Image source: Getty Images

Rumours have swirled for months that the Treasury is about to make seismic changes to the Cash ISA. It’s part of a plan to encourage greater participation in equity investing using products like the Stocks and Shares ISA

Changes could be announced as soon as Chancellor of the Exchequer Rachel Reeves’ Mansion House speech on 15 July, according to the Financial Times.

By considering altering the ISA regime, Reeves wants to get the UK investing in riskier assets such as shares. In doing so, she hopes that:

- Britons will achieve better long-term returns than savings accounts typically offer.

- The UK economy will receive a boost from higher investment flows.

- The London Stock Exchange will enjoy a revival in trading volumes and new listings.

Reeves said earlier this year that she wants to foment “a culture in the UK of retail investing like what you have in the US”. In the States, more than 60% of people own shares. That compares with around 20% in Britain.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

What are the options?

Given the superior returns on offer from share investing, I believe Britons should give the stock market greater consideration when planning for retirement. However, that’s not to say I think the government is right to encourage this by cutting Cash ISA allowances!

It’s important to note that even if allowances are changed, Britons will still be able to keep saving cash as usual.

Individuals will still be able to make regular contributions to one of these tax-efficient products, though the annual savings is likely to be lower. People will also still be able to use standard savings accounts to keep cash, but tax will be due on interest that exceeds personal allowances.

However, now could be a good time for Britons to consider the other options available to them. With the Stocks and Shares ISA, individuals can choose from a wide range of shares, trusts and funds that cater to a wide range of risk profiles.

Low-risk investing

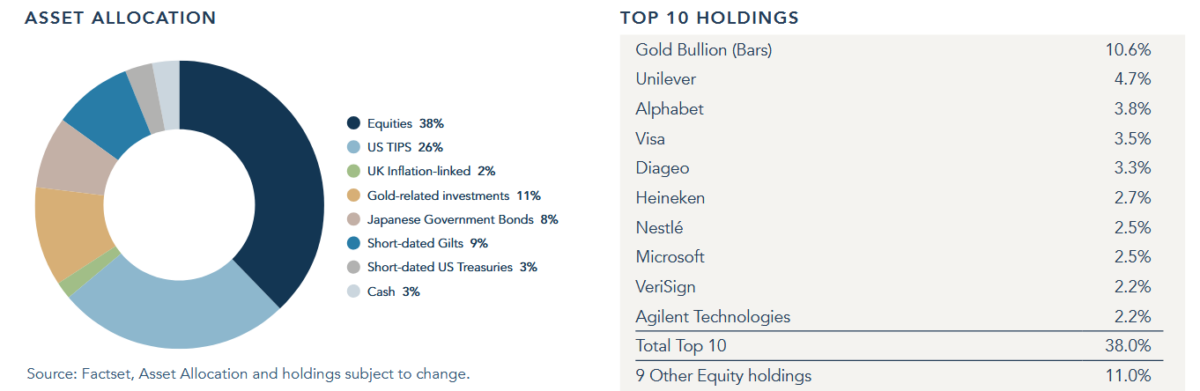

Take the Personal Assets Trust (LSE:PNL), for instance. Like many UK investment trusts it owns a selection of UK and global shares. But its portfolio consists of 18 separate companies spread across different sectors and regions, a strategy that greatly reduces risk.

What’s more, less than 40% of the fund is tied up in the stock market. Instead, the majority of its capital is invested in classic safe-haven assets like government bonds, cash and precious metals — gold bullion is in fact its largest single holding:

Naturally, a trust with stock market exposure carries higher risk than a Cash ISA, and especially during economic downturns. But over the long term, trusts like this can still deliver strong returns.

The average annual return from Personal Assets Trust is 5.4% since 2015, beating the Cash ISA average of around 1.2%. This makes it worth serious consideration, by illustrating how regular savers can put their money to work effectively without having to take on lots of added risk.

This story originally appeared on Motley Fool