Image source: Getty Images

A lump sum of £15,000 might not seem life-changing. But with a smart investing strategy and enough time, it could form the foundation of a sizeable passive income portfolio.

Historically, the stock market has delivered average annual returns of around 8%–10%. At a 10% growth rate, a £15,000 investment left untouched could compound into roughly £300,000 in 32 years. From there, a 5% yield could generate £15,000 in annual passive income — essentially turning savings into a salary.

That’s one way to do it. But there’s a way to get there faster.

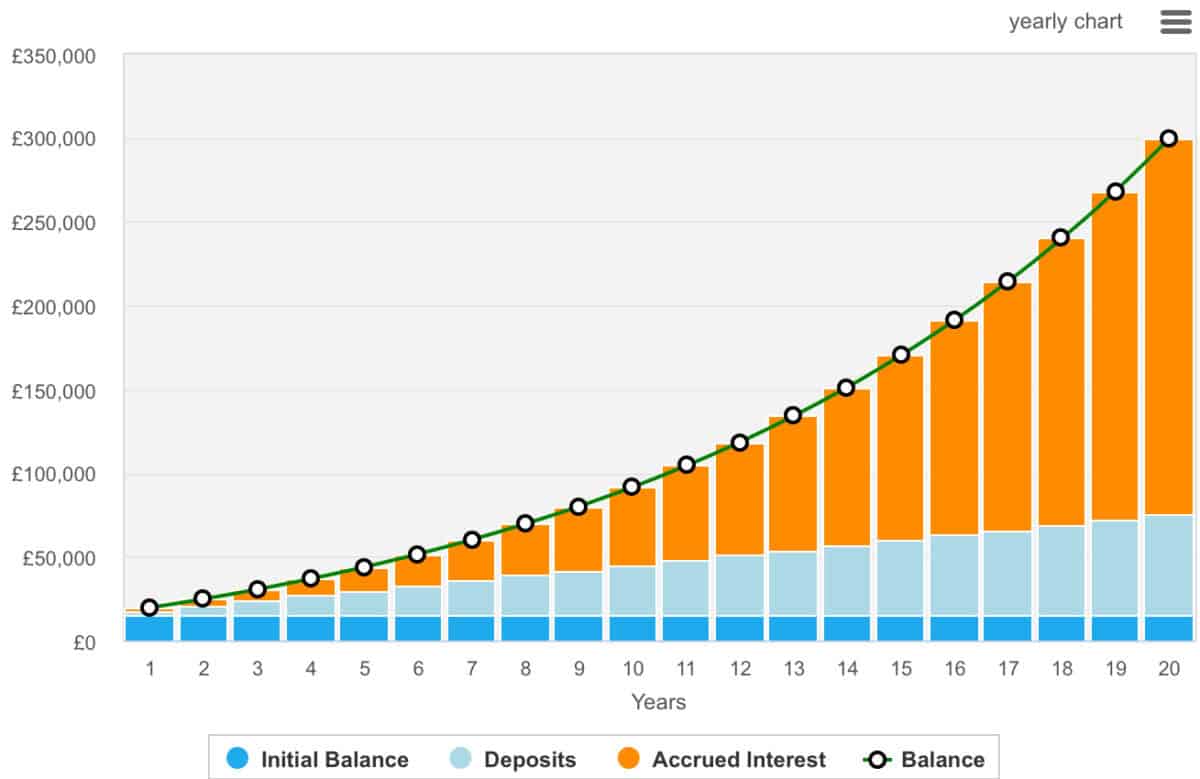

By adding just £250 per month and reinvesting all returns, an investor could reach nearly £300,000 in just 20 years, assuming that same 10% growth. That’s less than half the time compared to a lump sum alone.

Here’s how the numbers stack up:

- After 10 years: approximately £91,800

- After 15 years: approximately £170,400

- After 20 years: approximately £299,800

Compounding is the secret sauce

This impressive end result comes from combining regular contributions with compounding returns. Each monthly deposit has the chance to grow and multiply over time, accelerating wealth creation. Just look at how the accrued interest grows over time.

To protect gains and income from tax, investments can be held within a Stocks and Shares ISA, where both capital growth and dividends are shielded from HMRC.

So, what’s key to success? Patience, consistency, and a long-term mindset. Dividend-paying shares, low-cost index funds, and global equity trusts can all play a role in building a resilient, income-generating portfolio.

It’s a simple idea — but one that could change the trajectory of a financial future. However, investors should be wary that they can lose money, especially over the short term.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investing to beat the market

Novice investors may wish to start their investing journeys by buying index tracking funds. This is a super diversified way to get going.

However, more ambitious investors may wish to pick individual stocks. One stock I like is Pinterest (NYSE:PINS). It looks attractively valued for a platform with strong earnings momentum and growing AI integration. The company sits on a net cash position of $2.5bn and trades at just 19.9 times forecasted earnings for 2025 — falling to 10.6 by 2028 based on current consensus.

Analysts expect earnings growth of nearly 40% in 2025, driven by improved ad monetisation, deeper engagement, and AI-powered content curation. Pinterest’s ability to link visual discovery with shopping makes it uniquely positioned in the social commerce space, in my view.

However, the key risk is competitive pressure. Larger platforms like Meta and TikTok are also investing heavily in AI and commerce, and Pinterest’s smaller scale could limit its reach and pricing power in digital ads.

That said, with strong financials, consistent user growth, and an improving margin profile, I believe the shares are worth considering at current levels.

This story originally appeared on Motley Fool