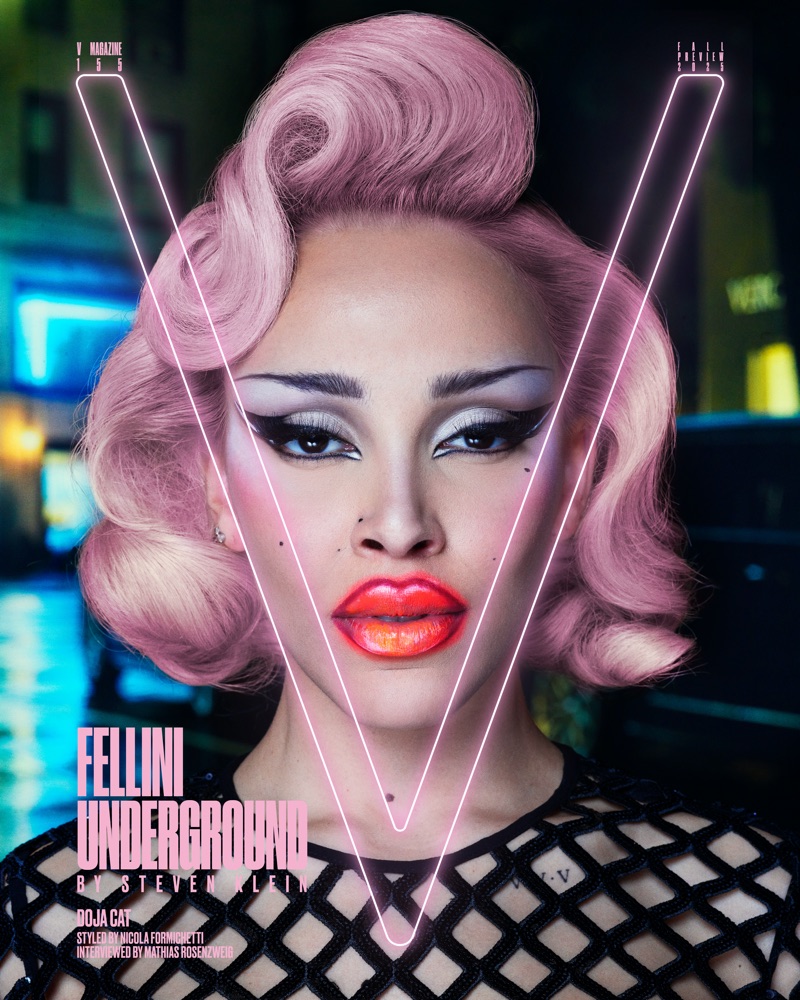

V Magazine’s V155 Fall Preview 2025 cover is a cinematic manifesto of maximalist glamour and post-midnight rebellion featuring Doja Cat. In Fellini Underground, lens master Steven Klein and stylist Nicola Formichetti conjure a neon-drenched ode to New York nightlife, casting Doja Cat as its fearless ringleader.

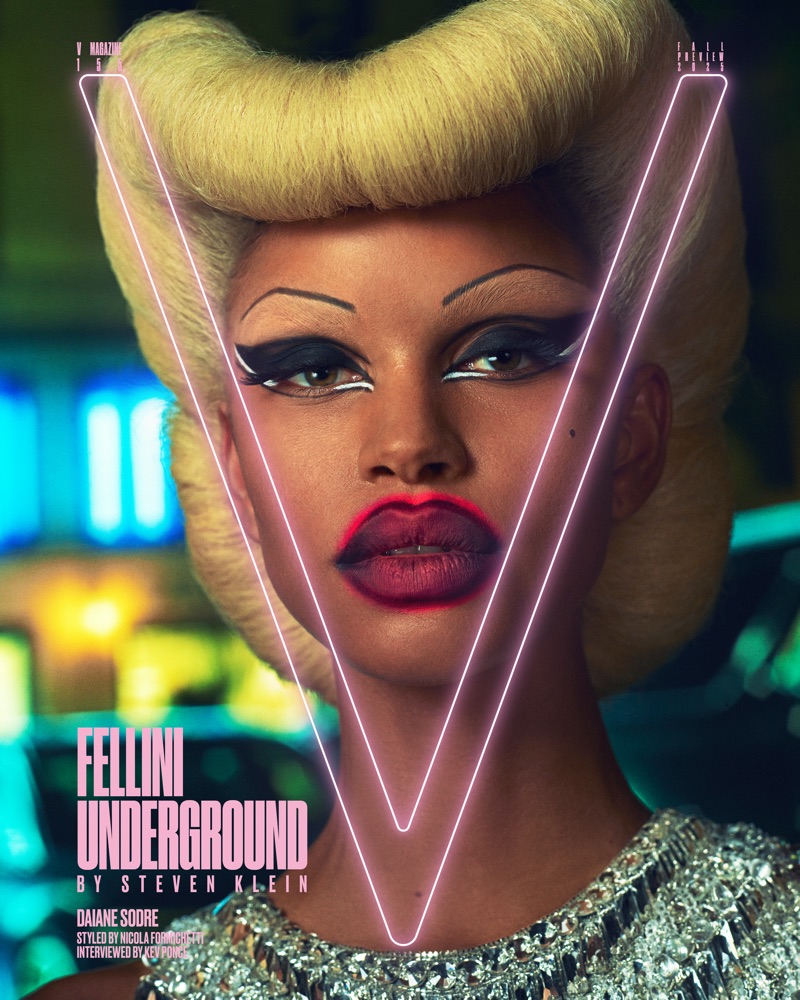

The covers also feature fashion muses Amelia Gray, Delilah Belle Hamlin, and Daiane Sodre. Doja channels old Hollywood vamp with electric-pink bouffants and exaggerated siren eyes, her lips a clash of coral gloss and fierce intent.

Doja Cat on V Magazine V155 Fall 2025

In another look, she’s a sapphire-haired seductress in leather and diamonds, nails sharp enough to slice egos. Amelia and Delilah? A tangle of limbs and latex, with surrealist curls in acid hues. It’s camp meets couture on the curb of downtown cool.

Behind the glam, Doja opens up about her new album Vie, an intimate reinvention laced with ‘80s Lo-Fi textures. “I want to kind of swim back upstream, so to speak, and go back where I was, and just re-trim and evolve everything.”

V155 lands July 11 globally, with a deluxe Doja-starring digital edition on Shopify. One thing’s clear: this fall, fashion howls with attitude.

This story originally appeared on FashionGoneRogue