cash flow of $6.3bn from revenue of $9.8bn in its fiscal Q1 2026. Therefore, it’s very profitable and has the wherewithal to really invest in this massive market opportunity.

The share price is down 18% year to date, which might reflect the fact that many businesses have paused investments due to ongoing uncertainty around global trade. So there’s a risk of a sharp economic downturn later this year.

Taking a longer view, however, I’m bullish on the AI market opportunity. The stock has a forward price-to-earnings (P/E) ratio of 24, which isn’t expensive for a world-class software firm.

Large US market opportunity

Turning to premium mixer firm Fevertree Drinks (LSE: FEVR) now, which is much smaller with a £1.1bn market cap. The share price is up 32% in 2025, but still down 53% over five years.

The reason for the decline relates to 2022, when profits and margins started falling dramatically as the firm battled surging glass and transatlantic shipping costs. However, there was a 540 basis point improvement in gross margins last year.

The business is more resilient than ever, with a clear pathway to continued margin improvement in the years ahead.

CEO Tim Warrillow.

Fevertree has signed an important strategic partnership with Molson Coors, the second-largest US brewer. This will allow it to benefit from Molson Coors’ US production expertise and extensive network of distributors and customers across both on and off-trade.

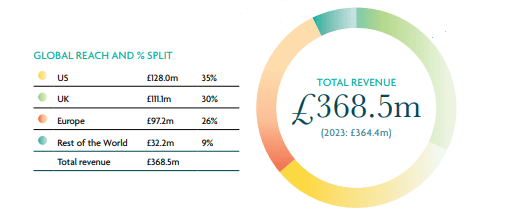

The US is already Fevertree’s largest market, where it leads the premium mixer category in both ginger beer and tonic water.

One near-term risk here though is another spike in inflation and a possible recession, which could further dampen consumer spending.

According to Hargreaves Lansdown, the stock’s forward P/E ratio is 35.8 versus a 10-year average of 44.2. So, while that certainly isn’t cheap, there is at least a discount here.

Through the Molson Coors partnership, Fevertree is set to gain further share in the massive US market over the next few years. I think the stock is worth considering at 888p.

This story originally appeared on Motley Fool