Image source: Getty Images

The BP (LSE: BP.) share price has bounced back strongly after hitting a three-year low in April. With Q3 results out today (4 November) showing further signs of improvement, I believe investors are starting to regain confidence in the company’s future prospects.

Q3 numbers

BP reported an underlying replacement cost profit of $2.2bn, down around $200m from the previous quarter. The decline was largely due to a higher tax rate.

Its refining division was the standout performer, delivering around $100m higher profit. That strength was driven by improved realised refining margins and the lowest level of turnaround activity in two decades.

By contrast, oil trading was weaker in the quarter, while production and operations remained broadly flat.

However, BP’s project pipeline looks particularly strong. In Kirkuk, the Iraqi government has now activated its contract to rehabilitate the region’s vast oilfields.

So far in 2025, BP has made 12 new discoveries. The highlight is Bumerangue in Brazil – its largest find in 25 years. Early tests indicate a 1,000-metre gross hydrocarbon column, pointing to significant long-term potential.

Dividend star

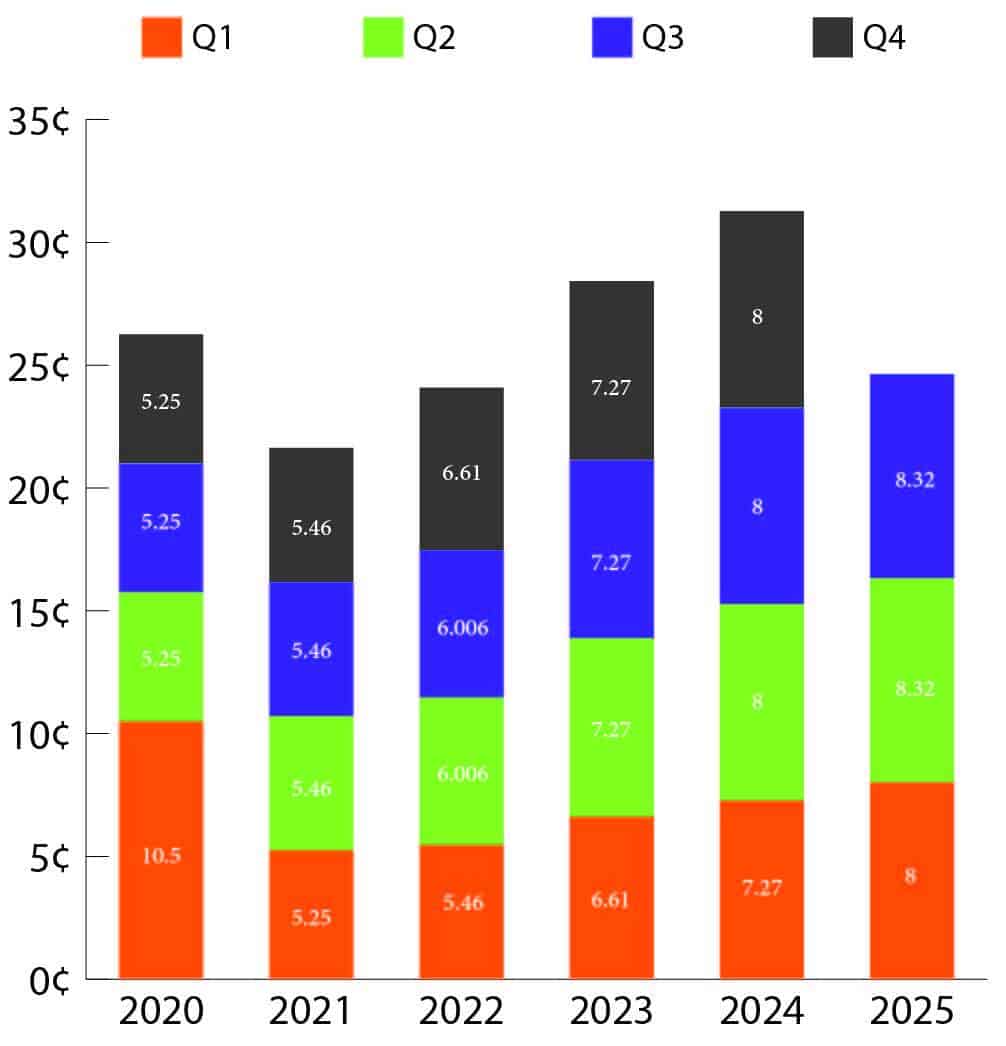

The oil giant kept its dividend at 8.25 cents per share, giving a forward dividend yield of 5.6%. The payout is still 22% lower than in 2019. But it has been steadily rebuilt in recent years, as the chart below shows. This points to growing confidence in cash generation.

Chart generated by author

The key question now is dividend sustainability. Last year, it reported earnings per share of just 2.38 cents. This is well below the level needed to cover its dividend. But for capital-intensive industries, cash-based measures offer a clearer picture of financial strength. On that basis, the company’s position looks far more robust.

Operating cash flow last year was more than five times the dividend payout, and the same pattern holds when looking at free cash flow. Since 2021, the dividend has consistently consumed less than half of its free cash flow – a clear indication that, despite profit volatility, the payout remains well supported by cash generation.

Oil mispriced

Oil markets are behaving in an extraordinary way. Despite strong support from the US administration, prices are roughly 20% lower than last November. Investor interest in oil is muted, and bearish sentiment is widespread – a scenario that has historically presented opportunities, as we saw in gold a couple of years ago.

Prices have lingered around $60 for some time, a level that seems unsustainable. Many US small producers are operating below break-even, meaning production could soon peak and decline.

The stress on the industry is clear: over the past two years, rig counts in the Permian basin have dropped 30%. While efficiency gains explain part of this decline, it is unlikely to account for such a sharp fall in such a short period.

Sustained low prices are weighing on commodities producers, with lay-offs becoming increasingly common. BP itself has already announced thousands of job cuts.

Bottom line

Despite negative sentiment across the industry, I believe oil prices are heading higher over the next 12-24 months. With improving fundamentals, I see BP as one of the major beneficiaries – which is why I continue to add to my position when finances allow.

This story originally appeared on Motley Fool