40 year investment veteran Steve Reitmeister unveils new clues that point to increased odds of bear market and new lows on the way for the S&P 500 (SPY). Get his updated market outlook, trading plan and top picks in the article below.

Back at the beginning of the year you could list Steve Reitmeister as one of the most bearish investment commentators. That’s because the recessionary storm clouds seemed ready to burst in Q1 which should have pushed stocks to new lows.

THE RECESSION DID NOT HAPPEN

Thus, investors wisely hit the buy button with stocks climbing to their highest levels since the bear market began. But then the Powell took the mic last Wednesday after the most recent Fed rate hike. What he said has me tilting the odds back to recession and bear market once again.

The reasons why will be spelled out in this week’s edition of the Reitmeister Total Return below…

Market Commentary

Since the start of April I have shared a balanced stock market outlook: 50% chance of starting new bull market…50% chance of continuing the bear market. This led to a balanced portfolio structure. Gladly that has panned out well with a +3.70% return as S&P 500 (SPY) has been just a notch above breakeven.

Now I would say that I have slid up to a 65% chance or recession forming with new bear lows on the way. Of course, what you want to know is why. And that starts with Fed Chairman Powell’s May 3rd proclamation that a mild recession is still their base case before high inflation is fully contained.

Note that the Fed has a bias to be slightly more positive with their comments because they do not want to scare the public. So, if they say mild recession…it is likely going to be even worse. But that is missing the point.

Why say recession at all given how much inflation has come down already?

Because when you dial into the Fed statements over the past several months, they believe anything short of recession will not truly stamp out the flames of inflation. If they just slow down the economy to touch their 2% inflation target, they fear that the remaining embers could reignite higher inflation in the months following.

So, under the heading “Don’t Fight the Fed” probably best that we take them at their word that a recession is coming. And when it is finally on the scene, that is when bears will take charge and stocks will retrace to the previous low of 3,491…and probably lower.

Now to help us appreciate if a recession is forming, I am going to turn it over to famed investor, David Rosenberg for some of his recent insights. The highlights of which are below. (Find full version here.)

Below is a chart Rosenberg put together to show that 12 of the last 15 rate hike cycles have ended in a recession. That is a 75% failure rate when you appreciate that virtually every time they predicted a soft landing. Yet this time they are predicting recession (again…perhaps smart to take them at their word).

Now consider this following chart from Rosenberg with some interesting insights to follow from John Mauldin:

Accompanying quote about inverted yield curve from John Mauldin:

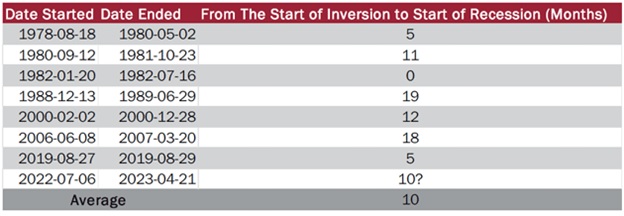

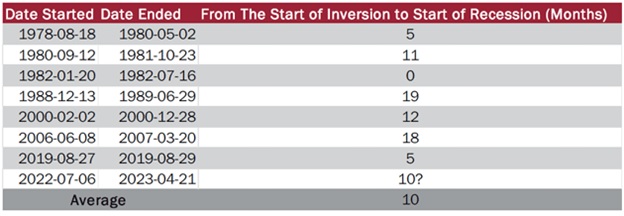

“And speaking of the yield curve, I’ve often described it as a reliable but early recession indicator. Rosie had a slide on that point. Looking at the 2-year and 10-year Treasury curve, he calculated the time until the last 7 recessions began. The average wait was 10 months. That means we are entering the zone this month. The longest delay was 19 months. So, unless the yield curve is wrong this time, recession will probably begin sometime this year, and could already be underway—recessions are typically identified in hindsight. (Minor amusing point: Many so-called “blue chip economists” continue to deny recession probabilities almost until we are completely through them. So much for their models.)”

Add it all up and the Rosenberg data says a recession should be coming soon…and the timing of which looks about right in the months ahead.

How does this affect our trading plan?

My recommendation is to stay balanced like we are doing in Reitmeister Total Return until the recession starts to rear its ugly head. That because there have been many false recessionary alarms over the past 15 months that did not come to fruition leading to a rise in stock prices.

Your best bear trading signal is when the market finally cracks below the 200 day moving average (currently at 3,972). From there a bearish FOMO rally should kick in with 10-20% more downside to eventual bottom.

Why not shift more bearish now?

Because if only 65% certain of bearish outcome…that means I still see a 35% chance that recession and deeper bear does NOT happen. So, we want more of the cards to be put on the table before we make a deeper bearish bet.

Again, staying balanced of late has paid off handsomely with a +3.70% gain for our portfolio since the start of April when the S&P 500 has been just a smidge above comatose. Please continue to rely upon this strategy until the bear comes out of hibernation by breaking below the 200 day moving average. Then we will press our advantage by getting even more bearish in our portfolio strategy.

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has beaten the S&P 500 by a wide margin in recent months.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused…volatile…uncertain.

Yet, even in this unattractive setting we can still chart a course to outperformance. Just click the link below to start getting on the right side of the action:

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.23 (+0.06%) in after-hours trading Tuesday. Year-to-date, SPY has gained 7.86%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Why Steve Reitmeister is Becoming More Bearish appeared first on StockNews.com

This story originally appeared on Entrepreneur